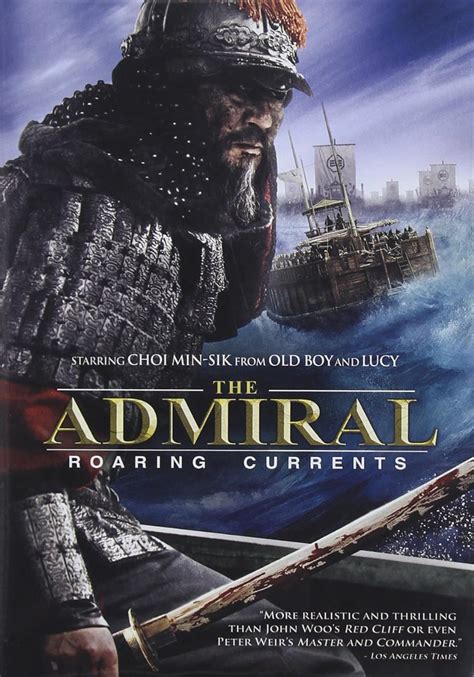

5 Ways Admiral Personal Injury Cover Protects You

Understanding Admiral Personal Injury Cover

Admiral Personal Injury Cover is a type of insurance policy designed to provide financial protection to individuals who have been injured in an accident. This coverage is specifically tailored to help policyholders navigate the often-complex process of seeking compensation for injuries sustained due to someone else’s negligence or fault. With Admiral Personal Injury Cover, you can ensure that you receive the support and financial assistance you need during a challenging time.

5 Key Ways Admiral Personal Injury Cover Protects You

1. Medical Expenses and Rehabilitation Costs

In the event of an accident, one of the primary concerns is the cost of medical treatment and rehabilitation. Admiral Personal Injury Cover helps alleviate this financial burden by providing coverage for a range of medical expenses, including:

- Doctor visits and hospital stays

- Physical therapy and rehabilitation programs

- Prescription medication and medical equipment

- Travel costs associated with medical treatment

2. Loss of Income and Earning Capacity

If your injury prevents you from working, Admiral Personal Injury Cover can help replace your lost income, ensuring that you can continue to meet your financial obligations. This coverage also takes into account potential future losses in earning capacity, providing a safety net for your financial future.

3. Pain and Suffering

In addition to physical injuries, accidents can also cause significant emotional distress and pain. Admiral Personal Injury Cover recognizes this and provides compensation for the pain and suffering you endure as a result of your injury.

4. Home and Vehicle Modifications

Depending on the severity of your injury, you may require modifications to your home or vehicle to accommodate your new needs. Admiral Personal Injury Cover can help cover the costs of these modifications, including:

- Installing wheelchair ramps or elevators

- Modifying bathrooms or kitchens for accessibility

- Adapting vehicles for safe transportation

5. Legal Expenses and Support

Navigating the process of seeking compensation for your injuries can be daunting, especially when dealing with complex legal systems. Admiral Personal Injury Cover provides access to experienced lawyers who can guide you through the claims process, ensuring that you receive the compensation you deserve.

💡 Note: It's essential to carefully review your policy to understand the specific terms and conditions of your coverage.

Additional Benefits of Admiral Personal Injury Cover

In addition to the five key ways outlined above, Admiral Personal Injury Cover also offers several additional benefits, including:

- A 24⁄7 claims hotline for immediate support

- Access to a network of medical professionals for expert advice

- A dedicated claims handler to guide you through the process

- Coverage for funeral expenses in the event of a fatal accident

Choosing the Right Policy for Your Needs

When selecting a personal injury cover policy, it’s crucial to consider your individual needs and circumstances. Admiral Personal Injury Cover offers a range of policy options, allowing you to choose the level of coverage that’s right for you.

By understanding the ways in which Admiral Personal Injury Cover protects you, you can make an informed decision about your insurance needs and ensure that you’re prepared for the unexpected.

What is Admiral Personal Injury Cover?

+

Admiral Personal Injury Cover is a type of insurance policy designed to provide financial protection to individuals who have been injured in an accident.

What types of medical expenses are covered?

+

Admiral Personal Injury Cover provides coverage for a range of medical expenses, including doctor visits, hospital stays, physical therapy, and prescription medication.

Can I choose my own lawyer?

+

Admiral Personal Injury Cover provides access to experienced lawyers who can guide you through the claims process. However, you may also be able to choose your own lawyer, depending on the terms of your policy.

In conclusion, Admiral Personal Injury Cover offers a range of benefits and protections designed to support individuals who have been injured in an accident. By understanding the ways in which this coverage can help, you can make an informed decision about your insurance needs and ensure that you’re prepared for the unexpected.

Related Terms:

- Driver injury cover Tesco

- What is personal injury cover

- Admiral whiplash payout

- Admiral Motor Legal Protection

- Admiral uninsured driver promise

- Admiral report accident