DC Tax Calculator Estimate

Introduction to DC Tax Calculator Estimate

The District of Columbia (DC) tax calculator estimate is a tool designed to help individuals and businesses estimate their tax liability in Washington D.C. This estimate is crucial for planning and budgeting purposes, as it provides an approximate amount of taxes owed to the DC government. In this article, we will delve into the world of DC tax calculator estimates, exploring their importance, how they work, and what factors influence the calculation.

Why Use a DC Tax Calculator Estimate?

Using a DC tax calculator estimate is essential for several reasons: * Accurate tax planning: By estimating tax liability, individuals and businesses can plan their finances accordingly, ensuring they have sufficient funds to cover their tax obligations. * Avoiding penalties: Underestimating tax liability can lead to penalties and interest, which can be avoided by using a reliable tax calculator estimate. * Maximizing refunds: Overestimating tax liability can result in overpayment, which can be reclaimed as a refund. A DC tax calculator estimate helps individuals and businesses maximize their refunds.

How Does a DC Tax Calculator Estimate Work?

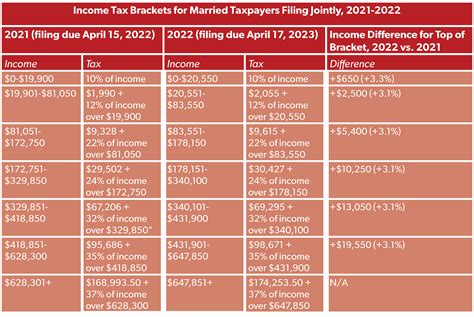

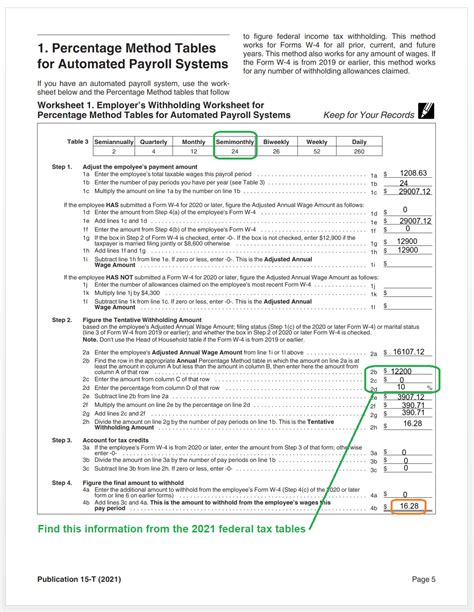

A DC tax calculator estimate typically considers various factors, including: * Gross income: The total income earned from all sources, including employment, self-employment, and investments. * Deductions and exemptions: Eligible deductions and exemptions, such as charitable donations, mortgage interest, and dependents. * Tax credits: Credits for specific expenses, like education or childcare costs. * Filing status: The individual’s or business’s filing status, which affects tax rates and eligibility for certain deductions.

Using these factors, the DC tax calculator estimate applies the relevant tax rates and formulas to calculate the estimated tax liability.

Factors Influencing DC Tax Calculator Estimates

Several factors can influence the accuracy of a DC tax calculator estimate: * Tax law changes: Changes to tax laws and regulations can impact tax liability, making it essential to use an up-to-date tax calculator estimate. * Income fluctuations: Changes in income can significantly affect tax liability, requiring adjustments to the estimate. * Deduction and exemption eligibility: Eligibility for deductions and exemptions can change over time, impacting the estimate.

Using a DC Tax Calculator Estimate Effectively

To get the most out of a DC tax calculator estimate, follow these tips: * Keep accurate records: Maintain detailed records of income, expenses, and deductions to ensure accurate estimates. * Regularly review and update estimates: As income, expenses, and tax laws change, update the estimate to reflect these changes. * Consult a tax professional: If unsure about any aspect of the estimate or tax planning, consult a qualified tax professional for guidance.

📝 Note: It is essential to consult a tax professional or the official DC government website for the most up-to-date and accurate information on tax laws and regulations.

Common Mistakes to Avoid When Using a DC Tax Calculator Estimate

When using a DC tax calculator estimate, be aware of the following common mistakes: * Underestimating income: Failing to account for all sources of income can lead to underestimation of tax liability. * Overclaiming deductions: Claiming ineligible deductions or exemptions can result in penalties and interest. * Ignoring tax law changes: Failing to account for changes to tax laws and regulations can lead to inaccurate estimates.

DC Tax Calculator Estimate Tools and Resources

Several tools and resources are available to help individuals and businesses estimate their tax liability in Washington D.C.: * Official DC government website: The official website provides tax calculator tools, forms, and resources for individuals and businesses. * Tax preparation software: Commercial tax preparation software, such as TurboTax or H&R Block, offers DC tax calculator estimates and filing assistance. * Tax professionals: Consulting a qualified tax professional can provide personalized guidance and ensure accurate estimates.

In summary, a DC tax calculator estimate is a valuable tool for individuals and businesses to plan and budget for their tax obligations in Washington D.C. By understanding how the estimate works, factors influencing the calculation, and common mistakes to avoid, individuals and businesses can ensure accurate estimates and minimize the risk of penalties and interest. Whether using online tools, tax preparation software, or consulting a tax professional, it is essential to stay informed and up-to-date on tax laws and regulations to maximize refunds and minimize tax liability.

What is the purpose of a DC tax calculator estimate?

+

The purpose of a DC tax calculator estimate is to provide an approximate amount of taxes owed to the DC government, helping individuals and businesses plan and budget for their tax obligations.

What factors influence a DC tax calculator estimate?

+

Factors influencing a DC tax calculator estimate include gross income, deductions and exemptions, tax credits, and filing status.

How often should I update my DC tax calculator estimate?

+

You should update your DC tax calculator estimate regularly, as income, expenses, and tax laws change, to ensure accurate estimates and minimize the risk of penalties and interest.