5 Ways to Determine Base Pay

Understanding Base Pay and Its Calculation

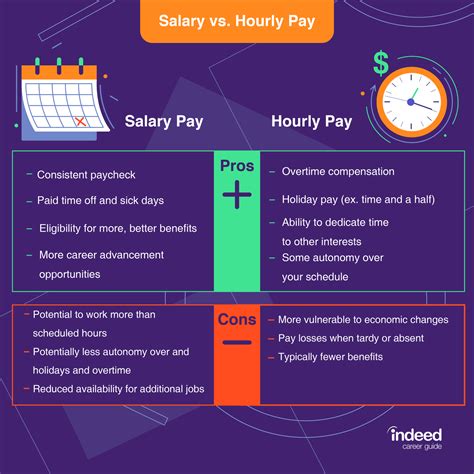

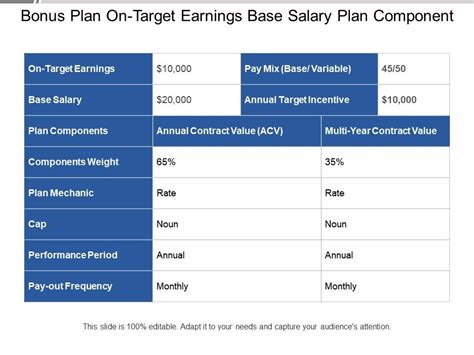

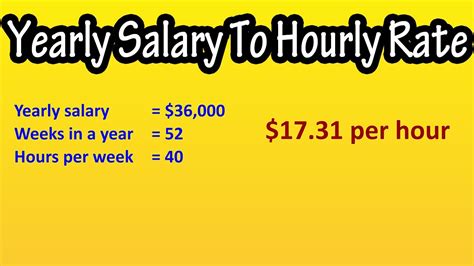

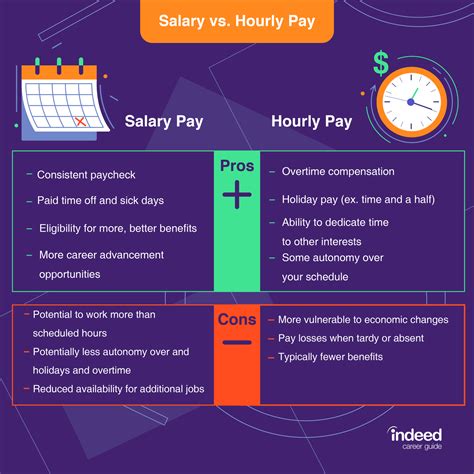

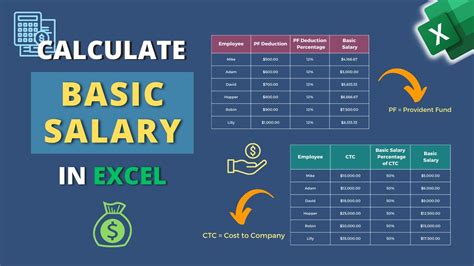

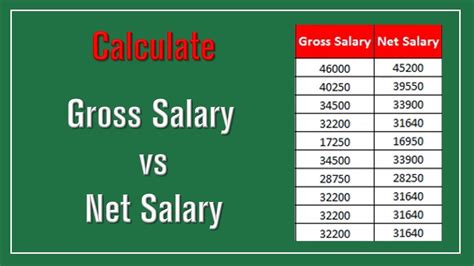

Determining base pay is a crucial step in the hiring process, as it directly affects the salary structure and compensation package of an employee. Base pay, also known as basic pay, is the minimum amount of money an employee earns before any additional forms of compensation, such as bonuses or overtime pay, are added. In this article, we will explore five ways to determine base pay, ensuring that employers and employees alike understand the calculation process.

Method 1: Market Rate Analysis

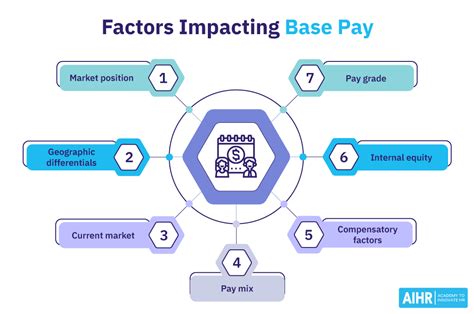

A market rate analysis involves researching the average salary for a specific job title in a particular industry and location. This method helps employers determine a fair base pay that is competitive with other companies in the same market. To conduct a market rate analysis:

- Gather data: Collect salary data from reputable sources, such as the Bureau of Labor Statistics, Glassdoor, or Payscale.

- Analyze the data: Compare the average salary ranges for the job title in your industry and location.

- Adjust for company size and budget: Consider your company’s size, budget, and industry standards when determining the base pay.

📊 Note: Market rate analysis is an essential step in determining base pay, as it ensures that your company is offering a competitive salary.

Method 2: Internal Equity Analysis

An internal equity analysis involves evaluating the salary structure within your company to ensure that base pay is fair and consistent across similar job titles and levels. To conduct an internal equity analysis:

- Gather internal data: Collect salary data for similar job titles and levels within your company.

- Analyze the data: Compare the salary ranges for similar job titles and levels to ensure internal equity.

- Adjust for company policies and budget: Consider your company’s policies, budget, and industry standards when determining the base pay.

📈 Note: Internal equity analysis helps ensure that your company's salary structure is fair and consistent, reducing the risk of internal conflicts.

Method 3: Job Evaluation Method

The job evaluation method involves assessing the value of a job based on its responsibilities, skills, and requirements. This method helps employers determine a base pay that reflects the job’s value to the company. To conduct a job evaluation:

- Identify job responsibilities: Break down the job into its key responsibilities and tasks.

- Evaluate job requirements: Assess the skills, education, and experience required for the job.

- Assign a job grade: Assign a job grade based on the job’s value to the company.

- Determine base pay: Determine the base pay based on the job grade and market rate.

📝 Note: Job evaluation is a detailed process that requires careful consideration of the job's responsibilities and requirements.

Method 4: Point-Factor Method

The point-factor method involves assigning points to different job factors, such as education, experience, and skills, to determine a base pay. To conduct a point-factor analysis:

- Identify job factors: Identify the key factors that contribute to the job’s value, such as education, experience, and skills.

- Assign points: Assign points to each factor based on its importance and value to the company.

- Calculate the total points: Calculate the total points for the job.

- Determine base pay: Determine the base pay based on the total points and market rate.

📊 Note: The point-factor method is a quantitative approach that helps ensure objectivity in determining base pay.

Method 5: Classification Method

The classification method involves grouping jobs into categories or classes based on their similarities and differences. This method helps employers determine a base pay that reflects the job’s classification. To conduct a classification analysis:

- Identify job categories: Identify the key categories or classes of jobs within your company.

- Group jobs: Group jobs into their respective categories based on their similarities and differences.

- Determine base pay: Determine the base pay for each category based on market rate and internal equity.

📈 Note: The classification method is a simple and efficient approach to determining base pay, but it requires careful consideration of job similarities and differences.

In conclusion, determining base pay is a critical step in the hiring process that requires careful consideration of various factors. By using one or a combination of these five methods, employers can ensure that they are offering a fair and competitive salary that reflects the job’s value to the company.

What is base pay?

+

Base pay, also known as basic pay, is the minimum amount of money an employee earns before any additional forms of compensation, such as bonuses or overtime pay, are added.

Why is it important to determine base pay accurately?

+

Determining base pay accurately is crucial to ensure that employees are fairly compensated and that the company remains competitive in the market.

What are the common methods for determining base pay?

+

The common methods for determining base pay include market rate analysis, internal equity analysis, job evaluation method, point-factor method, and classification method.