7 Tax Deductions for Hair Stylists

Running a hair salon, whether it's a bustling urban studio or a quaint neighborhood establishment, comes with its own set of financial challenges and rewards. One of the strategies hair stylists can employ to maximize their earnings is through understanding and claiming eligible tax deductions. While navigating the labyrinth of tax laws can be daunting, there are several key deductions that can significantly reduce the tax burden for hair stylists. Here's a comprehensive guide on the tax deductions that hair stylists should consider.

1. Salon Space Expenses

Whether you own your salon or rent a chair at a larger establishment, the costs associated with your workplace are deductible. Here’s what you can claim:

- Rent or Mortgage: If you rent your salon space, the entire monthly rent is deductible. For owners, mortgage interest can be claimed.

- Leasehold Improvements: Renovations or structural changes made to the salon, as long as they’re not permanent additions.

- Utilities: Electricity, water, gas, and internet used primarily for business activities.

🛠️ Note: If you use a part of your home as a salon, only the business-use percentage of home-related expenses can be claimed.

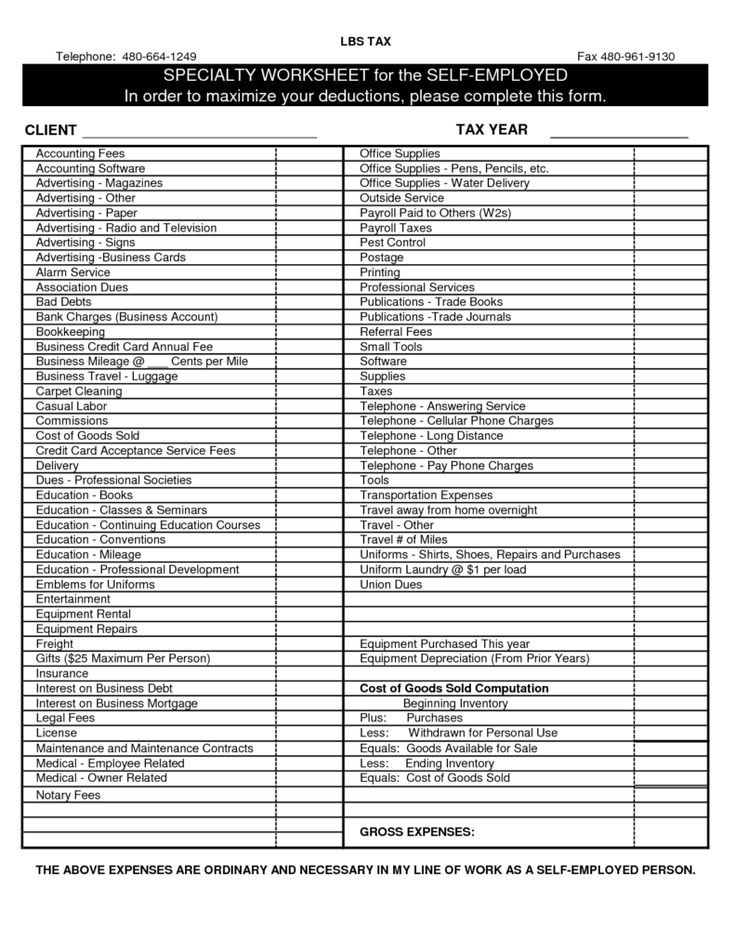

2. Equipment and Supplies

Hair salons rely heavily on tools and supplies, which are essential for delivering quality services. Deductible items include:

- Scissors, clippers, brushes, and combs: Essential tools of the trade.

- Shampoos, conditioners, dyes, and other chemical treatments: All used on clients are deductible.

- Furniture and decor: Chairs, stations, and salon decor that contribute to client experience.

- Protective gear: Gloves, capes, and aprons.

3. Education and Training

Staying current in the ever-evolving beauty industry requires continuous learning. Here’s what you can deduct:

- Tuition fees for advanced courses: Workshops, seminars, and further education in hair care.

- Travel expenses: For attending beauty conventions or training sessions.

- Certification costs: Required for maintaining professional licenses or certifications.

📚 Note: Professional development not only improves your skillset but also your business, making these expenses beneficial in more ways than one.

4. Advertising and Promotion

Marketing your salon can make a significant difference in client acquisition. Here’s what you might claim:

- Website and Online Advertising: Development, hosting, and ad spend.

- Print materials: Business cards, flyers, and local ads.

- Social Media Marketing: Costs associated with managing or outsourcing social media promotions.

5. Insurance Premiums

Having the right insurance can protect your business from unexpected setbacks. Deductibles include:

- Liability Insurance: Protection against claims related to business activities.

- Workers’ Compensation: If you have employees.

- Health Insurance: If you’re self-employed, a portion can be deducted.

6. Vehicle Expenses

If you use a personal vehicle for business activities like client visits, supply runs, or travel to training sessions, you can claim:

- Mileage: At the standard rate per mile for business use.

- Actual Expenses: Including gas, maintenance, and depreciation if you opt for this method over mileage.

7. Retirement Plan Contributions

Setting up a retirement plan not only secures your future but also offers tax benefits now. You can:

- Deduct Contributions: To plans like SEP-IRA or Solo 401(k).

Understanding these deductions requires diligent record-keeping, ensuring that you're not only staying on top of your financials but also maximizing your savings. By utilizing these deductions, hair stylists can improve their bottom line, making their passion for styling not just an artistic pursuit but a financially sound career as well.

In wrapping up, hair stylists should leverage these tax deductions to lessen their tax liability. From the day-to-day operations of the salon, the tools of the trade, continuous education, advertising, insurance, vehicle use, and even planning for retirement, there's a wealth of opportunities to reduce your tax burden. Remember, these are general deductions, and specifics can vary based on individual circumstances, changes in tax laws, or local regulations. Staying informed through professional advice or by consulting with a tax professional will ensure you're fully leveraging these tax benefits.

What counts as a deductible home expense for home salons?

+

Only the portion of your home used exclusively and regularly for business can be claimed. This includes rent or mortgage interest, utilities, and even some home maintenance expenses, but only for the business-use percentage of your home.

Can I deduct beauty school tuition if I own a salon?

+

Yes, continuing education expenses directly related to your profession, including beauty school tuition, are deductible as long as they help improve or maintain your job-related skills or meet the requirements of your profession.

Is it beneficial to keep my original receipts and invoices?

+

Absolutely. Keeping detailed records supports your deductions in case of an audit. It’s good practice to retain these documents for at least seven years to be safe.