5 Ways Homeowners Get Food Stamps

Introduction to Food Stamps for Homeowners

Homeownership is often associated with a level of financial stability, but the reality is that many homeowners face financial challenges that can make it difficult to afford basic necessities like food. The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is designed to help low-income individuals and families, including homeowners, purchase food. While the program is more commonly associated with renters, there are indeed pathways through which homeowners can qualify for and receive food stamp benefits. This article will explore five ways homeowners might be eligible for food stamps, highlighting the criteria, application process, and the importance of understanding the nuances of the program.

Understanding SNAP Eligibility

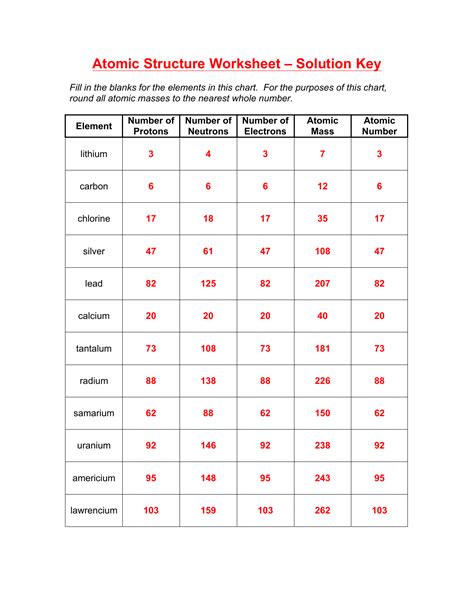

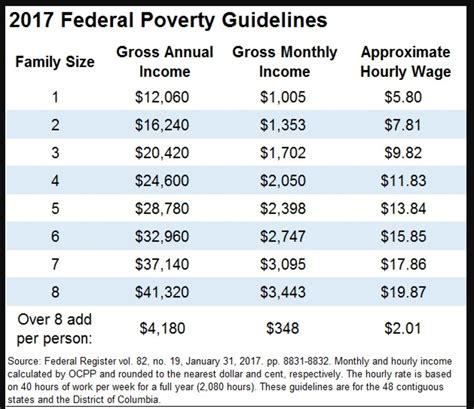

Before diving into the specifics of how homeowners can qualify, it’s essential to understand the basic eligibility criteria for SNAP. These criteria include income limits, resource limits (such as cash and savings), and employment status. The income limits vary by state and are typically based on the federal poverty guidelines, adjusted for family size. For instance, a family of three might be eligible if their gross income is at or below 130% of the poverty line, though this can vary. Resources, excluding certain assets like a primary home, are also considered. For many applicants, including homeowners, demonstrating a need based on these criteria is crucial for qualification.

5 Paths to Food Stamp Eligibility for Homeowners

1. Meeting Income and Resource Requirements

Homeowners who meet the income and resource requirements can qualify for SNAP. This means their income, after deductions for certain expenses like rent (if they have a mortgage considered as rent), utilities, and childcare, must be below the threshold. Additionally, their countable resources (excluding the value of their primary residence) must be within the limits set by their state. This path is straightforward but requires a thorough understanding of how income and resources are calculated for SNAP purposes.

2. Expenses Deductions

For homeowners, certain expenses can be deducted from their income when calculating eligibility for SNAP. These can include mortgage payments, property taxes, insurance, and maintenance costs. By reducing their countable income through these deductions, homeowners may find they meet the eligibility criteria even if their gross income is above the threshold. This is particularly relevant for homeowners with high housing costs relative to their income.

3. Disability and Elderly Considerations

Homeowners who are elderly (60 or older) or have a disability may face different eligibility criteria. For instance, the resource limit may be higher for these groups, and certain deductions may be more generous, making it easier to qualify. Additionally, programs like the SNAP Disability Project in some states aim to assist individuals with disabilities in applying for and maintaining SNAP benefits, recognizing the unique challenges these individuals may face.

4. Temporary Assistance

Sometimes, homeowners may experience a temporary financial setback, such as a job loss, medical emergency, or other crisis, that makes it hard to afford food. In such cases, applying for temporary SNAP benefits can provide critical support. This pathway emphasizes the program’s role as not just a long-term solution but also as a safety net for unexpected hardships.

5. State-Specific Programs and Waivers

Some states offer their own programs or have waivers that can make it easier for homeowners to qualify for SNAP. For example, a state might have a higher income limit for certain groups or offer additional deductions for specific expenses. These programs can vary widely, so it’s crucial for potential applicants to research the specific rules and options available in their state.

The Application Process

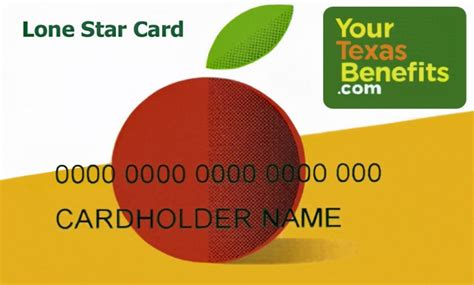

To apply for SNAP, homeowners typically need to submit an application through their local social services department or online, depending on the state’s system. The application will require detailed financial information, including income, expenses, and resources. After submission, an interview may be conducted to review the application and ensure all information is accurate and complete. Approval times can vary, but once approved, benefits are usually provided on an Electronic Benefits Transfer (EBT) card, which can be used like a debit card to purchase eligible food items.

📝 Note: It's essential to gather all necessary documents before applying, as this can speed up the process and reduce the likelihood of delays or denials.

Importance of Accurate Information

Given the complexity and the variability of SNAP eligibility criteria by state, it’s vital for homeowners to seek out accurate and up-to-date information. This might involve consulting with local social services, visiting the official SNAP website, or reaching out to non-profit organizations that specialize in food security and assistance programs. Misunderstandings about eligibility can lead to missed opportunities for support, emphasizing the need for clear, reliable information.

Can homeowners with a high-value property qualify for SNAP?

+

Yes, the value of a primary residence is generally not considered when determining SNAP eligibility. However, other factors like income and additional resources are crucial in the decision.

How do I apply for SNAP if I am a homeowner?

+

To apply, contact your local SNAP office or visit their website. You will need to provide detailed financial information, including income, expenses, and resources, excluding the value of your primary home.

Are there any specific programs for elderly or disabled homeowners?

+

Yes, some states offer programs with more generous eligibility criteria for elderly or disabled individuals, including homeowners. These may include higher resource limits or additional expense deductions.

In summary, while the Supplemental Nutrition Assistance Program is often associated with renters, there are several pathways through which homeowners can qualify for and receive food stamp benefits. Understanding the eligibility criteria, application process, and the nuances of how homeownership affects SNAP eligibility is crucial for those seeking assistance. By recognizing the complexities and seeking accurate information, homeowners in need can better navigate the system and access the support they require.