5 Ways to Simplify IRS Form 941-X with Excel

Have you ever found yourself struggling with the complexities of IRS Form 941-X, often wishing there was a simpler way to manage it? If you run a business or manage payroll, you understand the importance of accurate reporting to the IRS. Mistakes can lead to costly penalties, audits, and delays in processing. However, with the power of Excel, this form can become much less daunting. Here are five Excel-based strategies to simplify the process of filling out and managing IRS Form 941-X:

1. Use Dynamic Ranges for Easier Data Entry

Excel’s dynamic ranges can revolutionize the way you input data for IRS Form 941-X:

- Define named ranges: Use the “Name Manager” to define dynamic ranges that automatically update when new data is added.

- Implement OFFSET function: This function can help adjust the size of the range dynamically, reducing errors when data changes.

📝 Note: Dynamic ranges ensure that your form remains accurate even as data grows or changes.

2. Automate Calculations with Formulas

IRS Form 941-X involves numerous calculations. By automating these with Excel formulas, you minimize calculation errors:

- Use basic math functions: SUM, AVERAGE, and IF statements can handle simple computations.

- Create custom formulas: For complex calculations, custom formulas can automate tasks like wage adjustment calculations.

3. Implement Data Validation Rules

To ensure accuracy, use Excel’s data validation features:

- Set input restrictions: Use dropdown lists or restrict input to numeric values only where applicable.

- Create error alerts: Configure error messages for invalid data entries to guide users.

🔔 Note: Data validation acts as a quality control mechanism, reducing the chances of submitting erroneous data to the IRS.

4. Utilize Conditional Formatting for Quick Checks

Highlighting discrepancies or anomalies in your data is crucial for IRS Form 941-X:

- Color-code cells: Highlight cells based on specific conditions like negative values or over/under limits.

- Set up alerts: Use conditional formatting to alert when values are outside expected norms.

5. Protect Sheets to Prevent Unauthorized Changes

Ensure your work is tamper-proof:

- Lock cells: Protect sensitive cells that contain formulas or data that shouldn’t be edited.

- Allow edits to specific cells: Enable users to make changes only in areas where adjustments are necessary.

By implementing these strategies, you not only streamline the process of filling out IRS Form 941-X but also enhance the accuracy and efficiency of your reporting. Excel's versatility allows you to tailor the form to your needs, automate repetitive tasks, and minimize human error. The strategies detailed above provide a foundation for not just this form but other similar compliance documents as well.

As we've explored these methods, remember that understanding your data and keeping abreast of any changes in tax laws will further improve your filings' accuracy. Using Excel to manage IRS Form 941-X means you're equipped with tools that simplify the process, ensure compliance, and provide a record for future audits or reviews.

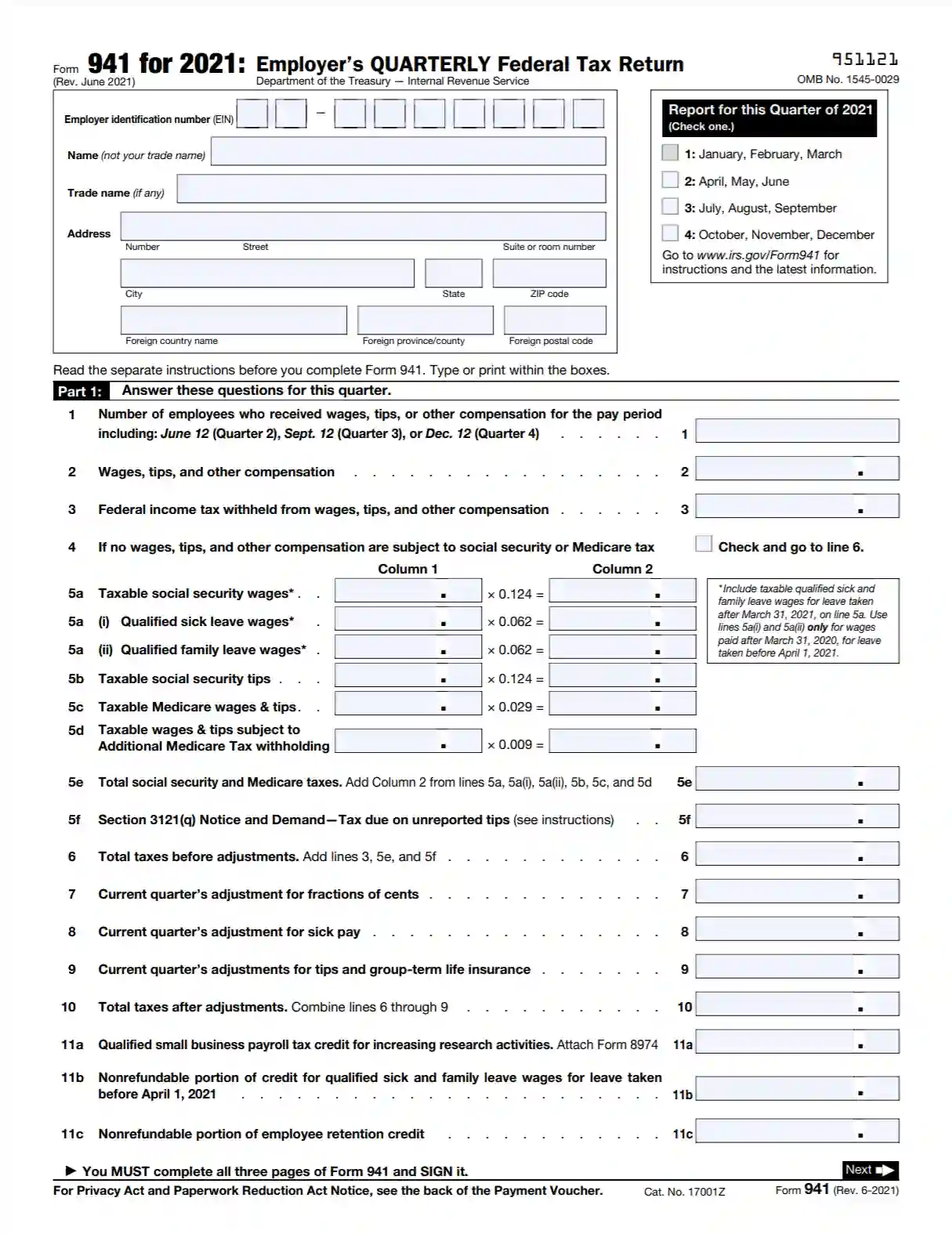

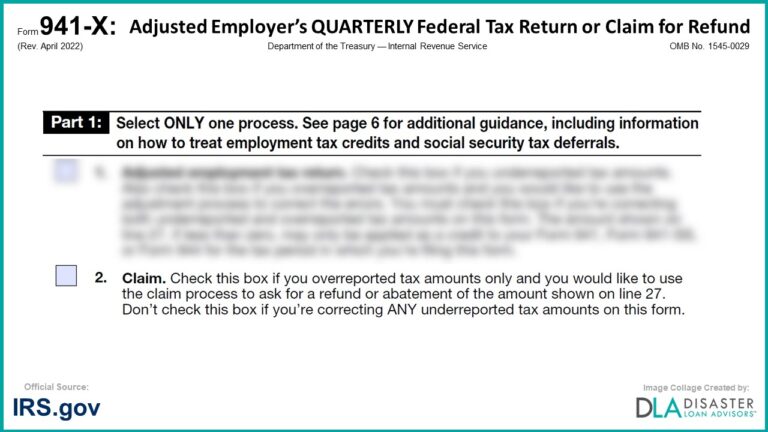

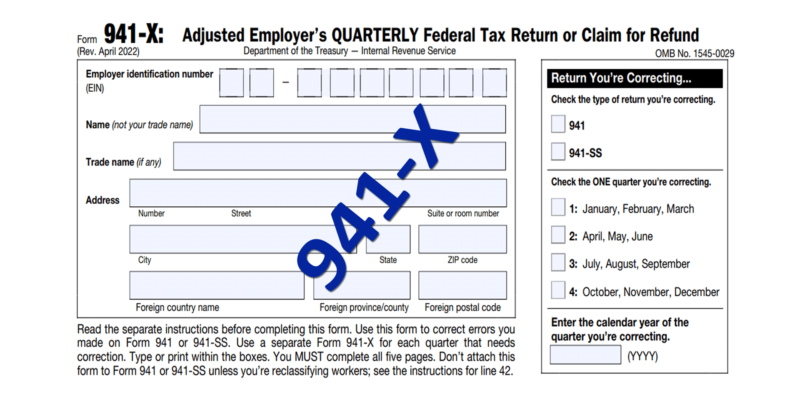

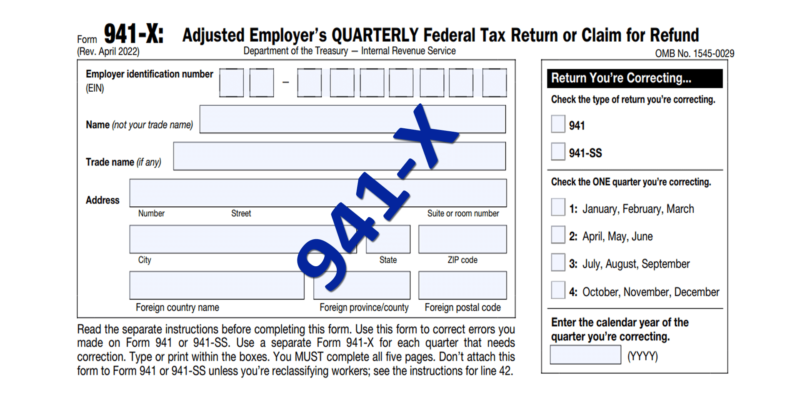

What is IRS Form 941-X?

+

IRS Form 941-X is an adjusted employer’s quarterly federal tax return, used to correct errors on previously filed Form 941.

Why should I use Excel for IRS Form 941-X?

+

Excel offers tools for data management, calculations, and error checking which significantly simplify the task of filling out and managing complex tax forms like Form 941-X.

Can I automate IRS Form 941-X completely with Excel?

+

While Excel can automate many aspects, human oversight is still necessary for ensuring data accuracy and compliance with current tax laws.

How often do I need to update my Excel file for IRS Form 941-X?

+

Updates should be made whenever there’s a correction to be reported or changes in the form’s requirements by the IRS.

What are the benefits of using dynamic ranges for IRS Form 941-X?

+

Dynamic ranges help manage fluctuating data, keeping your spreadsheet accurate and adaptable without manual adjustments.