5 Ways Food Stamps Affect Credit

Introduction to Food Stamps and Credit

The relationship between food stamps and credit is a complex one, often filled with misconceptions. Food stamps, now more commonly referred to as the Supplemental Nutrition Assistance Program (SNAP), are designed to help low-income individuals and families purchase food. On the other hand, credit scores are a measure of an individual’s or family’s creditworthiness, reflecting their history of borrowing and repaying debts. The question of whether food stamps affect credit scores is one that sparks debate and curiosity. In this article, we will delve into the ways food stamps can influence credit scores, exploring both the direct and indirect impacts.

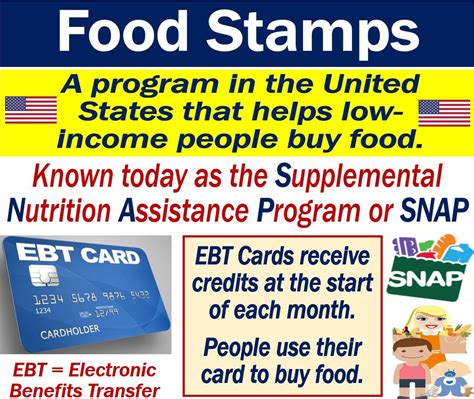

Understanding Food Stamps

Before we dive into the effects of food stamps on credit, it’s essential to understand what food stamps are and how they work. SNAP is a federal program that provides food assistance to eligible individuals and families. The program is administered by the United States Department of Agriculture (USDA) and is overseen by each state’s social services or human services department. Eligibility for SNAP benefits is based on factors such as income, expenses, and family size. Once eligible, participants receive an Electronic Benefits Transfer (EBT) card, which they can use to purchase food items from authorized retailers.

Direct Impact on Credit Scores

The direct impact of food stamps on credit scores is minimal to non-existent. Receiving food stamps does not directly affect your credit score because the program does not involve borrowing money. Credit scores are primarily based on your history of borrowing and repaying debts, such as credit cards, loans, and mortgages. Since food stamps are not a form of credit, using them does not add to your credit history or affect your credit score. However, it’s crucial to distinguish between the direct and indirect effects, as there are scenarios where food stamps can indirectly influence credit scores.

Indirect Impact on Credit Scores

While food stamps themselves do not directly impact credit scores, there are indirect ways in which they can influence an individual’s or family’s financial situation, potentially affecting their credit. Here are five key areas to consider: - Financial Stability: For many individuals and families, receiving food stamps can be a vital part of maintaining financial stability. By helping to cover food expenses, SNAP benefits can free up income for other necessities, including rent/mortgage, utilities, and debt payments. This stability can indirectly contribute to better credit management and, by extension, a healthier credit score. - Debt Management: The financial assistance provided by food stamps can also help reduce the need to accumulate debt. For example, if an individual is struggling to pay for both food and other expenses, they might turn to credit cards or payday loans, which can lead to debt spirals. By alleviating some of this financial pressure, food stamps can help individuals avoid debt traps that could negatively affect their credit scores. - Credit Utilization: Although food stamps do not directly impact credit utilization ratios, the financial relief they provide can help individuals manage their existing credit more effectively. Lower credit utilization (the amount of credit used compared to the amount available) is beneficial for credit scores. If food stamps help an individual pay their bills on time and reduce their reliance on credit for daily expenses, this could reflect positively in their credit utilization and overall credit score. - Public Assistance and Credit Reporting: It’s worth noting that participation in public assistance programs like SNAP is not reported to credit bureaus. This means that simply being on food stamps will not appear on your credit report. However, if an individual’s financial situation improves due to the assistance and they begin to engage more positively with credit (e.g., making on-time payments), this could lead to an improvement in their credit score over time. - Employment and Income Stability: Finally, the stability that food stamps can provide might also indirectly affect credit scores by enabling individuals to seek and maintain employment. A stable income can lead to better financial management, including the ability to make debt payments on time, which is a significant factor in determining credit scores.

Managing Finances with Food Stamps

For those receiving food stamps, managing finances effectively is crucial to avoiding debt and maintaining a good credit score. Here are some tips: - Budgeting: Create a budget that accounts for all income and expenses. Prioritize essential expenses like rent, utilities, and minimum debt payments. - Debt Reduction: If possible, allocate extra funds towards reducing debt, especially high-interest debts like credit card balances. - Savings: Even small, regular savings can provide a safety net against financial shocks and reduce the need for credit. - Credit Monitoring: Keep an eye on your credit report and score. You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year.

📝 Note: Understanding your credit report and score is essential for managing your financial health. Incorrect information on your credit report can negatively affect your credit score, so it's crucial to review and correct any errors.

Conclusion and Final Thoughts

In summary, while food stamps do not directly impact credit scores, they can have indirect effects by providing financial stability, reducing the need for debt, and potentially improving debt management and credit utilization. By understanding these dynamics and managing finances wisely, individuals and families can navigate the complexities of credit and public assistance programs more effectively. Remember, credit scores are just one aspect of overall financial health, and programs like SNAP can play a vital role in supporting individuals as they work towards financial stability and security.

Do food stamps directly affect my credit score?

+

No, receiving food stamps does not directly affect your credit score because it is not a form of credit and does not involve borrowing money.

Can food stamps indirectly influence my credit score?

+

Yes, food stamps can indirectly influence your credit score by providing financial stability, reducing the need for debt, and improving your ability to manage existing credit effectively.

How can I manage my finances effectively while on food stamps?

+

Effective financial management while on food stamps involves creating a budget, prioritizing debt reduction, building savings, and monitoring your credit report and score. These practices can help improve your financial stability and, by extension, your credit score.