Washington State Paycheck Calculator Tool

Introduction to Washington State Paycheck Calculator Tool

The Washington State Paycheck Calculator Tool is a comprehensive online resource designed to help employees and employers calculate take-home pay, gross income, and tax deductions. This tool is essential for understanding the intricacies of the Washington state tax system and how it affects net pay. In this article, we will delve into the features, benefits, and usage of the Washington State Paycheck Calculator Tool, providing a detailed guide on how to navigate its functionalities.

Key Features of the Washington State Paycheck Calculator Tool

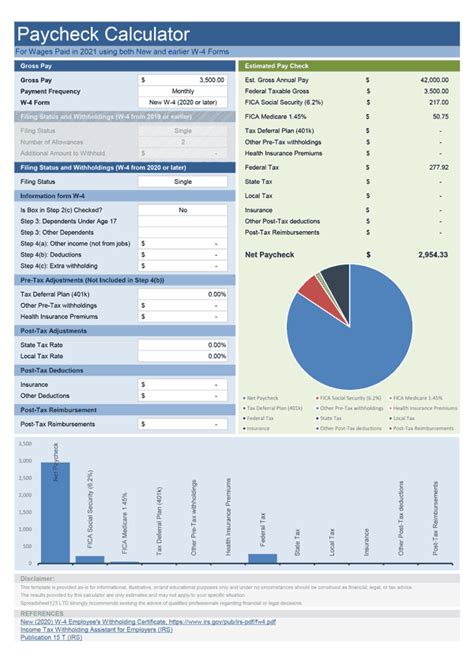

The Washington State Paycheck Calculator Tool boasts several key features that make it an indispensable resource for both employees and employers. Some of these features include: * User-friendly interface: The tool is designed with a simple and intuitive interface, making it easy for users to navigate and calculate their paychecks. * Customizable inputs: Users can input their hourly wage, salary, number of pay periods, and other relevant details to get accurate calculations. * Tax deductions: The tool takes into account various tax deductions, including federal income tax, state income tax, and local taxes. * Benefits and deductions: Users can also input benefits and deductions, such as health insurance, 401(k), and other pre-tax deductions.

Benefits of Using the Washington State Paycheck Calculator Tool

Using the Washington State Paycheck Calculator Tool offers numerous benefits, including: * Accurate calculations: The tool provides accurate calculations of take-home pay, gross income, and tax deductions, helping users plan their finances effectively. * Time-saving: The tool saves time and effort by automating calculations, reducing the risk of human error. * Informed decision-making: By providing a clear breakdown of tax deductions and benefits, the tool enables users to make informed decisions about their finances.

How to Use the Washington State Paycheck Calculator Tool

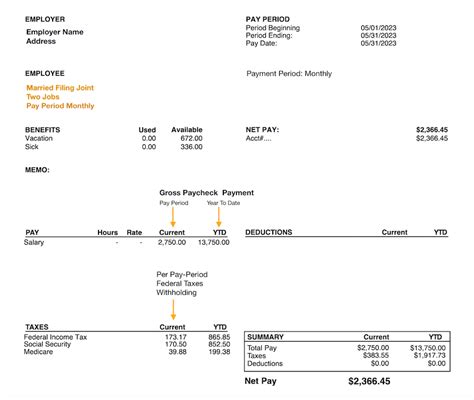

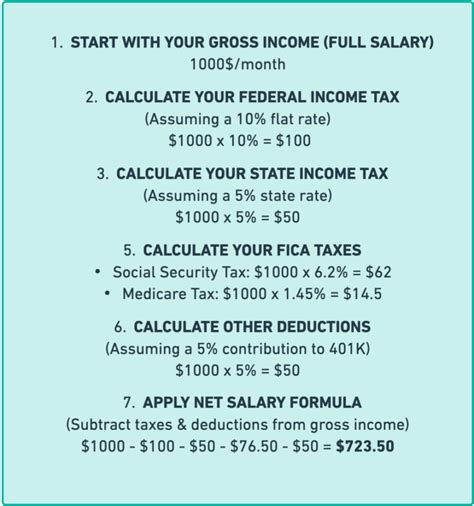

To use the Washington State Paycheck Calculator Tool, follow these steps: * Input your salary or hourly wage: Enter your annual salary or hourly wage to get started. * Select your pay frequency: Choose your pay frequency, such as bi-weekly, monthly, or quarterly. * Input tax deductions and benefits: Enter your tax deductions and benefits, such as federal income tax, state income tax, and health insurance. * Calculate your take-home pay: Click the calculate button to get your take-home pay, gross income, and tax deductions.

📝 Note: It is essential to input accurate information to get precise calculations.

Washington State Tax System

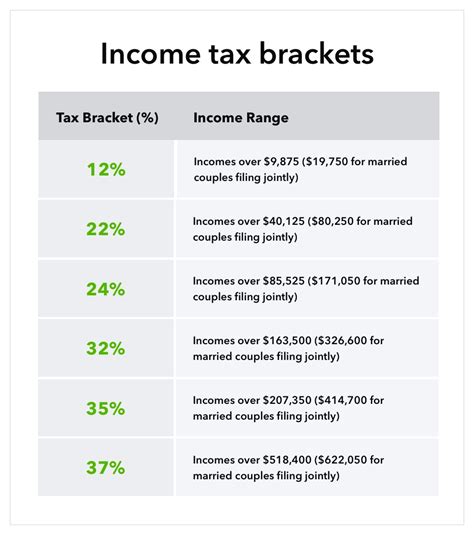

The Washington state tax system is a progressive tax system, meaning that higher income earners are taxed at a higher rate. The state has no state income tax, but there are local taxes and federal income tax to consider. Understanding the Washington state tax system is crucial for accurate calculations and financial planning.

Comparison with Other Paycheck Calculator Tools

The Washington State Paycheck Calculator Tool stands out from other paycheck calculator tools due to its user-friendly interface, customizable inputs, and accurate calculations. While other tools may offer similar features, the Washington State Paycheck Calculator Tool is specifically designed for Washington state residents, taking into account the state’s unique tax system.

| Feature | Washington State Paycheck Calculator Tool | Other Paycheck Calculator Tools |

|---|---|---|

| User-friendly interface | Yes | Varies |

| Customizable inputs | Yes | Varies |

| Accurate calculations | Yes | Varies |

As we have explored the features, benefits, and usage of the Washington State Paycheck Calculator Tool, it is clear that this resource is invaluable for both employees and employers in Washington state. By providing accurate calculations and taking into account the state’s unique tax system, the tool enables users to make informed decisions about their finances.

To summarize, the key points of this article include the introduction to the Washington State Paycheck Calculator Tool, its key features, benefits, and usage, as well as a comparison with other paycheck calculator tools. By understanding how to use this tool and its significance in the context of the Washington state tax system, users can better navigate their financial obligations and plan for the future.

What is the Washington State Paycheck Calculator Tool?

+

The Washington State Paycheck Calculator Tool is a comprehensive online resource designed to help employees and employers calculate take-home pay, gross income, and tax deductions.

How do I use the Washington State Paycheck Calculator Tool?

+

To use the tool, input your salary or hourly wage, select your pay frequency, input tax deductions and benefits, and calculate your take-home pay.

What are the benefits of using the Washington State Paycheck Calculator Tool?

+

The benefits of using the tool include accurate calculations, time-saving, and informed decision-making.