5 Wisconsin Sales Tax Tips

Understanding Wisconsin Sales Tax

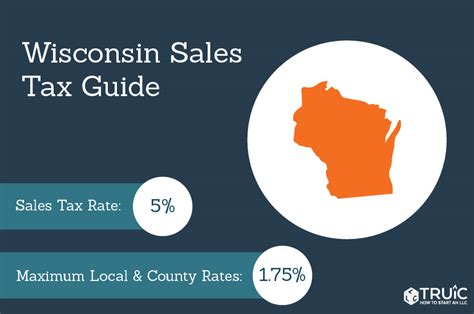

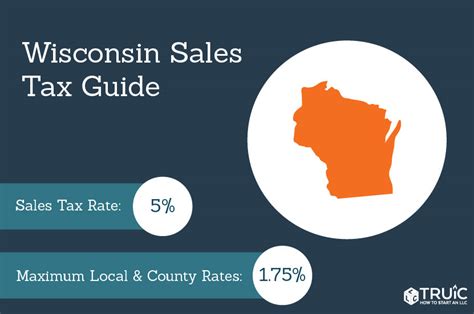

Wisconsin sales tax can be a complex and often confusing topic for businesses and individuals alike. With a state sales tax rate of 5% and additional local taxes, it’s essential to stay informed to avoid any potential issues. In this article, we will delve into the world of Wisconsin sales tax, providing you with 5 valuable tips to help you navigate the system with ease.

Tip 1: Registering for a Sales Tax Permit

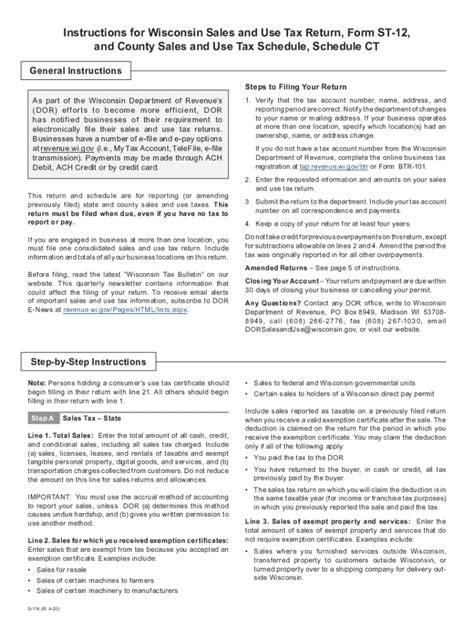

Before we dive into the tips, it’s crucial to understand the importance of registering for a sales tax permit. If your business sells tangible personal property or taxable services in Wisconsin, you are required to obtain a sales tax permit. This permit allows you to collect and remit sales tax to the state. To register, you can visit the Wisconsin Department of Revenue website and fill out the necessary application. Be sure to have all required documents and information ready to ensure a smooth registration process.

Tip 2: Calculating Sales Tax Rates

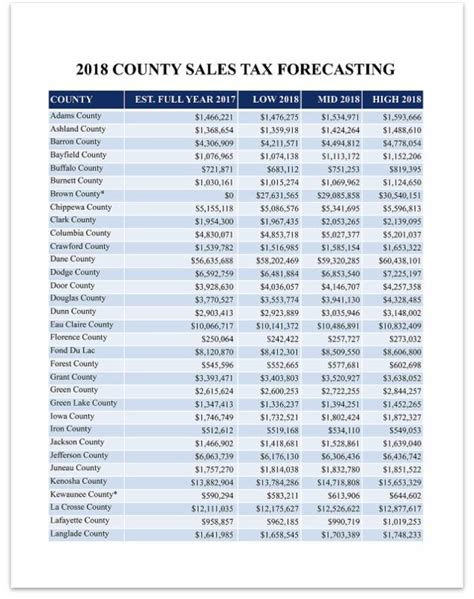

Calculating sales tax rates can be a daunting task, especially with the various local taxes that apply. Wisconsin has a state sales tax rate of 5%, but local jurisdictions can impose additional taxes, ranging from 0.1% to 1.5%. To calculate the total sales tax rate, you need to add the state rate to the local rate. For example, if you’re selling a product in Milwaukee, which has a local tax rate of 0.5%, the total sales tax rate would be 5.5%. It’s essential to stay up-to-date on local tax rates to ensure accurate calculations.

Tip 3: Determining Taxable Sales

Not all sales are subject to sales tax in Wisconsin. It’s crucial to understand what types of sales are taxable and which are exempt. Taxable sales include: * Tangible personal property, such as goods and merchandise * Certain services, like telecommunications and hotel accommodations * Digital goods, like e-books and streaming services On the other hand, exempt sales include: * Groceries and food products * Prescription medication and medical devices * Sales to exempt organizations, like non-profits and government agencies It’s essential to carefully review the Wisconsin sales tax laws to determine which sales are taxable and which are exempt.

Tip 4: Managing Sales Tax Exemptions

Sales tax exemptions can be a complex topic, and it’s essential to understand the rules and regulations. In Wisconsin, certain organizations and individuals are exempt from paying sales tax, including: * Non-profit organizations, like charities and religious institutions * Government agencies, like federal, state, and local governments * Native American tribes, for sales made on tribal lands To qualify for a sales tax exemption, you must provide the seller with a valid exemption certificate. It’s crucial to ensure that the exemption certificate is properly completed and retained, as it may be subject to audit.

Tip 5: Filing Sales Tax Returns

Filing sales tax returns is a critical aspect of complying with Wisconsin sales tax laws. You must file a sales tax return with the Wisconsin Department of Revenue, even if you don’t have any sales tax liability. The return must be filed monthly or quarterly, depending on your business’s sales tax liability. You can file your return online or by mail, and it’s essential to ensure that your return is accurate and complete to avoid any potential penalties.

💡 Note: It's crucial to maintain accurate records and documentation to support your sales tax returns, as they may be subject to audit.

To help you better understand the sales tax rates in Wisconsin, here is a table outlining the state and local tax rates:

| County | Local Tax Rate | Total Tax Rate |

|---|---|---|

| Milwaukee | 0.5% | 5.5% |

| Dane | 0.5% | 5.5% |

| Waukesha | 0.5% | 5.5% |

In summary, Wisconsin sales tax can be complex, but by following these 5 valuable tips, you can ensure compliance and avoid any potential issues. Remember to register for a sales tax permit, calculate sales tax rates accurately, determine taxable sales, manage sales tax exemptions, and file sales tax returns on time. By staying informed and up-to-date on Wisconsin sales tax laws, you can navigate the system with ease and confidence.

What is the state sales tax rate in Wisconsin?

+

The state sales tax rate in Wisconsin is 5%.

Are groceries and food products subject to sales tax in Wisconsin?

+

No, groceries and food products are exempt from sales tax in Wisconsin.

How often do I need to file sales tax returns in Wisconsin?

+

You need to file sales tax returns monthly or quarterly, depending on your business’s sales tax liability.