What Do Financial Managers Do

What Do Financial Managers Do?

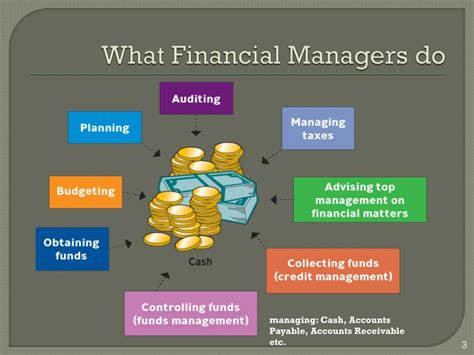

Financial managers play a crucial role in the success of an organization, whether it’s a multinational corporation, a small business, or a non-profit entity. They are responsible for overseeing the financial health of the organization, making strategic financial decisions, and ensuring that the organization’s financial goals are met.

Financial managers are responsible for a wide range of tasks, including:

- Financial Planning and Budgeting: Financial managers are responsible for creating financial plans and budgets that align with the organization’s goals and objectives. They must consider factors such as revenue projections, expense management, and cash flow to ensure that the organization has sufficient funds to meet its financial obligations.

- Financial Analysis and Reporting: Financial managers are responsible for analyzing financial data and preparing financial reports that provide insights into the organization’s financial performance. They must be able to identify trends, opportunities, and challenges, and provide recommendations for improvement.

- Investment and Funding: Financial managers are responsible for making investment decisions and securing funding for the organization. They must evaluate investment opportunities, assess risk, and make recommendations for investments that align with the organization’s financial goals.

- Risk Management: Financial managers are responsible for identifying and mitigating financial risks that could impact the organization. They must develop and implement risk management strategies that minimize potential losses and maximize potential gains.

- Compliance and Regulatory: Financial managers are responsible for ensuring that the organization complies with all relevant financial regulations and laws. They must stay up-to-date on changes in regulations and ensure that the organization is in compliance.

Types of Financial Managers

There are several types of financial managers, each with their own area of expertise:

- Chief Financial Officer (CFO): The CFO is the most senior financial manager in an organization and is responsible for overseeing all financial functions.

- Controller: The controller is responsible for managing the organization’s accounting and financial reporting functions.

- Treasurer: The treasurer is responsible for managing the organization’s cash and investments.

- Financial Analyst: Financial analysts are responsible for analyzing financial data and providing insights and recommendations to management.

- Portfolio Manager: Portfolio managers are responsible for managing investment portfolios and making investment decisions.

Skills and Qualifications

To be a successful financial manager, you will need to possess a range of skills and qualifications, including:

- Financial knowledge and expertise: Financial managers must have a strong understanding of financial concepts, including accounting, finance, and economics.

- Analytical and problem-solving skills: Financial managers must be able to analyze complex financial data and make sound decisions.

- Communication and interpersonal skills: Financial managers must be able to communicate complex financial information to non-financial stakeholders.

- Leadership and management skills: Financial managers must be able to lead and manage teams of financial professionals.

- Bachelor’s degree in finance or related field: A bachelor’s degree in finance or a related field is typically required for financial management positions.

- Certifications: Certifications such as the Chartered Financial Analyst (CFA) or Certified Management Accountant (CMA) can be beneficial for financial managers.

📊 Note: Financial managers must stay up-to-date on changes in regulations and laws, as well as new technologies and trends in finance.

Career Path and Salary

Financial managers can advance their careers by taking on more senior roles, such as CFO or controller, or by moving into related fields such as investment banking or financial planning.

The salary for financial managers can vary widely depending on factors such as location, industry, and level of experience. According to the Bureau of Labor Statistics, the median annual salary for financial managers was $142,000 in May 2020.

| Level of Experience | Salary Range |

|---|---|

| Entry-level (0-3 years) | $60,000 - $90,000 |

| Mid-level (4-7 years) | $90,000 - $140,000 |

| Senior-level (8-12 years) | $140,000 - $200,000 |

| Executive-level (13+ years) | $200,000+ |

Conclusion

Financial managers play a critical role in the success of an organization, and their responsibilities can vary widely depending on the organization’s size, industry, and goals. To be a successful financial manager, you will need to possess a range of skills and qualifications, including financial knowledge and expertise, analytical and problem-solving skills, and leadership and management skills.

What is the primary responsibility of a financial manager?

+

The primary responsibility of a financial manager is to oversee the financial health of an organization and make strategic financial decisions to ensure the organization’s financial goals are met.

What skills and qualifications do financial managers need to possess?

+

Financial managers need to possess a range of skills and qualifications, including financial knowledge and expertise, analytical and problem-solving skills, and leadership and management skills.

What is the average salary for financial managers?

+

The median annual salary for financial managers was $142,000 in May 2020, according to the Bureau of Labor Statistics.