Mastering 941 X Worksheet with Excel in 2023

As we step into 2023, businesses are constantly seeking efficient ways to manage their financial compliance duties, particularly when it comes to IRS Form 941, which reports payroll taxes. To ease this process, many are turning to software like Microsoft Excel to master the intricacies of the 941 X Worksheet, which allows for adjustments to previously filed Forms 941. Here's your guide on mastering the 941 X Worksheet with Excel, enhancing accuracy, saving time, and minimizing errors.

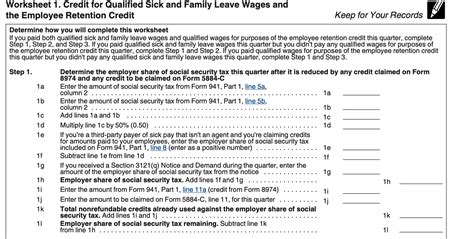

Understanding Form 941 X and Its Importance

The IRS Form 941 X, also known as the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, is used to correct errors in the previously submitted Form 941. It’s essential for businesses to reconcile their payroll tax records accurately, as failure to do so could lead to penalties or an incorrect tax liability.

📝 Note: Remember, Form 941 X can only be filed to correct errors from a Form 941 of the same tax year.

Setting Up Your Excel Worksheet

Before you dive into the data, setting up your Excel worksheet correctly is crucial:

- Open Microsoft Excel and create a new workbook.

- Label columns appropriately for each data entry field in Form 941 X. Common fields include: Taxable Social Security Wages, Taxable Medicare Wages, Federal Income Tax Withheld, and so on.

- Use merge & center for headers and conditional formatting to visually separate the quarters or periods you are adjusting.

Data Entry for Form 941 X in Excel

With your worksheet ready:

- Enter the company information: Include the business name, EIN, and the quarter you're correcting. This information should match with the original Form 941 you are amending.

- Enter adjustment details: For each line on Form 941 X, enter the original amount, the corrected amount, and the difference in separate columns.

Here's a simple table to visualize how you might structure your Excel worksheet:

| Line Number | Description | Original Amount | Corrected Amount | Adjustment |

|---|---|---|---|---|

| 1 | Number of employees | 15 | 16 | 1 |

| 2 | Taxable Social Security Wages | $50,000 | $51,000 | $1,000 |

🛈 Note: Ensure the 'Adjustment' column calculates the difference correctly using Excel's formula capabilities (e.g., =D2-C2).

Calculating Adjustments

Excel’s power lies in its ability to perform calculations:

- Use formulas for each tax line to compute the adjustments (increase or decrease).

- Summarize the adjustments on a summary sheet to quickly identify the net effect of all changes.

For example, to calculate the adjustment for Social Security taxes:

=B2*$0.124💡 Note: Always verify the tax rates with the current IRS guidelines, as they may change.

Verification and Review

Accuracy is paramount. Here’s how to double-check your work:

- Validate the data input against the original Form 941 to ensure accuracy in the adjustments.

- Use Excel's Data Validation feature to restrict certain entries, preventing misinputs.

- Perform a manual review of critical lines, especially the total tax due or refund amount.

Importance of Time Management

Efficient time management while preparing Form 941 X:

- Set up formulas to automate calculations, reducing manual effort.

- Use conditional formatting to highlight any adjustments that exceed a certain threshold, alerting you to potential errors or areas requiring review.

⏰ Note: Time spent now on accurate input will save hours in potential audits or re-filing later.

Finalization and Printing

Once you are satisfied with your adjustments:

- Finalize your worksheet by ensuring all data is up to date, and calculations are correct.

- Check for any last-minute changes or updates to tax laws.

- Print or prepare a PDF copy of the Form 941 X to file with the IRS, ensuring to include any necessary signatures or authorizations.

Key points to remember for mastering Form 941 X with Excel:

- Accuracy in data entry and adjustments is crucial.

- Utilize Excel's features like formulas and data validation to ensure accuracy.

- Timely verification saves effort and potential penalties.

- Keep abreast of IRS updates regarding tax rates and filing requirements.

In summary, Excel provides an invaluable tool for managing and adjusting the complexities of Form 941 X, offering an organized and less time-consuming approach. It's not just about ensuring compliance but also about optimizing your accounting workflow for efficiency, reducing errors, and facilitating easier audits. With these insights and steps, businesses can confidently prepare and file their amended payroll tax returns for 2023, ensuring they maintain good standing with tax authorities.

What is Form 941 X used for?

+

Form 941 X is used to correct errors on previously filed Form 941, the Employer’s Quarterly Federal Tax Return. It’s for adjusting or claiming refunds for overpayments made during the same tax year.

Can Form 941 X be filed electronically?

+

As of 2023, the IRS does not support the electronic filing of Form 941 X. You need to file it on paper and send it by mail to the IRS.

How do I know which figures to enter in the 941 X Worksheet?

+

The figures you enter in the 941 X Worksheet should reflect the corrections you are making. Compare your original Form 941 with the correct figures, and enter the differences accordingly in the worksheet.