Caroline Blues Credit Report Worksheet Answer Key Revealed

Understanding and managing your credit can be a daunting task, especially when it comes to the enigmatic details of your credit report. One particular tool that has gained popularity among individuals wanting to decipher their credit standing is the Caroline Blues Credit Report Worksheet. This blog post aims to provide an extensive overview of the answer key for the Caroline Blues Credit Report Worksheet, helping you navigate through your credit report with ease and clarity.

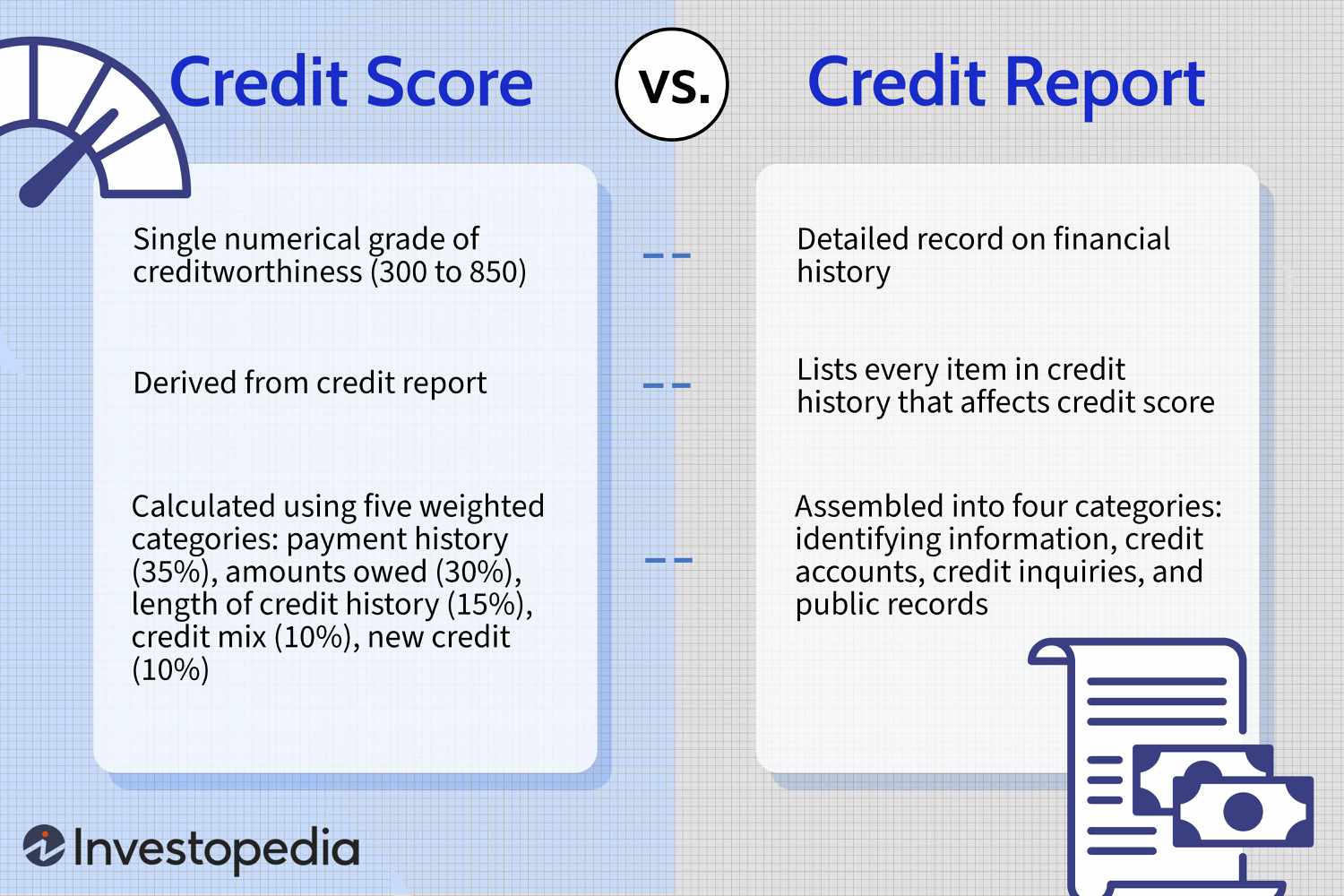

Understanding Your Credit Report

Before diving into the specifics of the Caroline Blues Credit Report Worksheet, let’s establish a fundamental understanding of what a credit report entails:

- Personal Information: Includes your name, current and previous addresses, date of birth, and employer details.

- Public Records: Shows bankruptcies, foreclosures, lawsuits, wage attachments, liens, and judgments.

- Credit Accounts: Lists all your credit accounts, including loans, credit cards, lines of credit, mortgages, and even closed accounts.

- Account History: This section records how you’ve managed each account, detailing payment history, credit limits, current balances, and terms of payment.

- Inquiries: Divided into two types - hard inquiries which can lower your credit score, and soft inquiries which have no impact on your score.

- Negative Items: Late payments, charge-offs, collections, and other derogatory marks appear here.

Dissecting the Caroline Blues Worksheet

The Caroline Blues Credit Report Worksheet provides a structured approach to analyzing your credit report:

Section 1: Personal Details

| Category | Answer Key |

|---|---|

| Full Legal Name | Matches your credit report |

| Current Address | Should be current and correct |

| Previous Addresses | Last two addresses listed on your credit report |

| Date of Birth | Should match your report |

| Employment Details | Current and previous employers |

Section 2: Credit Accounts

- Account Information: This section requires you to list each account, including type of credit, account number, credit limit, current balance, payment history, and dates of account openings.

- Accuracy Check: Verify all account details for accuracy.

- Status: Current, closed, in collections, etc.

Section 3: Public Records and Collections

- Any public records, collections, or tax liens should be noted.

- The age of each record should be checked to see if they are past their reporting limit (7 years for most negative entries).

Section 4: Inquiries

- List all hard inquiries over the last two years.

- Soft inquiries do not need to be listed.

Section 5: Items to Dispute

Here, you should identify any items on your credit report that you believe are inaccurate or outdated. The Caroline Blues Credit Report Worksheet provides a framework to:

- Identify Errors: Check for incorrect personal information, accounts you did not open, or payments marked as late when they were on time.

- Plan Disputes: Document each item you wish to dispute, including the reason for the dispute.

🛠 Note: Ensure all disputes are accompanied by supporting documentation to strengthen your case. If possible, use certified mail with return receipt requested to keep track of your dispute process.

What to Do with Your Findings

After completing the Caroline Blues Credit Report Worksheet, you’ll have a clear understanding of your credit profile:

- Review and Correct: Identify errors and take steps to correct them by filing disputes with the credit bureaus.

- Monitor: Regularly check your credit report for any unauthorized changes or new errors.

- Improve: Use the insights to pay off debts, reduce credit utilization, and improve your credit habits.

Wrapping Up

Having a solid grasp on your credit report is crucial for financial health. The Caroline Blues Credit Report Worksheet serves as an excellent tool to demystify the intricacies of your credit profile. By using this answer key, you can ensure your credit report is accurate, work on enhancing your credit score, and make informed financial decisions. Remember, managing your credit report is an ongoing process, but with the right tools and knowledge, you can turn it into a manageable and even empowering journey.

What does a hard inquiry mean?

+

A hard inquiry occurs when a lender checks your credit report because you’ve applied for credit. These inquiries can temporarily lower your credit score.

How long do negative items stay on my credit report?

+

Most negative items remain on your credit report for 7 years, with bankruptcy potentially staying for up to 10 years.

Can I dispute items on my credit report myself?

+

Yes, you can dispute items directly with the credit bureaus by providing evidence that the items are incorrect or outdated.

Why might personal information on my credit report be incorrect?

+

Incorrect personal information can result from clerical errors, outdated data, or identity theft, where someone else’s information might be mixed with yours.