5 Army Loan Tips

Introduction to Army Loans

Army loans are a type of financial assistance designed specifically for active and retired military personnel, including those in the army. These loans often come with favorable terms, such as lower interest rates and more flexible repayment options, compared to traditional loans. Understanding how to navigate and utilize army loans effectively can be crucial for military families and individuals facing financial challenges. In this article, we will explore five key tips for managing and benefiting from army loans.

Understanding Your Financial Situation

Before applying for an army loan, it’s essential to have a clear understanding of your financial situation. This includes knowing your credit score, income, expenses, and any existing debts. A good credit score can significantly improve your chances of getting approved for a loan with a lower interest rate. Additionally, having a comprehensive view of your financial landscape will help you determine how much you can afford to borrow and repay each month. Consider using a budgeting app or spreadsheet to track your income and expenses.

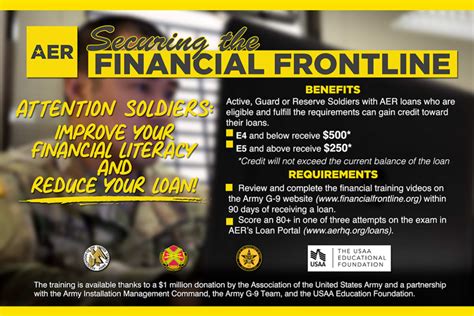

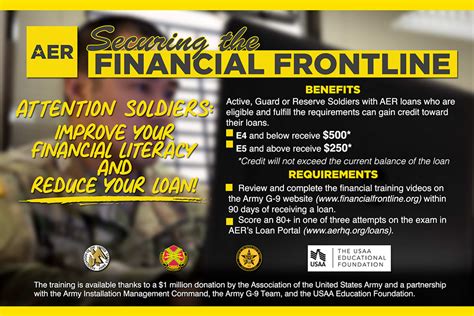

Exploring Army Loan Options

There are various types of loans available to army personnel, including personal loans, payday loans, and VA loans for those looking to purchase a home. Each of these options has its own set of benefits and drawbacks. For instance, VA loans offer zero-down mortgage options and lower interest rates, but they may have stricter eligibility criteria. It’s crucial to research and compare the different types of loans to find the one that best suits your financial needs and situation.

Applying for an Army Loan

When applying for an army loan, ensure you have all the necessary documentation ready. This typically includes identification, proof of military service, income verification, and sometimes a copy of your credit report. Applying online can be convenient, but be cautious of lenders with very high interest rates or hidden fees. Some lenders specialize in loans for military personnel and may offer more favorable terms. Always read the fine print and understand the terms of the loan before signing any agreement.

Managing Your Loan Repayments

Effective management of your loan repayments is key to avoiding debt traps and maintaining a healthy financial profile. Consider setting up automatic payments to ensure you never miss a payment. Creating a budget that prioritizes your loan repayments can help you stay on track. Additionally, look into options for consolidating debt or negotiating lower interest rates if you’re finding it difficult to manage your repayments.

Avoiding Debt Traps

It’s easy to fall into debt traps, especially with the allure of quick cash from payday lenders. However, these loans often come with extremely high interest rates and fees that can lead to a cycle of debt. Be cautious of lenders that promise guaranteed approval without considering your credit history or that charge exorbitant interest rates. Always explore alternatives, such as borrowing from a credit union or seeking financial assistance programs designed for military personnel.

| Loan Type | Interest Rate | Repayment Terms |

|---|---|---|

| Personal Loan | 6% - 36% | 2 - 5 years |

| Payday Loan | 300% - 780% | 2 weeks - 1 month |

| VA Loan | 2.5% - 4% | 15 - 30 years |

💡 Note: Always review the terms and conditions of any loan before applying, and consider seeking advice from a financial advisor if you're unsure.

In summary, navigating the world of army loans requires careful consideration and planning. By understanding your financial situation, exploring the right loan options, applying wisely, managing your repayments effectively, and avoiding debt traps, you can make the most of the financial assistance available to you as a member of the army. Whether you’re looking to cover unexpected expenses, consolidate debt, or achieve a long-term financial goal, such as purchasing a home, being informed and strategic in your approach to army loans can provide significant benefits and peace of mind.

What are the eligibility criteria for army loans?

+

Eligibility for army loans varies depending on the type of loan. Generally, active, retired, and sometimes reserve members of the military are eligible. For VA loans, eligibility is based on the length and type of military service.

How do I apply for an army loan?

+

Application processes vary, but most lenders offer online applications. You’ll typically need to provide identification, proof of military service, and financial information. Some loans may require a credit check.

Can I get an army loan with bad credit?

+

Yes, it’s possible to get an army loan with bad credit, but the interest rates may be higher. Some lenders specialize in loans for military personnel with less-than-perfect credit. VA loans, for example, do not require a minimum credit score for eligibility.