5 Alabama Tax Tips

Understanding Alabama Tax Tips

Alabama, known as the Yellowhammer State, has its own set of tax rules and regulations that residents and businesses must follow. Being aware of these tax tips can help individuals and companies navigate the complex world of taxation, potentially saving them money and avoiding legal issues. In this article, we will delve into five key Alabama tax tips that are essential for anyone looking to manage their tax obligations effectively.

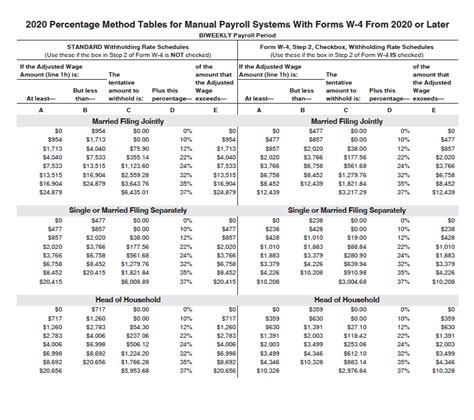

1. Income Tax: Understanding Your Alabama Income Tax Liability

Alabama imposes a state income tax on its residents. The state has a progressive income tax system, with tax rates ranging from 2% to 5%. It’s crucial for taxpayers to understand their tax liability and how it applies to their income. This includes knowing which tax deductions and credits they are eligible for, such as the Alabama Standard Deduction or the Earned Income Tax Credit (EITC), if they qualify.

2. Sales Tax: Alabama Sales Tax Rates and Exemptions

Alabama has a state sales tax rate of 4%, but this can increase when local sales taxes are added, making the total sales tax rate vary across different locations within the state. Some items are exempt from sales tax, such as groceries and prescription medications. Understanding what is taxable and what is exempt can help consumers make informed purchasing decisions and potentially reduce their sales tax burden.

3. Property Tax: Navigating Alabama Property Tax Assessments

Property owners in Alabama are subject to property taxes, which are used to fund local government services and public schools. The tax is based on the assessed value of the property, which is typically a percentage of its fair market value. Homeowners should be aware of their property’s assessed value and understand how it impacts their tax bill. They should also explore any available property tax exemptions or homestead exemptions that could reduce their tax liability.

4. Tax Credits and Deductions: Claiming What You’re Eligible For

Alabama offers various tax credits and deductions that can significantly reduce an individual’s or business’s tax liability. For example, there are credits for contributions to Alabama’s 529 college savings plan, historic rehabilitation projects, and qualified investments in rural areas. Taxpayers should thoroughly review the available credits and deductions to ensure they claim all the ones they are eligible for, as this can lead to substantial tax savings.

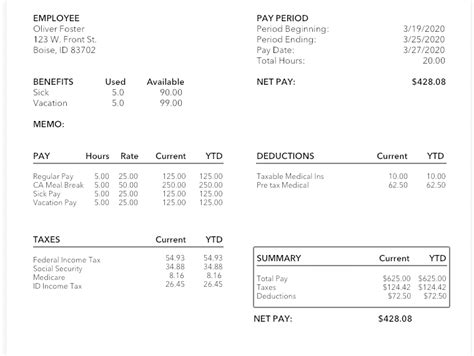

5. Tax Filing: Meeting Your Alabama Tax Filing Obligations

Finally, it’s essential for taxpayers to understand their tax filing obligations in Alabama. This includes knowing the tax filing deadline, which is typically the same as the federal tax filing deadline, and being aware of the forms and documentation required for filing. Taxpayers may choose to file their taxes electronically or by mail, and they should ensure they have all necessary W-2 forms, 1099 forms, and other relevant documents before starting the filing process. Additionally, taxpayers who are unable to meet the filing deadline may need to file for an extension to avoid penalties and interest on their tax bill.

📝 Note: Tax laws and regulations can change, so it's always a good idea to consult with a tax professional or check the official Alabama Department of Revenue website for the most current information.

In summary, being informed about Alabama’s tax system is crucial for managing tax obligations effectively. By understanding income tax, sales tax, property tax, available tax credits and deductions, and tax filing obligations, individuals and businesses can navigate the complex world of taxation with more ease, potentially saving money and avoiding legal issues. Whether you’re a long-time resident or new to the state, staying up-to-date on Alabama tax tips can make a significant difference in your financial planning and compliance with state tax laws.

What is the state sales tax rate in Alabama?

+

The state sales tax rate in Alabama is 4%, but this can increase with local sales taxes.

Are there any property tax exemptions available in Alabama?

+

Yes, Alabama offers property tax exemptions, including homestead exemptions for eligible homeowners.

What is the deadline for filing Alabama state income tax returns?

+

The deadline for filing Alabama state income tax returns is typically the same as the federal tax filing deadline.