Military

Hawaii Tax Calculator Estimate

Introduction to Hawaii Tax Calculator

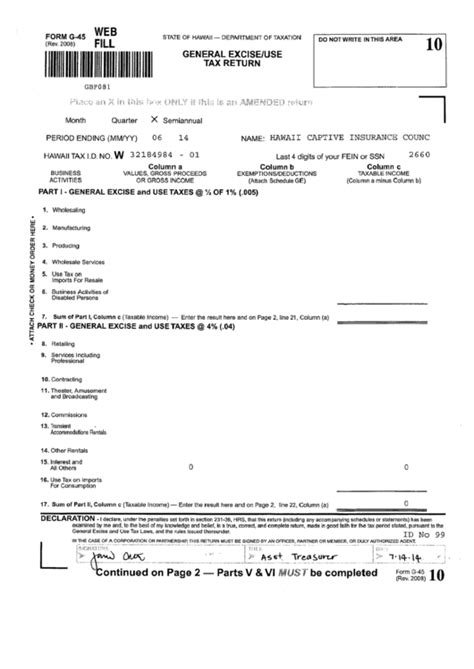

When it comes to understanding and estimating taxes in Hawaii, having the right tools can make a significant difference. A Hawaii tax calculator is designed to help individuals and businesses estimate their tax liability based on their specific financial situations. This tool is especially useful for navigating the complexities of Hawaii’s tax system, which includes a range of deductions, exemptions, and tax rates that can impact how much you owe in taxes.

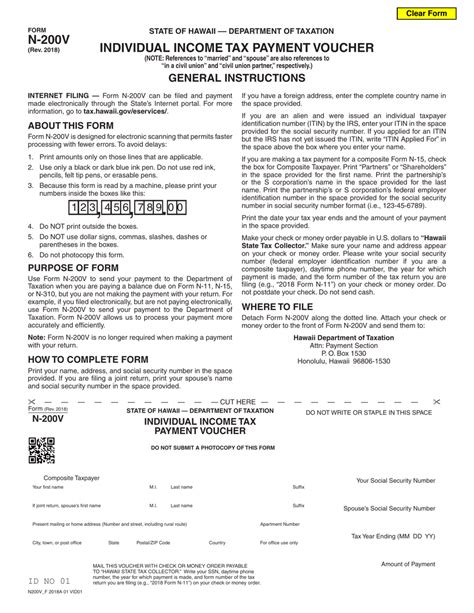

How to Use a Hawaii Tax Calculator

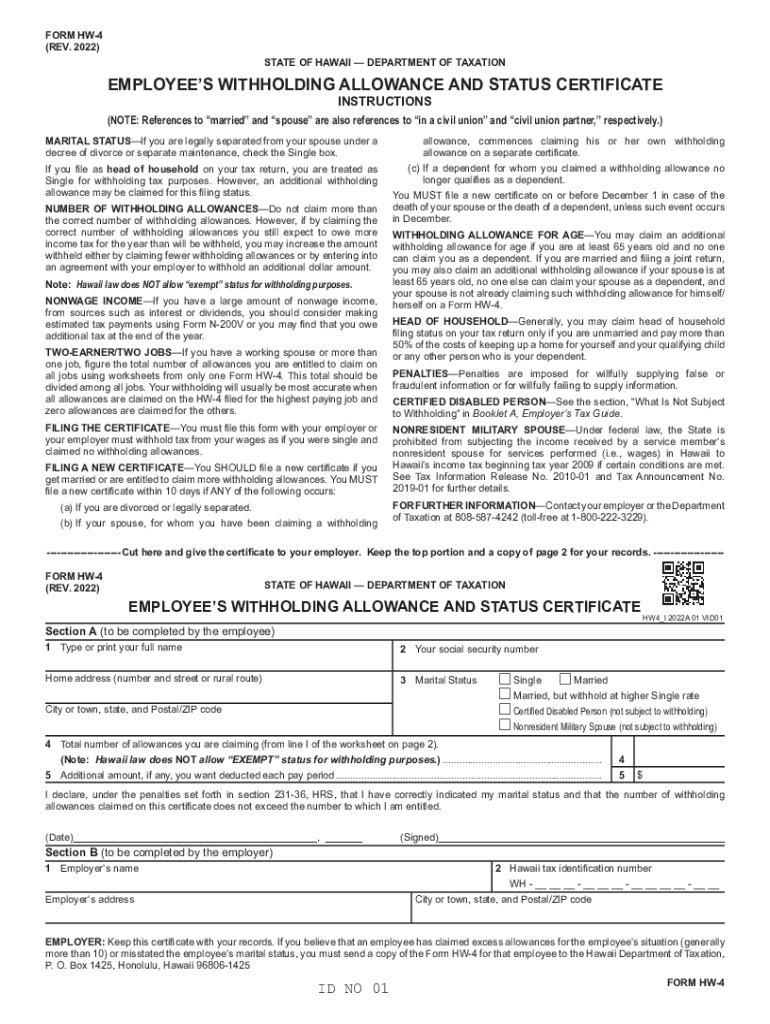

Using a Hawaii tax calculator is typically straightforward. You start by entering your filing status, income level, and any deductions or exemptions you’re eligible for. The calculator then uses this information to estimate your tax liability. Here are the general steps involved: - Determine Your Filing Status: This could be single, married filing jointly, married filing separately, head of household, or qualifying widow(er). - Enter Your Income: Include all sources of income, such as wages, salaries, tips, and any income from self-employment. - Claim Deductions and Exemptions: These can include the standard deduction, itemized deductions, and any personal exemptions you’re eligible for. - Consider Tax Credits: Tax credits can significantly reduce your tax liability and are available for things like education expenses, child care, and earned income.

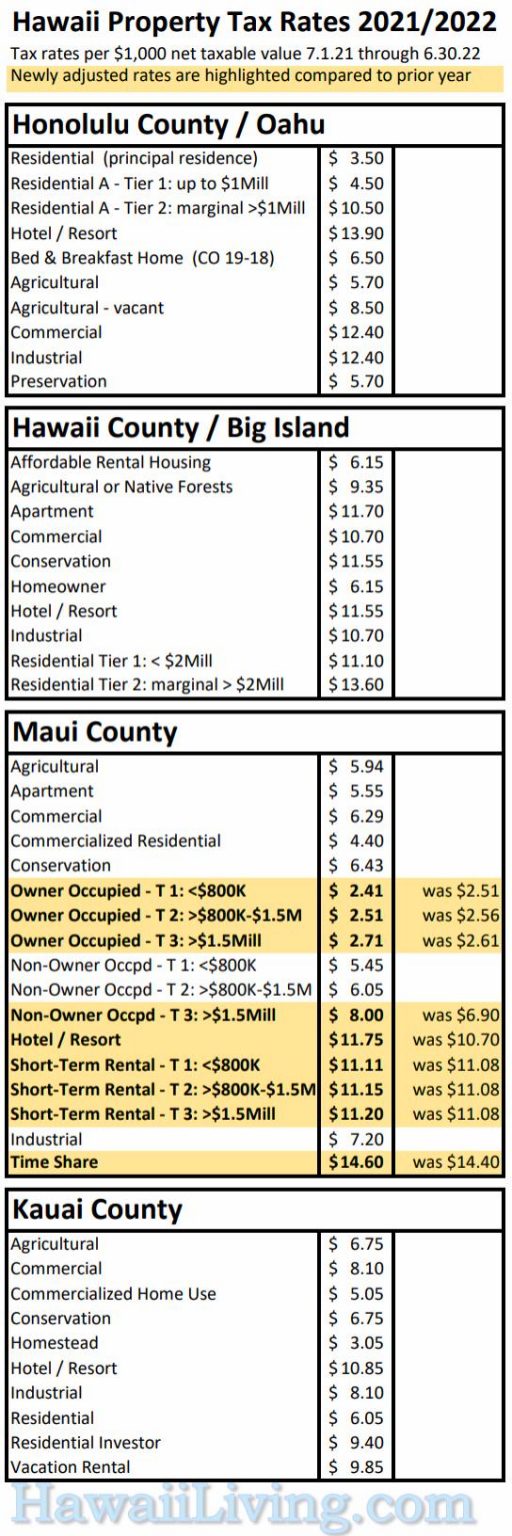

Understanding Hawaii Tax Rates

Hawaii has a progressive income tax system, meaning that higher income levels are taxed at higher rates. As of the last update, Hawaii’s income tax rates range from 1.4% to 11% across eight tax brackets. Understanding these rates and how they apply to your income is crucial for accurately estimating your tax liability.

Tax Deductions and Exemptions in Hawaii

Hawaii offers a variety of tax deductions and exemptions that can help reduce your taxable income. Some of these include: - Standard Deduction: A fixed amount that can be deducted from your income without needing to itemize deductions. - Itemized Deductions: These can include expenses like mortgage interest, state and local taxes, medical expenses, and charitable donations. - Personal Exemptions: Although the federal exemption amount has been suspended, some states, including Hawaii, may offer personal exemptions or credits. - Tax Credits: These are direct reductions to your tax liability and can be especially beneficial for low-income families, students, and first-time homebuyers.

Importance of Accurate Estimation

Accurately estimating your taxes is important for several reasons: - Avoid Underpayment Penalties: The IRS and state tax authorities can impose penalties if you underpay your taxes throughout the year. - Plan Your Finances: Knowing how much you owe in taxes can help you plan your finances more effectively, ensuring you have enough set aside for tax payments. - Maximize Refunds: If you’re due a refund, accurate estimation can help you understand how much you might receive, allowing you to plan how to use this money wisely.

📝 Note: Tax laws and rates can change, so it's essential to consult the latest tax information and possibly a tax professional to ensure you're getting the most accurate estimate possible.

Conclusion and Next Steps

In summary, a Hawaii tax calculator is a valuable tool for anyone looking to estimate their tax liability in the state. By understanding how to use these calculators, the tax rates in Hawaii, and the deductions and exemptions available, you can better navigate the state’s tax system. Whether you’re a resident, a non-resident with income sourced from Hawaii, or a business owner, accurate tax estimation is key to avoiding penalties, planning your finances, and maximizing any refunds you might be due. Always consult the latest tax information and consider seeking professional advice to ensure you’re meeting all your tax obligations and taking advantage of all the deductions and credits available to you.

What is the highest tax rate in Hawaii?

+

The highest tax rate in Hawaii is 11% for income above a certain threshold, which can vary by year and filing status.

Does Hawaii offer a state tax credit for education expenses?

+

Hawaii, like some other states, may offer tax credits for education expenses, but the specifics can change, so it’s best to check the latest tax information.

How do I ensure I’m taking advantage of all possible tax deductions in Hawaii?

+

Consulting with a tax professional or using tax preparation software can help ensure you’re not missing any deductions or credits you’re eligible for.