941X Worksheet 1

Are you intrigued by the mystery of the 941X Worksheet 1? If you're responsible for calculating payroll, dealing with employment taxes, or running a small business in the United States, this document will soon become one of your closest companions. Let's delve into its role, its importance, and how to master its complexities.

What is the 941X Worksheet 1?

The 941X Worksheet 1 is not just another piece of paper; it’s a critical component of the IRS Form 941X, which is used for adjusting employment taxes previously reported on Form 941. This worksheet helps in:

- Calculating the corrected wages and taxes

- Ensuring accurate reporting to the IRS

- Reconciling discrepancies

Why Use the 941X Worksheet?

The primary purposes of using the 941X Worksheet are:

- Avoiding Penalties: Accurate adjustments help prevent penalties for underpayment or overpayment of employment taxes.

- Employee Accuracy: Ensuring employees receive the correct tax credits, deductions, and withholdings.

- Record Keeping: Maintaining a clear, auditable paper trail for tax authorities.

Key Elements of Form 941X and Worksheet 1

Here’s what you’ll typically find on Form 941X and how Worksheet 1 ties into it:

- Employee Information: Names, SSN, and wage adjustments.

- Tax Adjustments: Corrected Social Security, Medicare, and federal income tax withholdings.

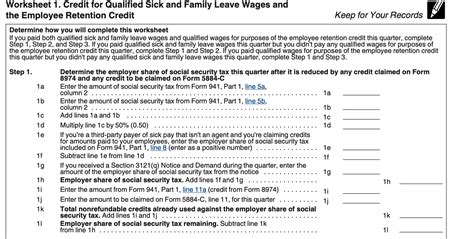

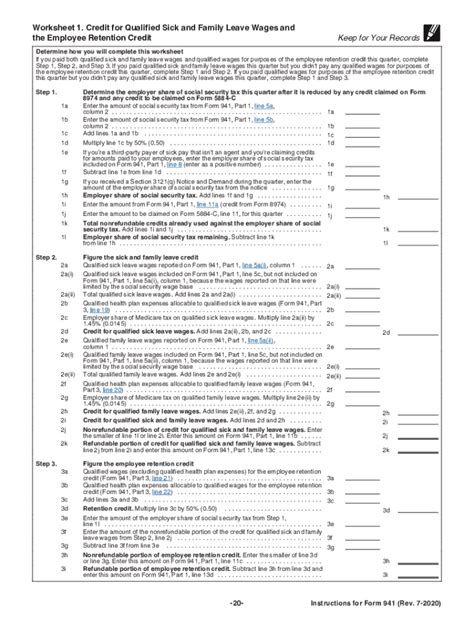

- Line by Line Corrections: From Part 1 to Part 5, Worksheet 1 guides through correcting previous mistakes line by line.

How to Fill Out the 941X Worksheet

Filling out the 941X Worksheet requires attention to detail. Here’s a step-by-step guide:

- Identify the Adjustment Period: Determine which quarter the adjustment pertains to.

- Record Wage Information: Enter corrected wages and tips for each employee on lines 1-6 of Worksheet 1.

- Compute the Corrected Tax Amounts: Use lines 7-15 to calculate the correct tax amounts.

- Transcribe to Form 941X: Transfer these calculations to Form 941X.

✏️ Note: Always check the latest IRS guidelines, as forms and instructions can change periodically.

Common Mistakes to Avoid

Mistakes in filling out Form 941X can lead to audits or penalties. Here are some common pitfalls:

- Incorrectly calculating wages or tips.

- Transposing or miscalculating line items.

- Missing to sign and date the form.

- Not filling out Worksheet 1 accurately before transcribing to Form 941X.

Using Technology to Simplify 941X Filing

Fortunately, technology has evolved to simplify the often arduous task of 941X filing:

- Automated Payroll Software: Programs like QuickBooks or ADP automatically calculate adjustments and generate necessary forms.

- Online Filing: IRS e-filing options make it easier to submit corrected forms without the risk of postal errors.

- Excel Templates: For those who prefer manual entry, pre-formatted Excel sheets can mimic the 941X Worksheet 1, reducing calculation errors.

The journey through the 941X Worksheet 1 might seem intimidating at first, but with the right approach, it becomes a manageable part of your payroll duties. In the end, mastering this worksheet ensures your business's compliance with tax regulations, accurate employee records, and smooth financial operations. Remember, it's not just about avoiding penalties; it's about maintaining the integrity of your financial reporting and building trust with both your employees and the tax authorities.

Can I file Form 941X electronically?

+

Yes, the IRS offers an e-filing option for Form 941X, which can reduce errors and streamline the process.

What if I’ve already filed Form 941 for the quarter?

+

You’ll need to file Form 941X for any adjustments, even if the original Form 941 was filed correctly. This ensures all discrepancies are accounted for.

How long do I have to file Form 941X?

+

Form 941X can be filed up to three years after the due date for the Form 941 for the quarter in which the adjustment should have been included.

Do I need to attach the 941X Worksheet when filing?

+

While not strictly required, including Worksheet 1 can help explain the adjustments and speed up the processing of your form.