Unlock Financial Freedom with Dave Ramsey Budget Worksheets

Are you tired of living paycheck to paycheck? Do you often find yourself wondering where all your money goes each month? If so, then Dave Ramsey’s budgeting tools might just be what you need to take control of your financial life. Known for his straightforward approach to money management, Dave Ramsey has devised several budgeting worksheets that can help you get your finances in check, save more, and ultimately, pave the way to financial freedom.

The Foundation of Dave Ramsey's Philosophy

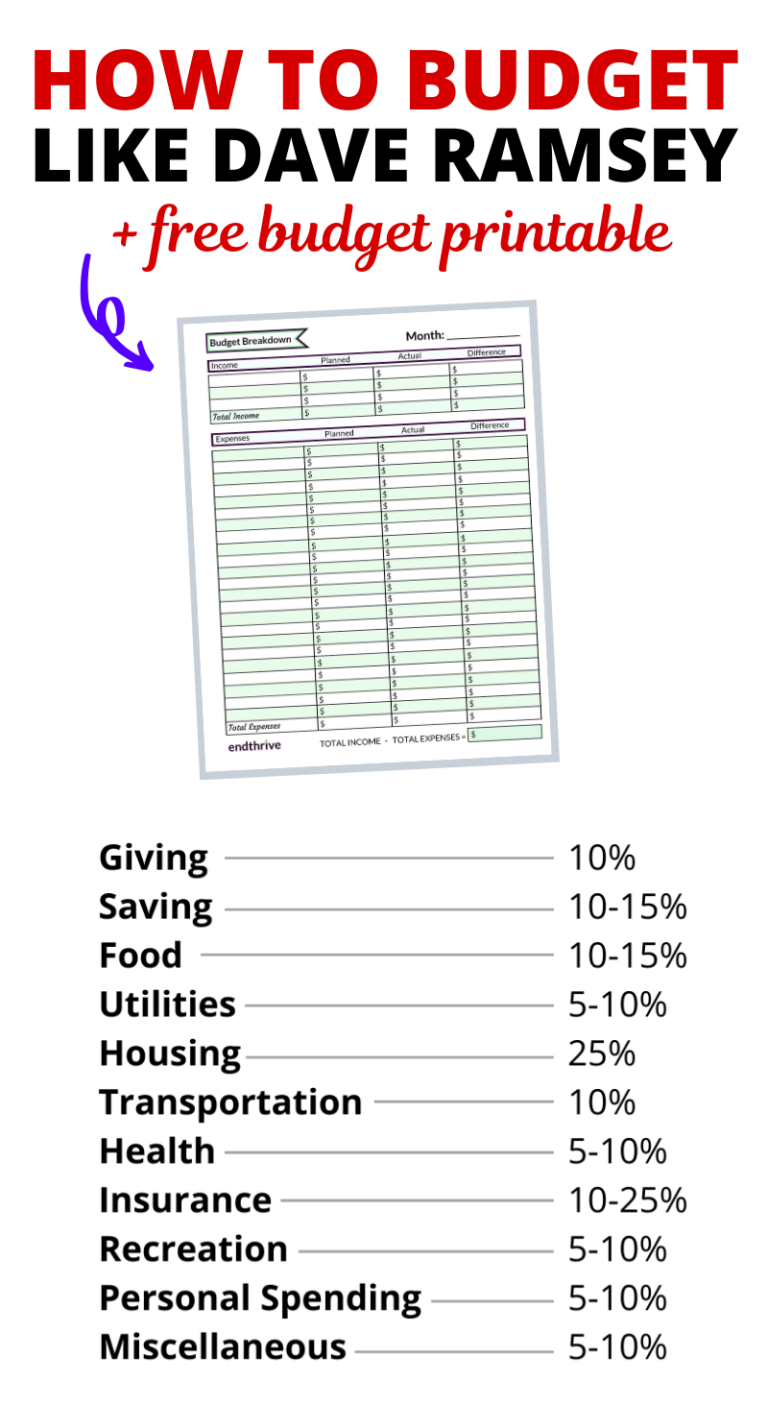

At the heart of Dave Ramsey's financial wisdom is the belief in living debt-free and managing money with a purpose. His budgeting method starts with understanding where your money goes, which is often the first step most people overlook. Here's how you can start implementing his philosophy using his Zero-Based Budget Worksheet:

- Track Every Penny: With this worksheet, every dollar you earn gets a name or a job before the month begins. If you have $3000 to spend, every one of those dollars should be allocated.

- Be Realistic: This method forces you to confront reality. It’s not just about wishful thinking; you must account for every expense, including fun money or miscellaneous costs.

How to Use Dave Ramsey's Budget Worksheet

Here are some steps to get you started with your budgeting journey:

- List Your Income: Start by adding up all sources of income for the month. This includes your salary, any side gigs, child support, or any other cash inflows.

- Fixed and Variable Expenses: Divide your expenses into fixed (like rent, mortgage, utilities) and variable (like groceries, entertainment). Input these into the appropriate sections of the worksheet.

- Allocate Funds: Assign every dollar to a category until you reach zero. If you're left with surplus funds, Ramsey suggests investing them in an emergency fund or snowballing debt payments.

- Use Budgeting Software: While Ramsey promotes using physical worksheets, digital tools like EveryDollar app can make this process less cumbersome by automating some tasks.

💡 Note: The Zero-Based Budget might seem stringent initially, but it's designed to give you freedom in your spending choices, not restrict it.

Budgeting Tools for Different Needs

Ramsey provides a variety of tools tailored to different life stages and financial situations:

- The Monthly Cash Flow Plan: Ideal for individuals or couples just starting with budgeting.

- Irregular Income Budget: Perfect for those with inconsistent earnings, like freelancers or commission-based workers.

- Family Budget: Specifically designed to include common family expenses like child care, school fees, and more.

| Worksheet | Best For | Features |

|---|---|---|

| Zero-Based Budget | Personal finance | Assign every dollar |

| Irregular Income Budget | Freelancers, commission-based income | Prioritizing essential expenses first |

| Monthly Cash Flow Plan | Beginners, Couples | Overview of monthly inflows and outflows |

| Family Budget | Families | Includes child-related expenses |

Financial Education through Budgeting

Using Dave Ramsey's worksheets isn't just about balancing numbers. Here are the educational benefits:

- Financial Awareness: You become acutely aware of how and where you spend your money.

- Goal Setting: Budgeting helps you set financial goals, like saving for a house or getting out of debt.

- Behavioral Changes: It encourages responsible financial behavior and discourages impulsive buying.

📚 Note: Ramsey's approach not only focuses on budgeting but also encourages you to learn and grow financially through his courses and podcasts.

Advanced Budgeting Tips from Ramsey

Once you've got the basics down, here are some advanced strategies to optimize your budgeting experience:

- Envelop System: Allocate cash into different envelopes for different expense categories to physically see where your money is going.

- Sinking Funds: Save for non-monthly or large expenses like vacations or car maintenance in advance.

- Budget Meetings: If you're budgeting as a couple or a family, having regular budget meetings can keep everyone on the same page.

The end of this budgeting journey isn't just about numbers or reaching zero; it's about gaining the control, understanding, and freedom that comes from knowing exactly where your finances stand. By adopting Dave Ramsey's budgeting strategies, you're not only planning your financial future but also shaping your mindset towards money in a way that fosters growth, security, and peace of mind. Remember, the power of a budget lies in its ability to help you prioritize what truly matters to you, giving you the financial freedom to live life on your terms.

In closing, budgeting with Dave Ramsey’s worksheets is about more than just money management; it's a lifestyle choice that guides you towards a debt-free, financially secure future. It instills discipline, fosters savings, and ultimately, helps you achieve the financial goals you've set for yourself. Whether you're a beginner or have been budgeting for years, these tools can refine your financial strategy, making your journey towards financial freedom both attainable and enjoyable.

What if my income is irregular?

+

If your income varies month to month, Ramsey suggests creating a buffer by saving during good months to cover shortfalls in leaner times. His irregular income budget helps in prioritizing essential expenses first.

Can budgeting help with getting out of debt?

+

Yes, budgeting is key to Ramsey’s debt snowball method, where you pay off debts in order of smallest to largest, regardless of interest rate. Budgeting ensures that you have the cash to throw at your debts aggressively.

How often should I review my budget?

+

Dave Ramsey recommends reviewing your budget monthly or even weekly if necessary, especially if you’re working towards a specific financial goal or your financial situation changes frequently.

Is budgeting software necessary?

+

While Ramsey prefers physical worksheets, software like the EveryDollar app can simplify the process by automatically categorizing your spending and helping track your progress, especially if you prefer digital methods.

What if I overspend in a category?

+

Use the Zero-Based Budget strategy to reassess your allocations. If one category is consistently overspent, consider adjusting the amounts or identifying areas where you can cut back to rebalance your budget.