What is a 45 Gap in Investing and Trading

Understanding the 45 Gap in Investing and Trading

In the world of investing and trading, there are various concepts and strategies that traders use to make informed decisions. One such concept is the “45 gap,” which refers to a specific type of price movement in a stock or asset. In this article, we will delve into the details of the 45 gap, its significance, and how traders can utilize this information to their advantage.

What is a 45 Gap?

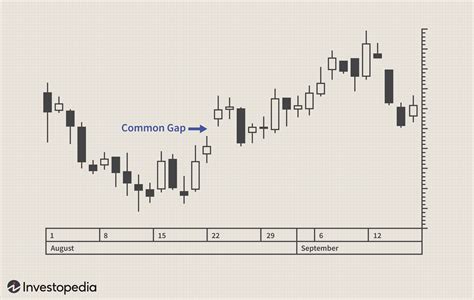

A 45 gap is a price movement that occurs when a stock or asset opens at a price that is at a 45-degree angle to the previous day’s close. This type of price movement is also known as a “gap up” or “gap down,” depending on whether the price opens higher or lower than the previous day’s close.

The 45 gap is calculated by drawing a 45-degree line on a chart, starting from the previous day’s close. If the stock opens above or below this line, it is considered a 45 gap. The 45 gap can be either a bullish or bearish signal, depending on the direction of the price movement.

Significance of the 45 Gap

The 45 gap is significant because it can indicate a change in market sentiment or a shift in the trend. When a stock opens with a 45 gap, it can be a sign that the market is becoming more bullish or bearish. Traders can use this information to adjust their strategies and make more informed decisions.

Here are some key points to consider when analyzing a 45 gap:

- Bullish 45 gap: A bullish 45 gap occurs when the stock opens above the 45-degree line. This can be a sign of a strong upward trend, and traders may consider buying the stock.

- Bearish 45 gap: A bearish 45 gap occurs when the stock opens below the 45-degree line. This can be a sign of a strong downward trend, and traders may consider selling the stock.

- Confirmation: A 45 gap can be used as a confirmation signal to enter a trade. For example, if a trader is considering buying a stock and it opens with a bullish 45 gap, it can be a sign to enter the trade.

How to Identify a 45 Gap

Identifying a 45 gap is relatively straightforward. Here are the steps to follow:

- Draw a 45-degree line: Draw a 45-degree line on a chart, starting from the previous day’s close.

- Check the opening price: Check the opening price of the stock and see if it is above or below the 45-degree line.

- Determine the gap: If the stock opens above the 45-degree line, it is a bullish 45 gap. If it opens below the line, it is a bearish 45 gap.

Here is an example of a 45 gap:

| Previous Day's Close | Opening Price | Gap Type |

|---|---|---|

| 100 | 105 | Bullish 45 Gap |

| 100 | 95 | Bearish 45 Gap |

Trading Strategies Using the 45 Gap

The 45 gap can be used in various trading strategies. Here are a few examples:

- Buy on a bullish 45 gap: If a trader is considering buying a stock and it opens with a bullish 45 gap, it can be a sign to enter the trade.

- Sell on a bearish 45 gap: If a trader is considering selling a stock and it opens with a bearish 45 gap, it can be a sign to enter the trade.

- Use as a confirmation signal: A 45 gap can be used as a confirmation signal to enter a trade. For example, if a trader is considering buying a stock and it opens with a bullish 45 gap, it can be a sign to enter the trade.

📝 Note: The 45 gap is just one of many tools that traders can use to make informed decisions. It is essential to combine this with other forms of analysis and risk management strategies to ensure successful trading.

What is a 45 gap in trading?

+

A 45 gap is a price movement that occurs when a stock or asset opens at a price that is at a 45-degree angle to the previous day's close.

How do I identify a 45 gap?

+

To identify a 45 gap, draw a 45-degree line on a chart, starting from the previous day's close. Check the opening price and see if it is above or below the 45-degree line.

Can I use the 45 gap as a trading strategy?

+

Yes, the 45 gap can be used as a trading strategy. It can be used as a confirmation signal to enter a trade or as a standalone strategy to buy or sell a stock.

In conclusion, the 45 gap is a useful tool for traders to identify potential trading opportunities. By understanding the concept of the 45 gap and how to identify it, traders can make more informed decisions and adjust their strategies accordingly. However, it is essential to combine this with other forms of analysis and risk management strategies to ensure successful trading.

Related Terms:

- 45 GAP Glock

- 45 GAP vs 9mm

- 45 GAP pistols

- 44 special

- 455 Webley