5 National Guard Pay Rates You Need to Know

Understanding National Guard Pay Rates

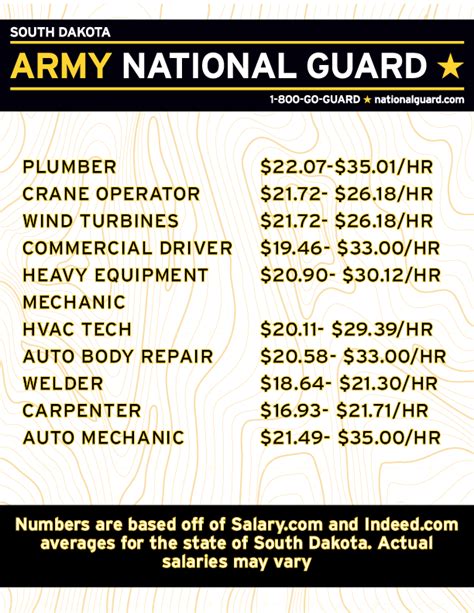

Serving in the National Guard can be a rewarding and challenging experience, offering a unique blend of military and civilian life. As a member of the National Guard, you’ll receive a competitive salary and benefits package, which varies based on your rank, time in service, and occupation. In this article, we’ll break down five key National Guard pay rates you need to know, including base pay, allowances, and special pays.

Base Pay: The Foundation of Your National Guard Salary

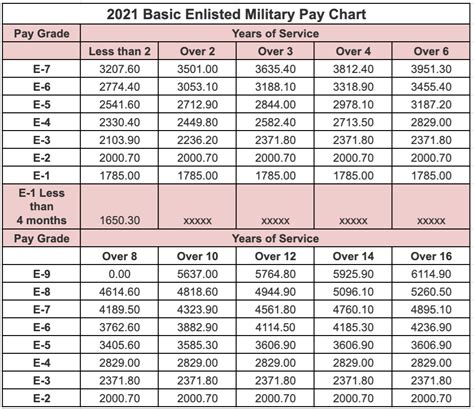

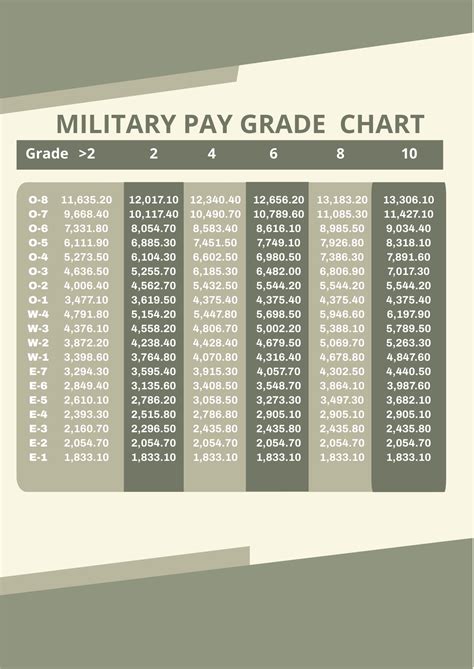

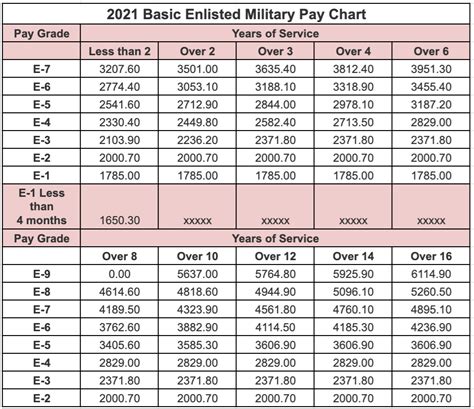

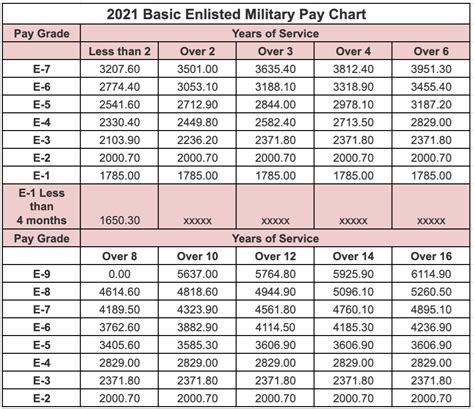

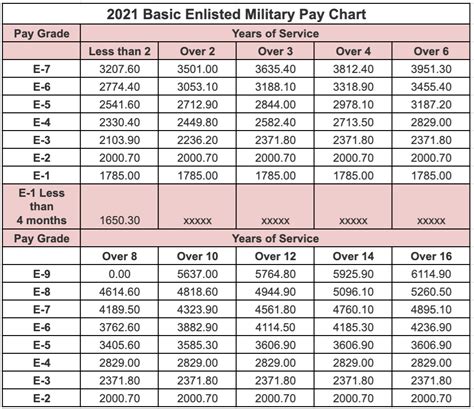

Base pay is the foundation of your National Guard salary, and it’s determined by your rank and time in service. The National Guard uses the same pay scale as the active-duty military, with pay grades ranging from E-1 (Private) to O-10 (General). Here’s a sample pay scale for National Guard members:

| Pay Grade | Rank | Monthly Base Pay (less than 2 years of service) | Monthly Base Pay (over 2 years of service) |

|---|---|---|---|

| E-1 | Private | $1,733.10 | $1,733.10 |

| E-2 | Private First Class | $1,942.50 | $2,044.70 |

| E-3 | Specialist/Corporal | $2,043.90 | $2,244.60 |

| E-4 | Sergeant | $2,330.70 | $2,586.50 |

| E-5 | Staff Sergeant | $2,684.60 | $3,174.10 |

🔹 Note: These rates are subject to change and may not reflect the current pay scale. Always check with your local National Guard office for the most up-to-date information.

Allowances: Additional Compensation for Your Service

In addition to base pay, National Guard members may receive allowances to help cover the costs of food, housing, and other expenses. Here are some common allowances you might receive:

- Basic Allowance for Subsistence (BAS): This allowance helps cover the cost of food, with a monthly rate of $369.39 (as of 2022).

- Basic Allowance for Housing (BAH): This allowance helps cover the cost of housing, with rates varying by location and pay grade.

- Cost of Living Allowance (COLA): This allowance helps offset the costs of living in high-cost areas, with rates varying by location.

Special Pays: Additional Compensation for Your Skills and Service

National Guard members may also receive special pays for their skills, service, and deployments. Here are some common special pays:

- Jump Pay: If you’re a parachutist, you may receive an additional 150-225 per month.

- Dive Pay: If you’re a diver, you may receive an additional 150-225 per month.

- Hazardous Duty Pay: If you’re performing hazardous duty, such as handling explosives or working with hazardous materials, you may receive an additional 150-500 per month.

- Combat Pay: If you’re deployed to a combat zone, you may receive an additional 500-1,000 per month.

Drill Pay: Your Weekend Salary

As a National Guard member, you’ll typically drill one weekend per month and attend an annual training period (usually two weeks). During these periods, you’ll receive drill pay, which is calculated based on your rank and time in service. Here’s a sample drill pay schedule:

- One-day drill: 1/30th of your monthly base pay

- Two-day drill: 1/15th of your monthly base pay

- Annual training: 1/6th of your monthly base pay for each day of training

Conclusion

Serving in the National Guard can be a rewarding and challenging experience, with a competitive salary and benefits package. By understanding the different components of your National Guard pay, including base pay, allowances, special pays, and drill pay, you can better plan your finances and make the most of your service.

How often do National Guard members get paid?

+

National Guard members typically receive pay twice per month, on the 1st and 15th of each month.

Can National Guard members receive bonuses?

+

Yes, National Guard members may be eligible for bonuses, such as enlistment bonuses, reenlistment bonuses, and student loan repayment bonuses.

Do National Guard members pay taxes on their income?

+

Yes, National Guard members are required to pay federal income taxes on their earnings. However, some states do not tax National Guard income.

Related Terms:

- National Guard pay by rank

- National Guard pay per month

- Full time National Guard pay

- National Guard pay calculator

- National Guard Officer pay

- Air Force National Guard pay