7 Degrees for a Financial Manager Career

Financial Manager Career: Unlocking Success with the Right Degree

In today’s fast-paced and ever-evolving business landscape, financial managers play a crucial role in driving organizational growth, mitigating risks, and optimizing financial performance. To succeed in this field, it’s essential to have the right combination of skills, knowledge, and education. Here, we’ll explore the top 7 degrees that can propel your financial manager career to new heights.

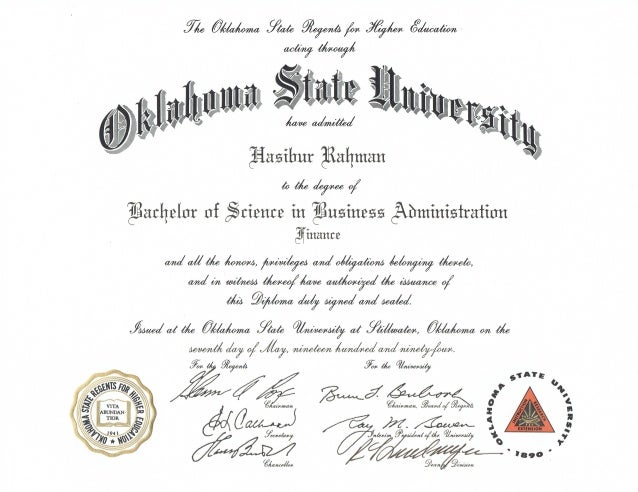

1. Bachelor's in Finance

A Bachelor’s degree in Finance is an excellent starting point for a financial manager career. This degree program provides a comprehensive understanding of financial markets, instruments, and institutions. Students learn about financial modeling, investments, corporate finance, and financial planning. With a strong foundation in finance, you’ll be well-equipped to take on entry-level positions in financial analysis, planning, and management.

📊 Note: A Bachelor's in Finance can also serve as a stepping stone for advanced degrees in finance, such as an MBA or MSF.

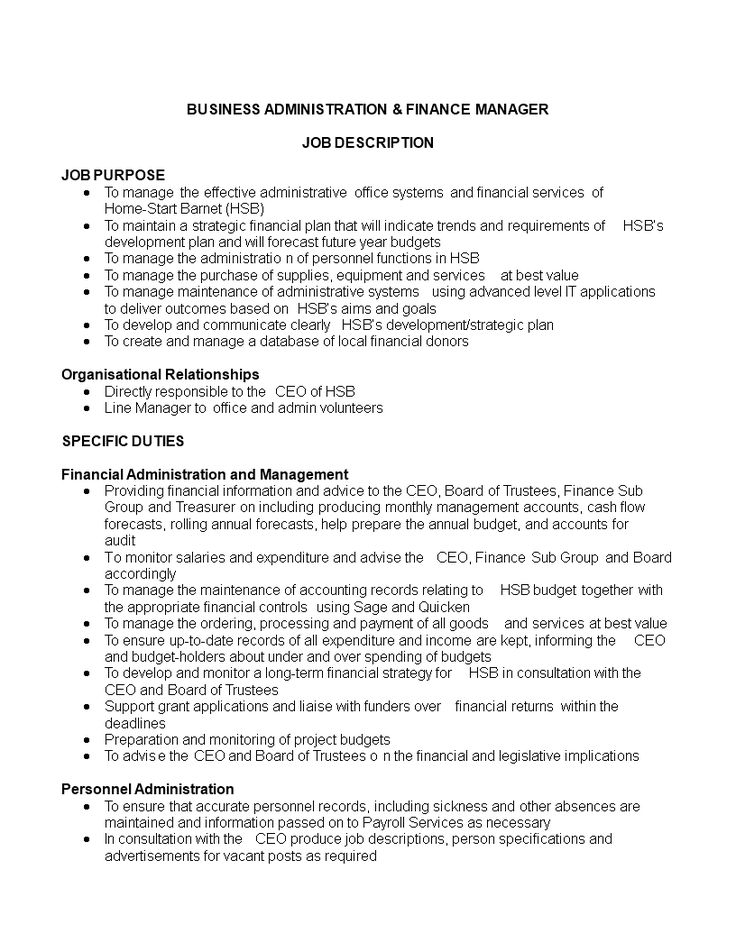

2. Master's in Business Administration (MBA)

An MBA is a highly sought-after degree for financial managers, as it develops leadership, strategic thinking, and problem-solving skills. This graduate degree program covers a broad range of topics, including financial management, marketing, operations, and human resources. With an MBA, you’ll gain the expertise to drive business growth, manage teams, and make informed financial decisions.

3. Master's in Finance (MSF)

A Master’s in Finance (MSF) is a specialized degree that delves deeper into the world of finance. This graduate program focuses on advanced financial concepts, such as financial modeling, derivatives, and risk management. With an MSF, you’ll develop the expertise to analyze complex financial data, create forecasts, and optimize investment strategies.

4. Chartered Financial Analyst (CFA) Program

The CFA program is a professional certification that demonstrates your expertise in investment analysis and portfolio management. This program is designed for experienced professionals who want to advance their careers in finance. With a CFA charter, you’ll gain recognition as a skilled investment analyst and be eligible for senior roles in asset management, research, and portfolio management.

5. Certified Management Accountant (CMA)

The CMA certification is a professional credential that validates your expertise in management accounting and financial management. This certification program covers topics such as financial planning, performance measurement, and cost management. With a CMA certification, you’ll be recognized as a skilled management accountant and be eligible for senior roles in financial management and analysis.

6. Bachelor's in Accounting

A Bachelor’s degree in Accounting provides a solid foundation in financial accounting, taxation, and auditing. This degree program develops your analytical and technical skills, enabling you to analyze financial data, prepare financial statements, and ensure compliance with regulatory requirements. With a Bachelor’s in Accounting, you’ll be well-prepared for entry-level positions in accounting and financial analysis.

7. Certified Public Accountant (CPA)

The CPA certification is a professional credential that demonstrates your expertise in public accounting and financial reporting. This certification program covers topics such as financial accounting, taxation, and auditing. With a CPA certification, you’ll be recognized as a skilled public accountant and be eligible for senior roles in auditing, taxation, and financial reporting.

| Degree | Duration | Career Opportunities |

|---|---|---|

| Bachelor's in Finance | 4 years | Financial Analyst, Financial Planner, Investment Banker |

| Master's in Business Administration (MBA) | 2 years | Financial Manager, Business Development Manager, Management Consultant |

| Master's in Finance (MSF) | 1-2 years | Financial Analyst, Investment Manager, Risk Manager |

| Chartered Financial Analyst (CFA) Program | 1-3 years | Investment Analyst, Portfolio Manager, Asset Manager |

| Certified Management Accountant (CMA) | 1-2 years | Financial Manager, Cost Accountant, Management Accountant |

| Bachelor's in Accounting | 4 years | Accountant, Financial Analyst, Auditing Assistant |

| Certified Public Accountant (CPA) | 1-2 years | Public Accountant, Auditor, Tax Consultant |

In conclusion, a successful financial manager career requires a combination of education, skills, and experience. By pursuing one of these 7 degrees, you’ll be well on your way to unlocking your full potential in the world of finance.

What is the average salary for a financial manager?

+

The average salary for a financial manager varies depending on factors such as location, industry, and level of experience. According to the Bureau of Labor Statistics, the median annual salary for financial managers in the United States was $142,000 in May 2020.

What skills do I need to become a financial manager?

+

To become a financial manager, you’ll need to develop a range of skills, including financial analysis, budgeting, forecasting, risk management, and leadership. You’ll also need to stay up-to-date with industry trends, regulations, and technologies.

What are the job prospects for financial managers?

+

According to the Bureau of Labor Statistics, employment of financial managers is projected to grow 5% from 2020 to 2030, which is slower than the average for all occupations. However, job prospects are expected to be strong for those with advanced degrees and certifications.