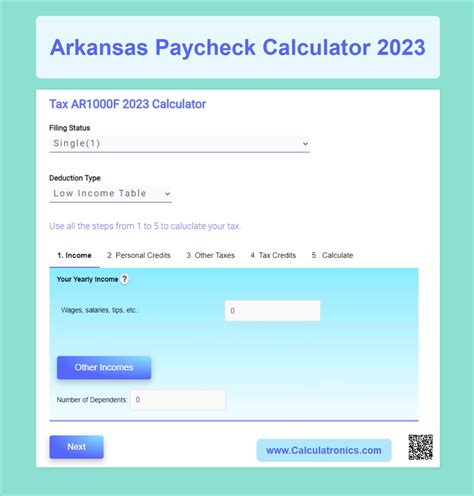

Arkansas Paycheck Calculator Tool

Introduction to Arkansas Paycheck Calculator Tool

The Arkansas Paycheck Calculator Tool is a valuable resource for both employers and employees in the state of Arkansas. This tool allows users to calculate the gross pay and net pay of an employee, taking into account various factors such as hourly wage, number of hours worked, pay frequency, and tax deductions. In this article, we will delve into the features and benefits of the Arkansas Paycheck Calculator Tool, and provide a step-by-step guide on how to use it.

Features of the Arkansas Paycheck Calculator Tool

The Arkansas Paycheck Calculator Tool is designed to be user-friendly and efficient. Some of its key features include: * Easy-to-use interface: The tool has a simple and intuitive interface that makes it easy for users to navigate and calculate paychecks. * Customizable: The tool allows users to customize the calculation by inputting specific values for hourly wage, number of hours worked, pay frequency, and tax deductions. * Accurate calculations: The tool provides accurate calculations of gross pay and net pay, taking into account federal income tax, state income tax, and other deductions. * Support for multiple pay frequencies: The tool supports various pay frequencies, including weekly, bi-weekly, monthly, and annually.

Benefits of Using the Arkansas Paycheck Calculator Tool

The Arkansas Paycheck Calculator Tool offers numerous benefits to employers and employees in Arkansas. Some of the benefits include: * Increased accuracy: The tool reduces the likelihood of errors in calculating paychecks, ensuring that employees receive the correct amount of pay. * Time-saving: The tool saves time and effort for employers, as it automates the calculation process and provides quick results. * Improved compliance: The tool helps employers comply with tax laws and regulations, reducing the risk of penalties and fines. * Better financial planning: The tool enables employees to plan their finances better, as they can accurately estimate their take-home pay.

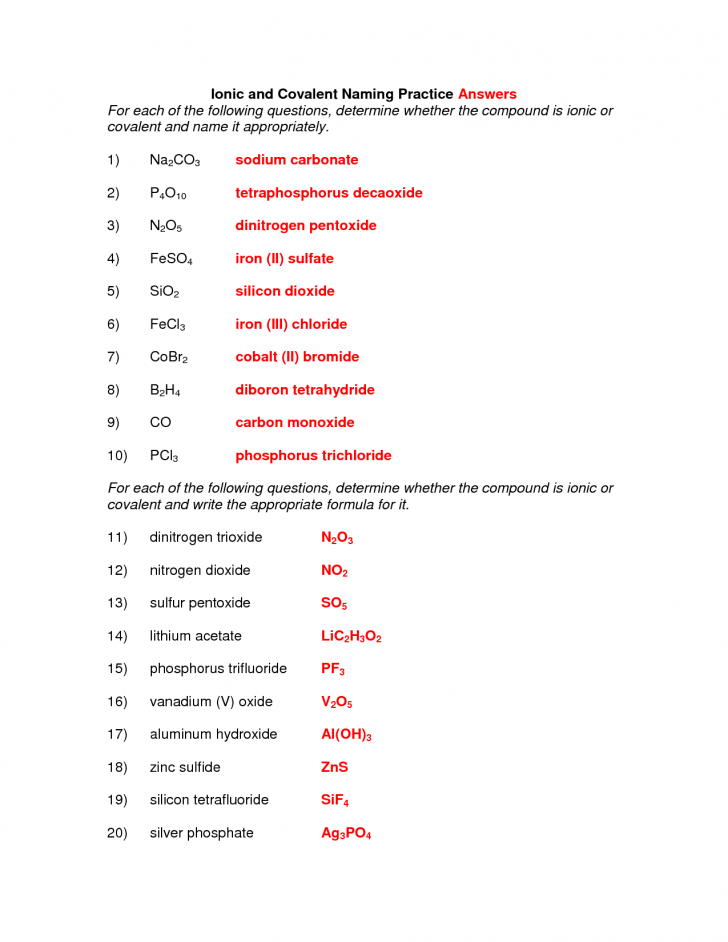

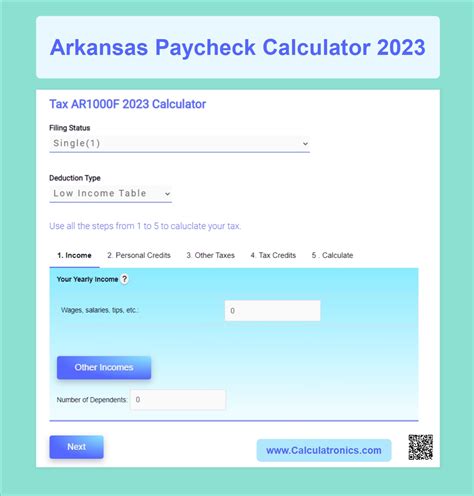

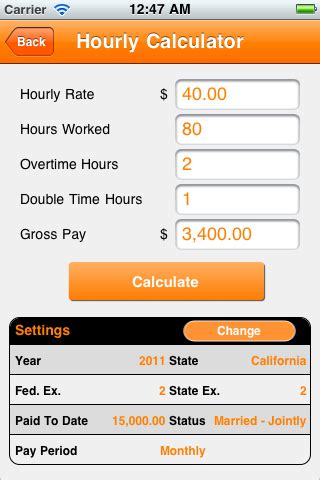

How to Use the Arkansas Paycheck Calculator Tool

Using the Arkansas Paycheck Calculator Tool is straightforward. Here’s a step-by-step guide: * Enter hourly wage: Input the employee’s hourly wage into the tool. * Enter number of hours worked: Input the number of hours worked by the employee. * Select pay frequency: Choose the pay frequency from the available options (e.g., weekly, bi-weekly, monthly, annually). * Enter tax deductions: Input any tax deductions, such as federal income tax and state income tax. * Calculate paycheck: Click the “Calculate” button to generate the gross pay and net pay.

💡 Note: It's essential to ensure that the input values are accurate to obtain precise calculations.

Arkansas Payroll Taxes

Arkansas has a progressive income tax system, with seven tax brackets ranging from 2.5% to 7%. The state also has a sales tax rate of 6.5%, which applies to most goods and services. Employers in Arkansas must comply with federal and state tax laws, including withholding taxes and paying unemployment taxes.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $4,299 | 2.5% |

| $4,300 - $8,399 | 3% |

| $8,400 - $12,699 | 3.5% |

| $12,700 - $21,099 | 4% |

| $21,100 - $35,099 | 5% |

| $35,100 - $73,699 | 6% |

| $73,700 and above | 7% |

As we near the end of our discussion on the Arkansas Paycheck Calculator Tool, it’s clear that this resource is an invaluable asset for employers and employees in the state. By providing accurate calculations and complying with tax laws, the tool helps ensure that employees receive the correct amount of pay, and employers avoid penalties and fines.

In final thoughts, the Arkansas Paycheck Calculator Tool is a powerful resource that streamlines the payroll process, saving time and effort for employers while ensuring accuracy and compliance with tax laws. By understanding the features, benefits, and usage of the tool, employers and employees can better navigate the complexities of payroll in Arkansas.

What is the Arkansas Paycheck Calculator Tool?

+

The Arkansas Paycheck Calculator Tool is a resource that calculates the gross pay and net pay of an employee, taking into account various factors such as hourly wage, number of hours worked, pay frequency, and tax deductions.

How do I use the Arkansas Paycheck Calculator Tool?

+

To use the tool, simply input the employee’s hourly wage, number of hours worked, pay frequency, and tax deductions, and click the “Calculate” button to generate the gross pay and net pay.

What are the benefits of using the Arkansas Paycheck Calculator Tool?

+

The benefits of using the tool include increased accuracy, time-saving, improved compliance with tax laws, and better financial planning for employees.