Fidelity's Excel Worksheet: Easy Retirement Budget Planner

Retirement marks the beginning of a new chapter in life where the focus often shifts from career-related growth to enjoying a peaceful and well-earned rest. Yet, transitioning into retirement can be filled with uncertainty, especially regarding financial stability. Crafting a retirement budget planner is not only a tool for financial health, but it also ensures peace of mind in your golden years. Here, we will guide you through setting up your retirement budget using Excel, an accessible and versatile tool for financial planning.

Why Choose Excel for Retirement Planning?

Excel offers a dynamic environment for managing finances, allowing users to:

- Calculate future expenses with ease.

- Track income sources like pensions, social security, and investments.

- Adjust variables to see various financial scenarios in real-time.

With Excel, you can visualize your financial roadmap, making it indispensable for retirement planning.

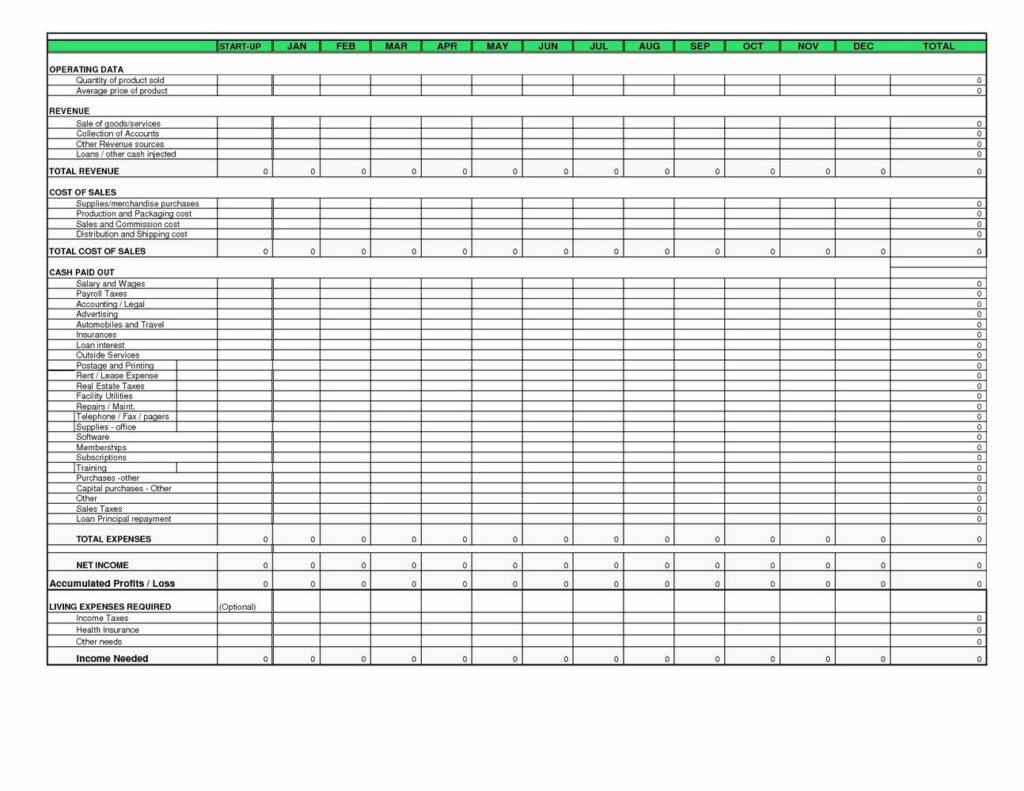

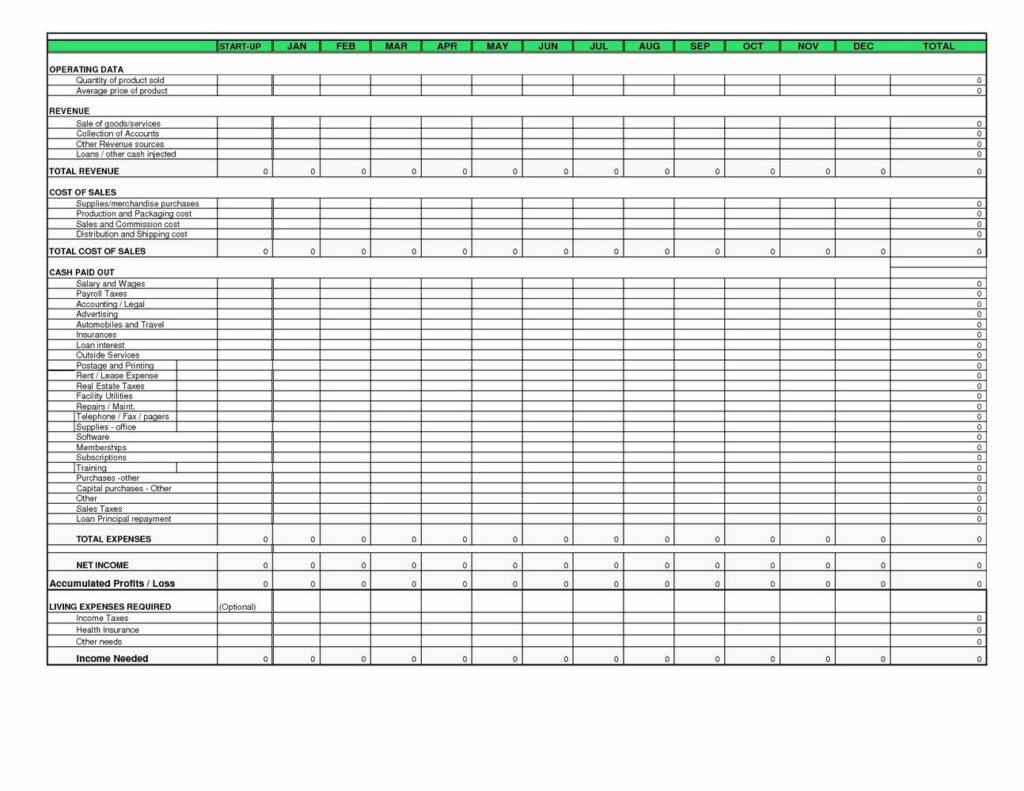

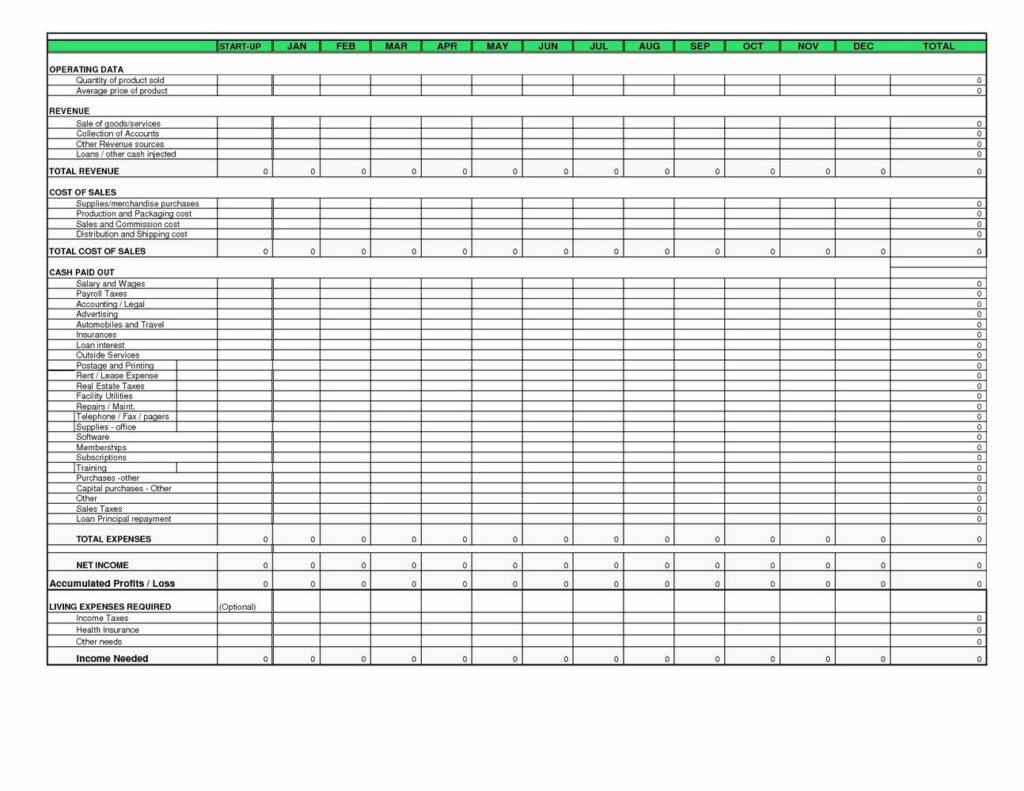

Setting Up Your Excel Budget Planner

Begin by creating a new workbook in Excel:

- Open Excel, and start with a fresh workbook.

- Label columns as follows:

- A: Month/Year - This will help track time.

- B: Income Sources - Where your money comes from.

- C: Amount - The amount expected.

- D: Expenses - What you’ll spend on.

- E: Cost - The cost of each expense.

- F: Balance - Your running financial status.

| Month/Year | Income Sources | Amount | Expenses | Cost | Balance |

|---|---|---|---|---|---|

| Jan 2024 | Pension | $1,500 | Rent/Mortgage | $700 | $800 |

| Jan 2024 | Social Security | $1,200 | Groceries | $300 | $1,700 |

✨ Note: Keep in mind that these are hypothetical figures, you'll need to input your actual numbers.

Calculating Income

Now, let’s delve into your income sources:

- Pensions

- Social Security

- Investment income (dividends, interest)

- Part-time work (if applicable)

Enter these under the ‘Income Sources’ column. Use Excel formulas to sum up your income for each month:

=SUM(C2:C6) // Adjust the range as necessary

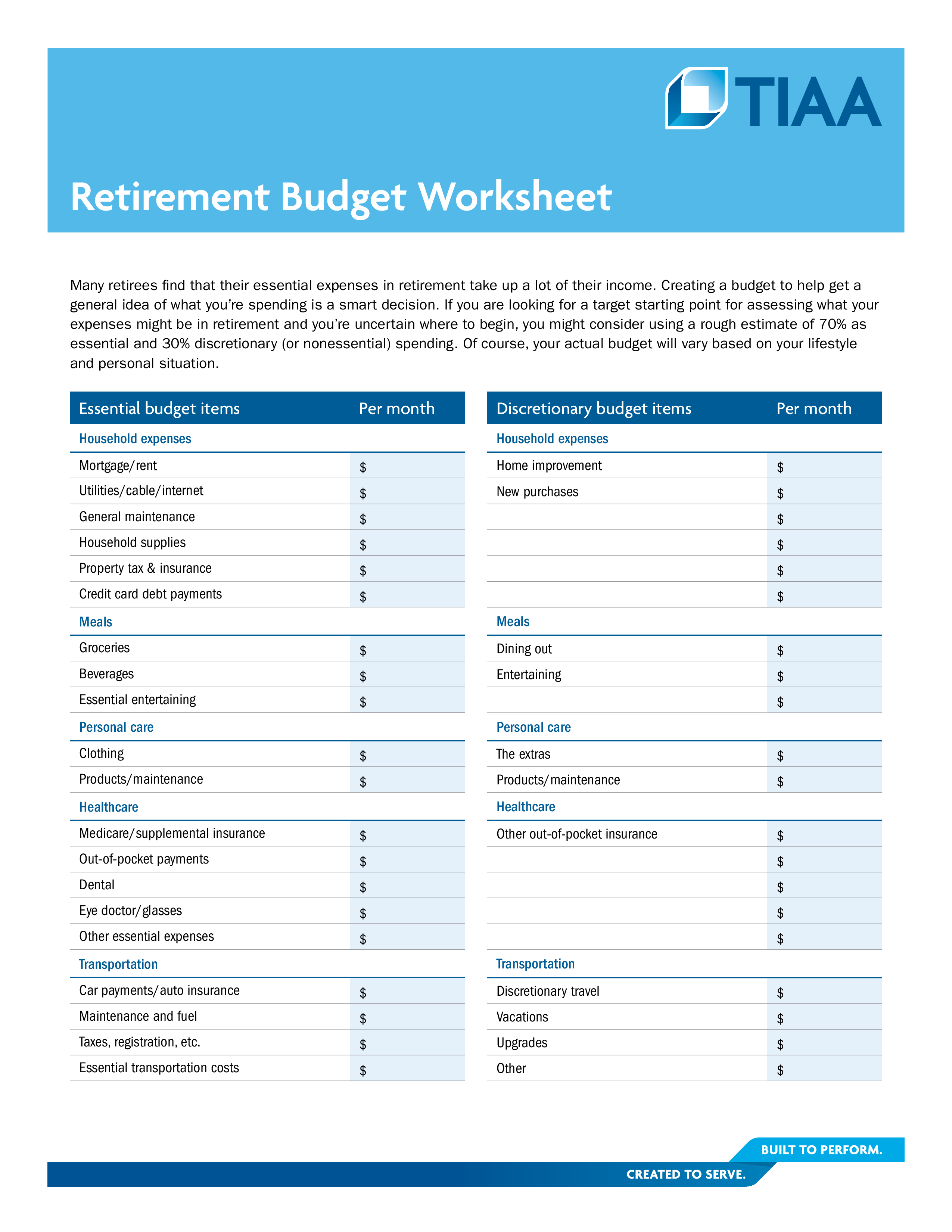

Tracking Expenses

Next, list your expected expenses:

- Housing (rent/mortgage, utilities)

- Food and dining

- Health care

- Entertainment

- Travel

- Insurance premiums

- Personal care

- Gifts and donations

Here too, use Excel to calculate the total expenses:

=SUM(E2:E10) // Adjust the range as necessary

Calculating and Monitoring Balance

To ensure you’re on track financially, compute your balance for each period:

=F1 + C2 - E2 // Adjust cell references for your setup

Drag this formula down to autofill subsequent rows.

Adding Visuals for Clarity

Charts and graphs can offer a quick overview of your financial health:

- Create a Line Chart to visualize income and expenses over time.

- Pie Charts for expenditure distribution.

These visuals can help identify trends and imbalances in your budget.

Scenario Planning

Retirement planning isn’t static; it requires flexibility. Use Excel’s ‘What-If Analysis’ tools:

- Data Tables for income or expense changes.

- Goal Seek for setting and achieving financial goals.

- Scenario Manager to compare different retirement scenarios.

These tools simulate different financial futures, helping you to prepare for potential changes.

In summary, setting up an Excel worksheet for retirement budget planning involves:

- Understanding your financial inflows and outflows.

- Regularly updating your budget to reflect changes in circumstances.

- Using Excel's functionalities to analyze and forecast your financial future.

With this Excel template, you'll not only plan for retirement effectively but also visualize your journey, making adjustments as life evolves. Now you have the tools to live out your retirement years with confidence and financial security.

Can I include taxes in my retirement budget planner?

+

Yes, you should definitely include taxes in your retirement budget. Estimate your tax obligations based on your income and investment withdrawals. Adjust these estimates as tax laws change or as your income fluctuates.

How often should I update my retirement budget?

+

It’s wise to review your budget monthly to catch any discrepancies, and annually to make more significant adjustments based on inflation, changes in income or expenses, or life events.

Is Excel enough for sophisticated financial planning?

+

Excel is very powerful for personal budgeting, but for complex financial planning like estate or tax planning, professional financial advisors or specialized software might be more appropriate.

What happens if my expenses exceed my income?

+

If your expenses consistently exceed your income, you’ll need to either reduce expenses, increase income, or both. Excel allows you to simulate these changes to see potential solutions.

How can I include investments in my budget planner?

+

Add investment income as an income source in your planner. If you plan to withdraw from investments, these should also be reflected in your expense column. Regular updates to your portfolio’s performance will keep your budget accurate.