5 Tips for Using Fannie Mae Income Worksheet in Excel

Using Excel to manage financial documentation can streamline your work significantly, especially when dealing with complex income calculations required by mortgage lenders. One such tool that is indispensable for loan officers, mortgage underwriters, and financial analysts is the Fannie Mae income worksheet. Here are five tips to maximize its utility:

1. Understand the Basics

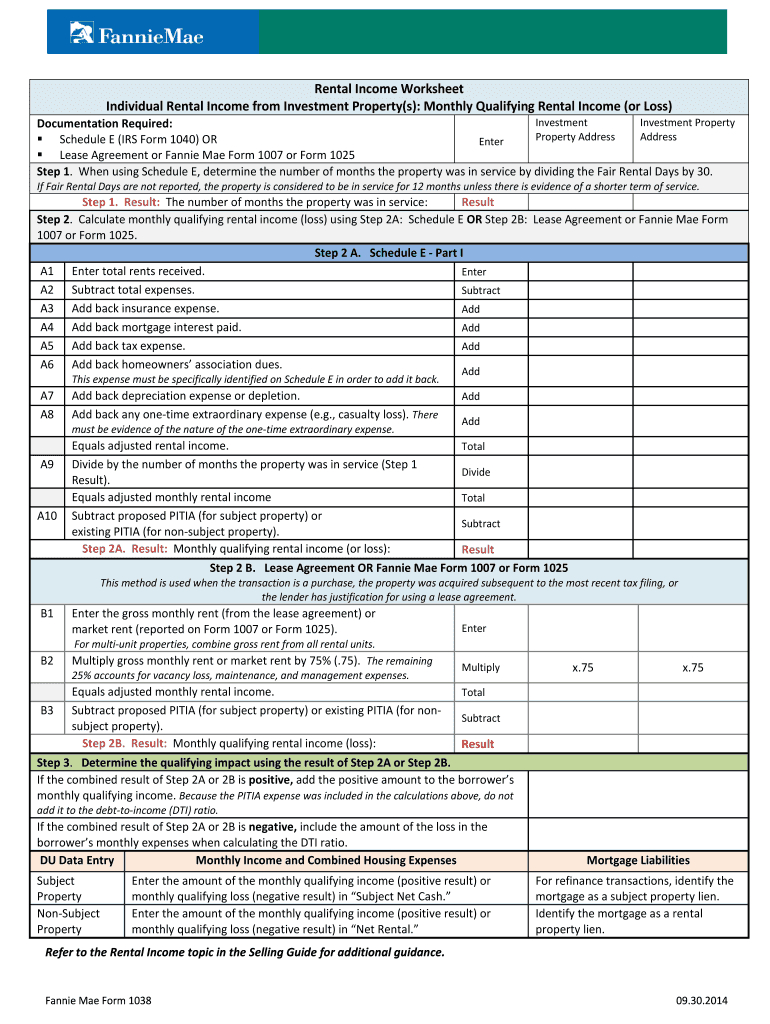

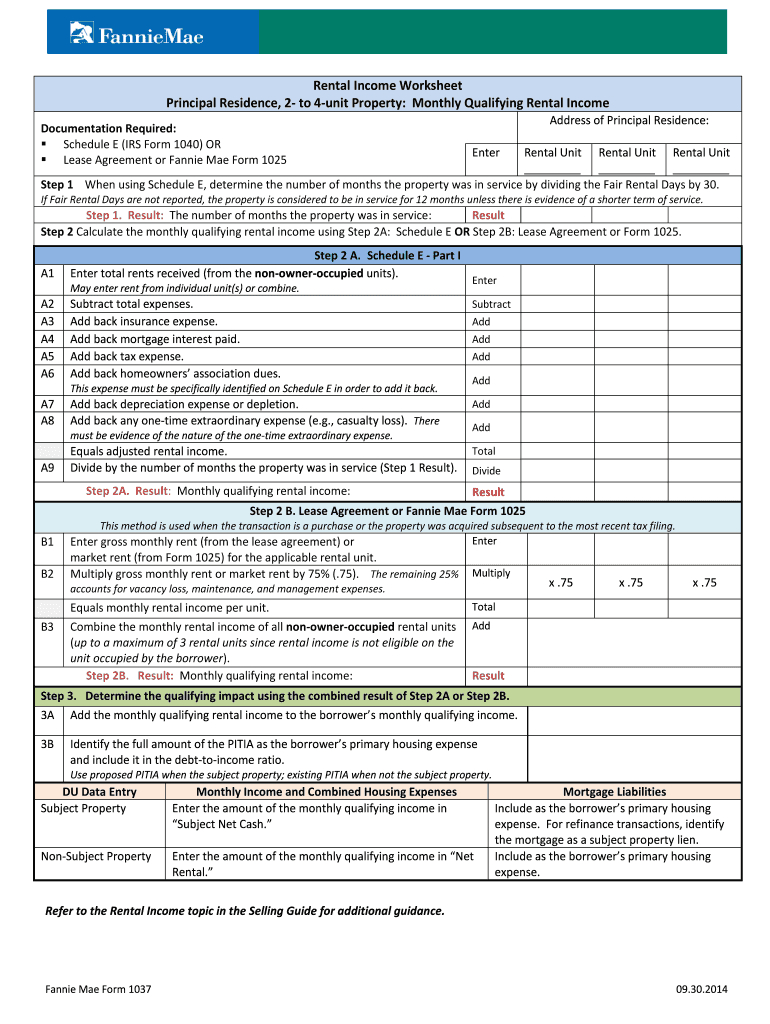

The Fannie Mae income worksheet is designed to help mortgage professionals verify and document borrowers’ income accurately. It includes various sections:

- Income Overview: Details on the borrower’s income sources.

- Stability & Continuity: Analysis of income stability over time.

- Irregular Income: Sections for handling self-employment, rental, and variable income.

- Calculations: Includes various calculations like average monthly income and qualifying income.

Before diving into the document, familiarize yourself with Fannie Mae’s guidelines to ensure compliance and accuracy.

2. Customize for Your Needs

Not all income scenarios are the same, so customizing the worksheet can help:

- Adjust Columns: You might need to add columns for additional income sources or modify existing ones to suit specific borrower profiles.

- Use Formulas: Automate calculations by incorporating Excel formulas that adhere to Fannie Mae’s requirements.

- Color Coding: Use colors to highlight different sections or income types for quick visual reference.

3. Inputting Data Accurately

Accuracy is key in mortgage underwriting:

- Data Entry: Double-check all data entries, especially when converting documents to Excel.

- Documentation: Keep all source documents, notes, or explanations as comments in Excel cells for future reference or audits.

- Consistency: Ensure that the data input matches the borrower’s financial statements and tax returns.

💡 Note: Errors in data input can lead to incorrect qualifying income figures, potentially impacting loan approval and terms.

4. Analyze & Interpret the Data

Excel allows for powerful data analysis:

- Trend Analysis: Use charts or pivot tables to analyze income trends, helping to assess the borrower’s income stability.

- What-If Analysis: Explore different scenarios by changing income or expense figures to understand their impact on loan qualification.

- Advanced Functions: Leverage Excel’s conditional formatting, data validation, and error-checking features to ensure data integrity.

5. Documentation & Audit Trail

Maintaining documentation:

- Track Changes: Enable the track changes feature to record all modifications to the document, providing an audit trail.

- Version Control: Save different versions of the worksheet, particularly when significant changes occur or at critical stages of the underwriting process.

- Protect Sheets: Use Excel’s worksheet protection features to prevent unauthorized or accidental changes to key cells or formulas.

In summary, the Fannie Mae income worksheet in Excel is a powerful tool for underwriting. By understanding its basic structure, customizing it to your needs, inputting data accurately, analyzing the data, and keeping a robust documentation trail, you can streamline your mortgage processes, increase accuracy, and ultimately provide better service to your clients.

How do I handle income from rental properties on the worksheet?

+

You can enter rental income in the “Irregular Income” section of the worksheet. Ensure to subtract expenses and document the rental agreements or tax schedules to validate the income.

Can I automate the entire worksheet using Excel VBA?

+

Yes, you can use Excel VBA to automate tasks like data input, calculations, and report generation. However, ensure that your automation does not override critical manual validations and review processes.

What if the borrower has income that doesn’t fit neatly into the worksheet?

+

Customize the worksheet or add custom columns to account for unique income sources. Always ensure that the rationale for any deviations from the standard form is well-documented.