5 Virginia Pay Tips

Understanding Virginia Pay Tips

In the state of Virginia, pay tips can be a bit confusing, especially for those who are new to the workforce or are unsure about the laws and regulations surrounding tipped employees. Tipped employees are those who receive a significant portion of their income from tips, such as waiters, bartenders, and hairdressers. In this blog post, we will explore five important tips about pay in Virginia, including the minimum wage for tipped employees, how tips are reported, and the importance of understanding your rights as a tipped employee.

Minimum Wage for Tipped Employees

The minimum wage for tipped employees in Virginia is 2.13 per hour, which is the same as the federal minimum wage for tipped employees. However, employers are required to ensure that their tipped employees receive at least the minimum wage of 7.25 per hour when tips are included. If an employee’s tips do not bring their hourly wage up to 7.25, the employer must pay the difference. For example, if an employee earns 2.13 per hour in wages and 5.00 per hour in tips, their total hourly wage would be 7.13, which is below the minimum wage. In this case, the employer would be required to pay the employee an additional 0.12 per hour to bring their total hourly wage up to 7.25.

Reporting Tips

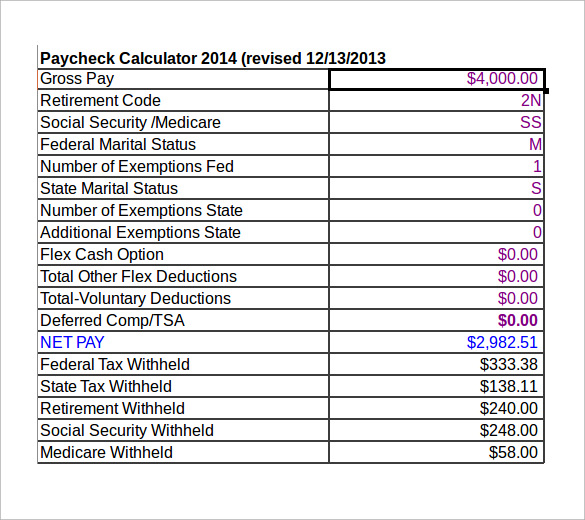

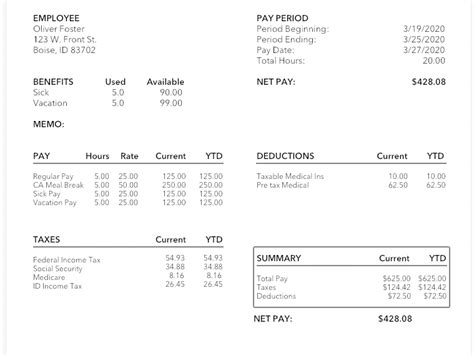

Tipped employees are required to report their tips to their employer, who is then required to report the tips to the IRS. Employers are also required to pay Social Security and Medicare taxes on the reported tips. Tipped employees can report their tips using Form 4070, which is a simple form that requires the employee to report the amount of tips they received each month. The employer is then required to use this information to calculate the amount of Social Security and Medicare taxes owed on the reported tips.

Tipped Employee Rights

As a tipped employee, it’s essential to understand your rights under the law. One of the most important rights is the right to receive at least the minimum wage when tips are included. Employers are not allowed to require tipped employees to share their tips with other employees, such as managers or supervisors, unless the tip pool is a legitimate arrangement that includes only tipped employees. Additionally, employers are not allowed to deduct credit card processing fees from an employee’s tips, as this can reduce the employee’s take-home pay.

Tip Pooling

Tip pooling is a common practice in the service industry, where tipped employees are required to pool their tips and share them with other employees. However, tip pooling can be a complex issue, and employers must ensure that their tip pooling arrangements are fair and comply with the law. For example, employers are not allowed to require tipped employees to share their tips with employees who do not customarily receive tips, such as kitchen staff or janitors. Additionally, employers must ensure that the tip pool is distributed fairly among the participating employees, and that the distribution is based on a reasonable formula, such as the number of hours worked or the amount of tips received.

Virginia Pay Tips Summary

In summary, pay tips in Virginia can be complex, but understanding the laws and regulations surrounding tipped employees is essential for both employers and employees. The key takeaways are: * The minimum wage for tipped employees is 2.13 per hour, but employers must ensure that tipped employees receive at least 7.25 per hour when tips are included. * Tipped employees are required to report their tips to their employer, who is then required to report the tips to the IRS. * Employers are not allowed to require tipped employees to share their tips with other employees, unless the tip pool is a legitimate arrangement that includes only tipped employees. * Tip pooling can be a complex issue, and employers must ensure that their tip pooling arrangements are fair and comply with the law. * Tipped employees have the right to receive at least the minimum wage when tips are included, and employers are not allowed to deduct credit card processing fees from an employee’s tips.

💡 Note: Tipped employees should keep accurate records of their tips and hours worked to ensure that they are receiving the correct amount of pay.

As we reflect on the key points discussed, it’s clear that understanding pay tips in Virginia is crucial for both employers and employees. By following the laws and regulations surrounding tipped employees, employers can ensure that they are complying with the law, and employees can ensure that they are receiving the correct amount of pay. Whether you’re a seasoned employer or a new employee, it’s essential to stay informed about the latest developments in pay tips and to understand your rights and responsibilities under the law.

What is the minimum wage for tipped employees in Virginia?

+

The minimum wage for tipped employees in Virginia is 2.13 per hour, but employers must ensure that tipped employees receive at least 7.25 per hour when tips are included.

How do tipped employees report their tips in Virginia?

+

Tipped employees can report their tips using Form 4070, which is a simple form that requires the employee to report the amount of tips they received each month.

Can employers require tipped employees to share their tips with other employees in Virginia?

+

Employers are not allowed to require tipped employees to share their tips with employees who do not customarily receive tips, unless the tip pool is a legitimate arrangement that includes only tipped employees.