Military

5 NFCU Balance Transfer Tips

Introduction to NFCU Balance Transfer

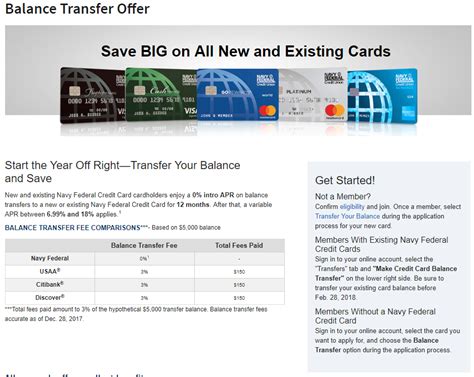

Navy Federal Credit Union (NFCU) offers its members a range of financial services, including credit cards with balance transfer options. Balance transfer allows individuals to move their existing credit card debt to a new credit card, often with a lower interest rate or more favorable terms. This can be a beneficial strategy for managing debt and saving money on interest payments. However, it’s essential to approach balance transfers with a clear understanding of the process and its implications. In this article, we will explore five key tips for navigating NFCU balance transfers effectively.

Understanding NFCU Balance Transfer Options

Before initiating a balance transfer, it’s crucial to research and understand the terms and conditions offered by NFCU. This includes knowing the balance transfer fee, the introductory APR, and the regular APR that will apply after the introductory period ends. NFCU members should also be aware of any credit limit restrictions and how they might impact the balance transfer amount.

Tips for NFCU Balance Transfers

Here are five tips to consider when planning an NFCU balance transfer: * Check Your Credit Score: A good credit score can qualify you for better balance transfer offers, including lower fees and more favorable interest rates. * Calculate the Savings: Use a balance transfer calculator to determine how much you can save by transferring your balance to an NFCU credit card. Consider both the interest savings and any applicable fees. * Choose the Right Card: NFCU offers several credit cards, each with its own set of benefits and terms. Select a card that aligns with your financial goals and provides the best balance transfer option for your situation. * Plan Your Payments: Create a payment plan to ensure you can pay off your transferred balance before the introductory APR period ends. This can help you avoid accumulating more debt and paying higher interest rates. * Monitor Your Credit Utilization: Keep an eye on your credit utilization ratio, which is the percentage of your available credit being used. High credit utilization can negatively impact your credit score, so it’s essential to keep this ratio as low as possible.

Benefits of NFCU Balance Transfers

NFCU balance transfers can offer several benefits, including: - Lower Interest Rates: Transferring your balance to a credit card with a lower interest rate can save you money on interest payments. - No Foreign Transaction Fees: Many NFCU credit cards do not charge foreign transaction fees, making them a good choice for international travel or purchases. - Rewards and Cashback: Some NFCU credit cards offer rewards or cashback programs, which can provide additional value when used responsibly.

Potential Drawbacks

While NFCU balance transfers can be beneficial, there are also potential drawbacks to consider:

| Drawback | Description |

|---|---|

| Balance Transfer Fees | A fee charged for transferring your balance, typically a percentage of the transferred amount. |

| Temporary Credit Score Impact | Applying for a new credit card and transferring a balance can temporarily affect your credit score. |

| Interest Rate Increases | After the introductory APR period ends, the regular APR may be higher, increasing your interest payments. |

📝 Note: Always review the terms and conditions of your NFCU credit card agreement to understand the specific benefits and drawbacks of your balance transfer.

Conclusion and Next Steps

In summary, NFCU balance transfers can be a valuable tool for managing debt and saving money on interest payments. By understanding the terms and conditions, choosing the right credit card, and planning your payments, you can make the most of this financial strategy. Remember to always monitor your credit utilization and be aware of potential drawbacks, such as balance transfer fees and temporary credit score impacts. With careful consideration and planning, an NFCU balance transfer can help you achieve your financial goals.

What is the typical balance transfer fee for NFCU credit cards?

+

The balance transfer fee for NFCU credit cards can vary but is often around 3% of the transferred amount, with a minimum fee applicable.

How long do introductory APR periods typically last for NFCU balance transfers?

+

Introductory APR periods for NFCU balance transfers can range from 6 to 18 months, depending on the specific credit card offer.

Can I transfer a balance from a non-NFCU credit card to an NFCU credit card?

+

Yes, NFCU allows balance transfers from other credit card issuers to their credit cards, subject to the terms and conditions of the NFCU credit card agreement.