Wisconsin Tax Calculator Tool

Introduction to Wisconsin Tax Calculator Tool

The Wisconsin Tax Calculator Tool is a valuable resource for individuals and businesses looking to calculate their tax liabilities in the state of Wisconsin. This tool takes into account various factors such as income, deductions, and credits to provide an accurate estimate of the taxes owed. In this article, we will explore the features and benefits of the Wisconsin Tax Calculator Tool, as well as provide a step-by-step guide on how to use it.

Features of the Wisconsin Tax Calculator Tool

The Wisconsin Tax Calculator Tool offers a range of features that make it an essential tool for tax planning and preparation. Some of the key features include: * Easy-to-use interface: The tool has a user-friendly interface that makes it easy to navigate and input information. * Accurate calculations: The tool uses the latest tax laws and regulations to provide accurate calculations of tax liabilities. * Support for multiple filing statuses: The tool supports multiple filing statuses, including single, married, head of household, and qualifying widow(er). * Handling of deductions and credits: The tool allows users to input deductions and credits, such as the standard deduction, itemized deductions, and earned income tax credit. * Estimation of tax refunds or liabilities: The tool provides an estimate of the tax refund or liability based on the input information.

Benefits of Using the Wisconsin Tax Calculator Tool

Using the Wisconsin Tax Calculator Tool can provide several benefits, including: * Accurate tax planning: The tool helps users plan their taxes accurately, reducing the risk of errors and penalties. * Time-saving: The tool saves time and effort by automating the tax calculation process. * Reduced stress: The tool reduces stress and anxiety associated with tax preparation by providing a clear and concise estimate of tax liabilities. * Improved financial planning: The tool helps users make informed financial decisions by providing a clear picture of their tax situation.

How to Use the Wisconsin Tax Calculator Tool

Using the Wisconsin Tax Calculator Tool is a straightforward process that involves the following steps: * Step 1: Gather necessary information, including income, deductions, and credits. * Step 2: Select the filing status and enter the necessary information. * Step 3: Input deductions and credits, such as the standard deduction, itemized deductions, and earned income tax credit. * Step 4: Review and confirm the input information. * Step 5: Calculate the tax liability or refund using the tool.

📝 Note: It is essential to ensure the accuracy of the input information to get a reliable estimate of tax liabilities.

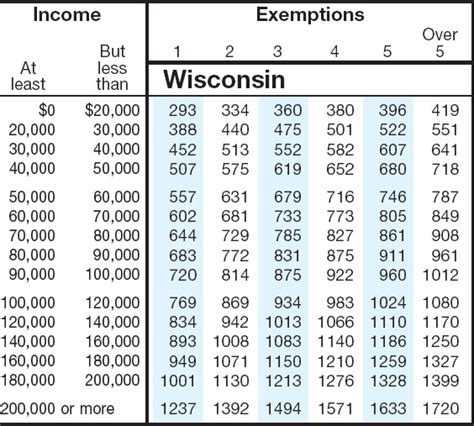

Tax Rates and Brackets in Wisconsin

Wisconsin has a progressive tax system, with tax rates ranging from 4% to 7.65%. The tax rates and brackets are as follows:

| Taxable Income | Tax Rate |

|---|---|

| 0 - 11,000 | 4% |

| 11,001 - 22,000 | 5.25% |

| 22,001 - 33,000 | 6.25% |

| $33,001 and above | 7.65% |

Conclusion and Final Thoughts

In conclusion, the Wisconsin Tax Calculator Tool is a valuable resource for individuals and businesses looking to calculate their tax liabilities in the state of Wisconsin. By using this tool, users can ensure accurate tax planning, save time and effort, and reduce stress and anxiety associated with tax preparation. It is essential to ensure the accuracy of the input information to get a reliable estimate of tax liabilities. By following the steps outlined in this article and using the Wisconsin Tax Calculator Tool, users can make informed financial decisions and plan their taxes with confidence.

What is the Wisconsin Tax Calculator Tool?

+

The Wisconsin Tax Calculator Tool is a resource that helps individuals and businesses calculate their tax liabilities in the state of Wisconsin.

How do I use the Wisconsin Tax Calculator Tool?

+

To use the tool, gather necessary information, select the filing status, input deductions and credits, review and confirm the input information, and calculate the tax liability or refund using the tool.

What are the tax rates and brackets in Wisconsin?

+

Wisconsin has a progressive tax system, with tax rates ranging from 4% to 7.65%. The tax rates and brackets are as follows: 4% for taxable income between 0 and 11,000, 5.25% for taxable income between 11,001 and 22,000, 6.25% for taxable income between 22,001 and 33,000, and 7.65% for taxable income above $33,000.