5 Illinois Tax Calculator Tips

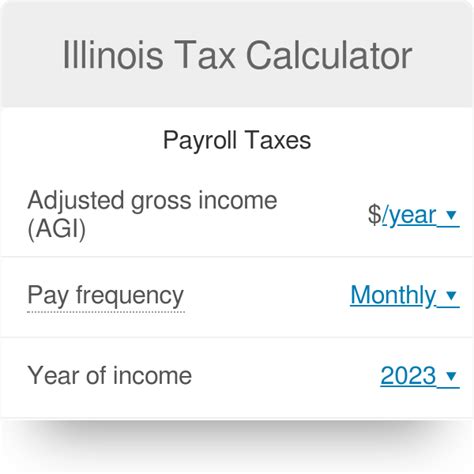

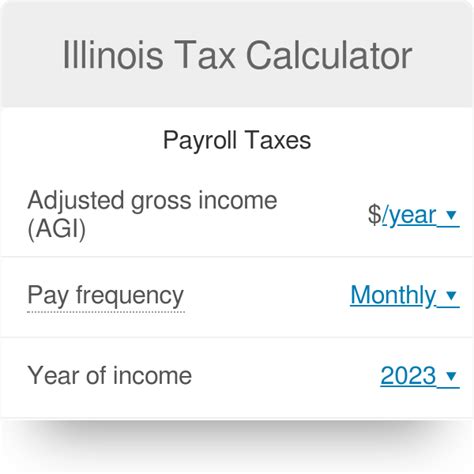

Introduction to Illinois Tax Calculator

When it comes to managing your finances, understanding how much you owe in taxes is crucial. For residents of Illinois, utilizing an Illinois tax calculator can simplify the process of estimating your tax liability. These calculators take into account various factors such as income, deductions, and credits to provide an accurate estimate of what you might owe. However, to get the most out of these tools, it’s essential to understand how they work and what factors can affect your calculations. In this article, we will delve into five key tips for using an Illinois tax calculator effectively.

Tip 1: Understand Your Income

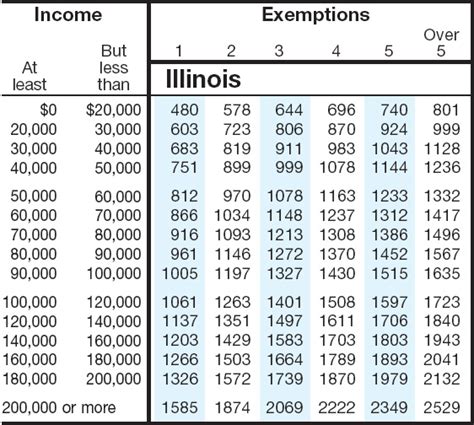

The first step in using an Illinois tax calculator is to have a clear understanding of your income. This includes not just your salary but also any other sources of income such as investments, retirement accounts, and self-employment income. Accurate income reporting is crucial because it directly affects your tax bracket and the amount of taxes you owe. For instance, if you have income from self-employment, you may need to account for the self-employment tax, which covers your contributions to Social Security and Medicare.

Tip 2: Familiarize Yourself with Deductions

Deductions can significantly reduce your taxable income, thereby lowering your tax liability. Illinois, like other states, offers various deductions that you might be eligible for. These can include standard deductions, itemized deductions for things like mortgage interest and charitable donations, and deductions for education expenses or medical expenses. Understanding what deductions you qualify for and ensuring you claim them can make a substantial difference in your tax calculation.

Tip 3: Consider Tax Credits

While deductions reduce your taxable income, tax credits directly reduce the amount of tax you owe, dollar for dollar. Illinois offers several tax credits, such as the Illinois Earned Income Tax Credit (EITC) for low-to-moderate-income working individuals and families, and credits for education expenses or child care. Tax credits can provide more significant savings than deductions, so it’s essential to explore which credits you might be eligible for.

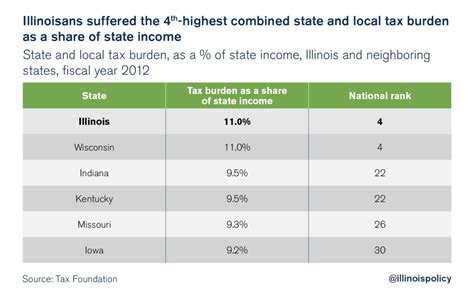

Tip 4: Account for Local Taxes

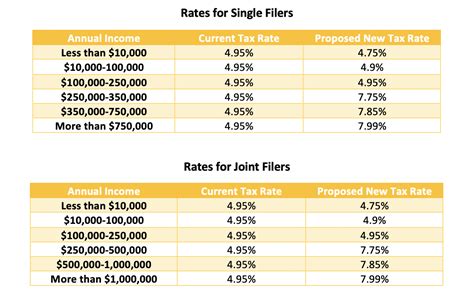

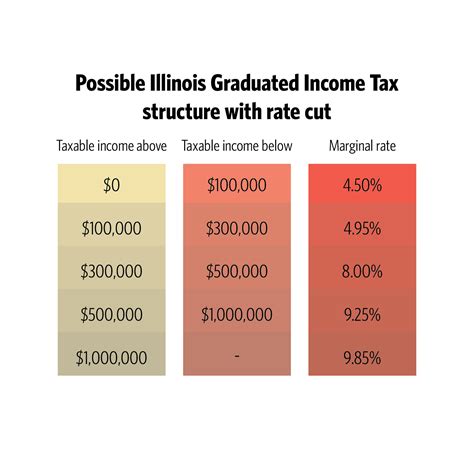

Illinois is known for having a relatively high overall tax burden, partly due to its state income tax rate and the presence of local taxes in some areas. If you live in a locality with its own income tax, you’ll need to factor this into your calculations. An Illinois tax calculator that accounts for these local taxes can give you a more accurate picture of your total tax liability.

Tip 5: Regularly Update Your Information

Tax laws and regulations can change frequently, affecting how your taxes are calculated. Additionally, changes in your personal financial situation, such as a new job, moving to a different part of the state, or having children, can also impact your tax liability. It’s crucial to regularly update your information in the tax calculator to ensure you’re getting the most accurate estimates. This includes staying informed about any tax law changes in Illinois that might affect your deductions, credits, or tax rates.

📝 Note: Always consult the official Illinois state website or a tax professional for the most current and detailed information on tax laws and regulations.

To further illustrate the importance of understanding and utilizing these tips, consider the following scenarios and how they might affect your tax calculation:

- If you recently started a new job with a higher salary, you might move into a higher tax bracket.

- If you had a child, you might be eligible for additional tax credits.

- If you purchased a home, you could claim deductions for mortgage interest and property taxes.

Understanding these factors and how they interact with Illinois tax laws can help you make informed decisions about your finances.

Now, summarizing the key points, using an Illinois tax calculator effectively involves understanding your income, familiarizing yourself with available deductions and credits, accounting for local taxes, and regularly updating your information to reflect changes in tax laws or your personal financial situation. By following these tips and staying informed, you can better manage your tax liability and make more informed financial decisions.

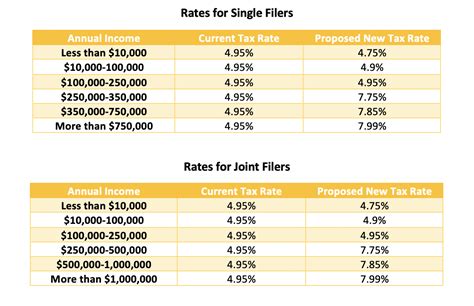

What is the Illinois state income tax rate?

+

The Illinois state income tax rate is 4.95% as of the last update. However, this rate can change, so it’s always best to check the latest information from the Illinois Department of Revenue.

How do I claim the Illinois Earned Income Tax Credit (EITC)?

+

To claim the Illinois EITC, you must first qualify for the federal EITC. Then, you can claim a percentage of your federal EITC on your Illinois tax return. The specific percentage can vary, so consult the Illinois tax instructions or a tax professional for the most accurate and up-to-date information.

Can I use an Illinois tax calculator for both state and federal taxes?

+

Yes, many tax calculators can estimate both your state and federal tax liabilities. These calculators will ask for information about your income, deductions, and credits, and then provide estimates based on both Illinois state tax laws and federal tax laws.