5 Facts Forced Pay

Introduction to Forced Pay

Forced pay, also known as forced payment or involuntary payment, refers to a situation where an individual or entity is compelled to make a payment against their will. This can occur in various contexts, including employment, business transactions, and legal disputes. In this article, we will explore five key facts about forced pay, its implications, and the relevant laws and regulations surrounding it.

Fact 1: Definition and Types of Forced Pay

Forced pay can take many forms, including wage garnishment, where an employer is required to withhold a portion of an employee’s wages to pay off a debt. Other types of forced pay include tax levies, where the government seizes a portion of an individual’s assets to pay off unpaid taxes, and child support withholding, where an employer is required to withhold a portion of an employee’s wages to pay off child support obligations. Understanding the different types of forced pay is essential for individuals and entities to navigate the complex landscape of involuntary payments.

Fact 2: Laws and Regulations Surrounding Forced Pay

The laws and regulations surrounding forced pay vary by jurisdiction, but most countries have laws in place to protect individuals and entities from unfair or abusive practices. For example, in the United States, the Fair Labor Standards Act (FLSA) regulates wage garnishment, while the Internal Revenue Code (IRC) governs tax levies. In the European Union, the European Union’s Directive on Unfair Terms in Consumer Contracts provides protections for consumers against unfair contract terms, including those related to forced pay.

Fact 3: Implications of Forced Pay

Forced pay can have significant implications for individuals and entities, including financial hardship, reputational damage, and legal consequences. For example, an individual who is subject to wage garnishment may experience financial hardship, while a business that is forced to pay a debt may suffer reputational damage. In some cases, forced pay can also lead to bankruptcy or insolvency, highlighting the need for individuals and entities to carefully manage their finances and seek professional advice when necessary.

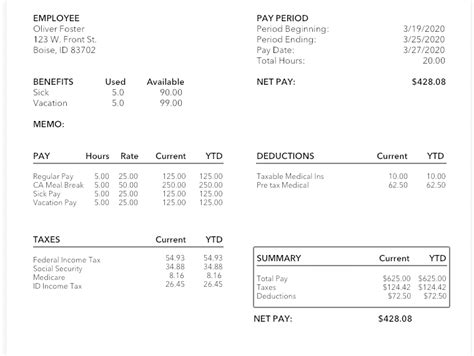

Fact 4: Procedures for Forced Pay

The procedures for forced pay vary depending on the type of payment and the jurisdiction. In general, however, the process typically involves the following steps: * Notification: The individual or entity is notified of the forced pay requirement. * Withholding: The employer or relevant authority withholds the required amount from the individual’s wages or assets. * Payment: The withheld amount is paid to the relevant party, such as a creditor or the government. * Verification: The individual or entity verifies that the payment has been made and that the debt has been satisfied.

Fact 5: Avoiding Forced Pay

While forced pay can be unavoidable in some cases, there are steps that individuals and entities can take to avoid it. These include: * Managing debt: Keeping debt levels under control and making timely payments can help avoid forced pay. * Seeking professional advice: Consulting with a financial advisor or attorney can help individuals and entities navigate complex financial situations and avoid forced pay. * Negotiating with creditors: In some cases, negotiating with creditors can help avoid forced pay by reaching a mutually agreeable payment plan.

📝 Note: It is essential to seek professional advice when dealing with forced pay, as the laws and regulations surrounding it can be complex and vary by jurisdiction.

In summary, forced pay is a complex and multifaceted issue that can have significant implications for individuals and entities. By understanding the different types of forced pay, the laws and regulations surrounding it, and the procedures involved, individuals and entities can better navigate the landscape of involuntary payments and avoid forced pay whenever possible.

What is forced pay, and how does it work?

+

Forced pay, also known as involuntary payment, refers to a situation where an individual or entity is compelled to make a payment against their will. This can occur in various contexts, including employment, business transactions, and legal disputes.

What are the different types of forced pay?

+

The different types of forced pay include wage garnishment, tax levies, and child support withholding, among others.

How can individuals and entities avoid forced pay?

+

Individuals and entities can avoid forced pay by managing debt, seeking professional advice, and negotiating with creditors, among other strategies.