WA Pay Calculator Tool

Introduction to WA Pay Calculator Tool

The WA Pay Calculator Tool is a digital solution designed to help individuals and businesses calculate payroll taxes and other deductions accurately and efficiently. With the increasing complexity of tax laws and regulations, this tool has become an essential resource for anyone looking to simplify their payroll processing. In this article, we will delve into the features and benefits of the WA Pay Calculator Tool, exploring how it can help users navigate the intricacies of payroll tax calculations.

Key Features of the WA Pay Calculator Tool

The WA Pay Calculator Tool boasts a range of features that make it an indispensable asset for payroll management. Some of the key features include: * User-friendly interface: The tool is designed with a user-friendly interface that allows users to easily input relevant data and generate accurate calculations. * Tax rate updates: The tool is regularly updated to reflect changes in tax rates and regulations, ensuring that users have access to the most up-to-date information. * Customizable calculations: Users can customize calculations to suit their specific needs, including adjusting for different tax rates, deductions, and exemptions. * Reporting and analytics: The tool provides detailed reporting and analytics, allowing users to track and manage their payroll expenses more effectively.

Benefits of Using the WA Pay Calculator Tool

The WA Pay Calculator Tool offers numerous benefits to users, including: * Increased accuracy: The tool helps users avoid errors and inaccuracies in payroll tax calculations, reducing the risk of penalties and fines. * Time savings: The tool streamlines the payroll calculation process, saving users time and effort that can be better spent on other tasks. * Improved compliance: The tool ensures that users are compliant with relevant tax laws and regulations, reducing the risk of non-compliance and associated penalties. * Cost savings: The tool helps users optimize their payroll expenses, identifying areas where costs can be reduced and streamlined.

How to Use the WA Pay Calculator Tool

Using the WA Pay Calculator Tool is straightforward and easy. Here are the steps to follow: * Gather relevant data: Collect all relevant data, including employee information, tax rates, and deductions. * Input data into the tool: Enter the relevant data into the tool, using the user-friendly interface to guide you through the process. * Generate calculations: The tool will generate accurate calculations based on the input data, taking into account tax rates, deductions, and exemptions. * Review and adjust: Review the calculations and adjust as necessary to ensure accuracy and compliance.

💡 Note: It is essential to regularly update the tool to ensure that you have access to the most up-to-date tax rates and regulations.

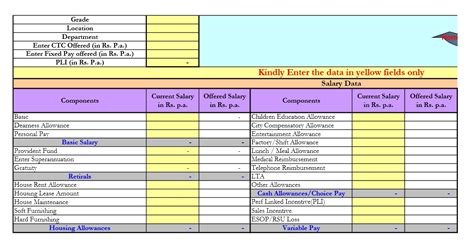

Common Payroll Tax Calculations

The WA Pay Calculator Tool can be used to calculate a range of payroll taxes, including: * Federal income tax: The tool can calculate federal income tax withholdings based on employee income and tax rates. * State income tax: The tool can calculate state income tax withholdings based on employee income and state tax rates. * Social Security tax: The tool can calculate Social Security tax withholdings based on employee income and tax rates. * Medicare tax: The tool can calculate Medicare tax withholdings based on employee income and tax rates.

| Tax Type | Tax Rate | Description |

|---|---|---|

| Federal income tax | 10%-37% | Tax on employee income |

| State income tax | 0%-13.3% | Tax on employee income, varies by state |

| Social Security tax | 6.2% | Tax on employee income, used to fund Social Security |

| Medicare tax | 1.45% | Tax on employee income, used to fund Medicare |

In summary, the WA Pay Calculator Tool is a valuable resource for individuals and businesses looking to simplify their payroll processing and ensure compliance with tax laws and regulations. With its user-friendly interface, customizable calculations, and detailed reporting and analytics, this tool is an essential asset for anyone looking to streamline their payroll management.

What is the WA Pay Calculator Tool?

+

The WA Pay Calculator Tool is a digital solution designed to help individuals and businesses calculate payroll taxes and other deductions accurately and efficiently.

What are the key features of the WA Pay Calculator Tool?

+

The key features of the WA Pay Calculator Tool include a user-friendly interface, tax rate updates, customizable calculations, and detailed reporting and analytics.

How do I use the WA Pay Calculator Tool?

+

To use the WA Pay Calculator Tool, simply gather relevant data, input it into the tool, generate calculations, and review and adjust as necessary.