DC Paycheck Calculator

Introduction to DC Paycheck Calculator

The DC Paycheck Calculator is a tool designed to help individuals calculate their take-home pay in Washington D.C. The calculator takes into account various factors such as gross income, deductions, and taxes to provide an accurate estimate of the net pay. In this article, we will explore the features and benefits of using a DC Paycheck Calculator, as well as provide a step-by-step guide on how to use it.

Why Use a DC Paycheck Calculator?

Using a DC Paycheck Calculator can be beneficial for several reasons: * Accurate calculations: The calculator ensures that your net pay is calculated accurately, taking into account all the necessary deductions and taxes. * Convenience: The calculator is easy to use and provides instant results, saving you time and effort. * Financial planning: By knowing your net pay, you can plan your finances better and make informed decisions about your budget.

How to Use a DC Paycheck Calculator

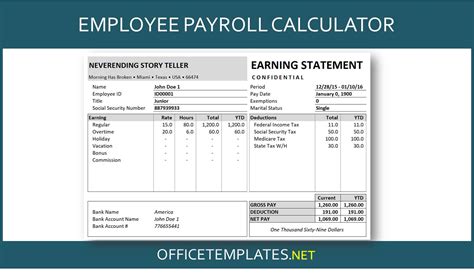

Using a DC Paycheck Calculator is a straightforward process. Here are the steps to follow: * Enter your gross income, which is your total income before any deductions. * Select your pay frequency, which can be weekly, bi-weekly, monthly, or annually. * Enter your deductions, such as health insurance, 401(k), or other benefits. * Enter your tax filing status, which can be single, married, or head of household. * Enter your number of dependents, if any. * Click the calculate button to get your net pay.

Factors That Affect Net Pay

Several factors can affect your net pay, including: * Taxes: Federal, state, and local taxes can reduce your net pay. * Deductions: Health insurance, 401(k), and other benefits can reduce your net pay. * Pay frequency: Your pay frequency can affect your net pay, with more frequent pay periods resulting in lower net pay. * Tax credits: Tax credits, such as the Earned Income Tax Credit (EITC), can increase your net pay.

DC Paycheck Calculator Example

Let’s say you have a gross income of 50,000 per year, and you are single with no dependents. You pay 25% in federal taxes, 8.95% in state taxes, and 4% in local taxes. You also have health insurance deductions of 200 per month. Using a DC Paycheck Calculator, your net pay would be:

| Gross Income | Federal Taxes | State Taxes | Local Taxes | Health Insurance | Net Pay |

|---|---|---|---|---|---|

| 50,000</td> <td>12,500 | 4,475</td> <td>2,000 | 2,400</td> <td>28,625 |

As you can see, your net pay would be 28,625 per year, or 2,385 per month.

📝 Note: This is just an example, and your actual net pay may vary depending on your individual circumstances.

Benefits of Using a DC Paycheck Calculator

Using a DC Paycheck Calculator can provide several benefits, including: * Accurate calculations: The calculator ensures that your net pay is calculated accurately, taking into account all the necessary deductions and taxes. * Convenience: The calculator is easy to use and provides instant results, saving you time and effort. * Financial planning: By knowing your net pay, you can plan your finances better and make informed decisions about your budget.

As we can see, using a DC Paycheck Calculator can be a valuable tool for individuals living in Washington D.C. By providing accurate calculations and taking into account various factors, the calculator can help you plan your finances better and make informed decisions about your budget.

In final consideration, understanding how to calculate your net pay is crucial for effective financial planning, and utilizing tools like the DC Paycheck Calculator can significantly simplify this process, providing you with a clearer picture of your financial situation and enabling you to make more informed decisions about your money.

What is a DC Paycheck Calculator?

+

A DC Paycheck Calculator is a tool designed to help individuals calculate their take-home pay in Washington D.C., taking into account various factors such as gross income, deductions, and taxes.

Why is it important to use a DC Paycheck Calculator?

+

Using a DC Paycheck Calculator is important because it provides accurate calculations of your net pay, taking into account all the necessary deductions and taxes, which can help you plan your finances better and make informed decisions about your budget.

What factors affect my net pay?

+

Several factors can affect your net pay, including taxes, deductions, pay frequency, and tax credits.