Military

Veterans Separation Pay Explained

Introduction to Veterans Separation Pay

When military personnel separate from the military, they may be eligible for Veterans Separation Pay, also known as separation pay or severance pay. This type of pay is intended to help veterans transition to civilian life by providing a lump sum payment. In this article, we will delve into the details of Veterans Separation Pay, including eligibility, calculation, and taxation.

Eligibility for Veterans Separation Pay

To be eligible for Veterans Separation Pay, military personnel must meet certain criteria. These criteria include: * Being an active-duty member of the armed forces * Having completed at least 6 years of service * Being involuntarily separated from the military, such as through a reduction in force or a medical discharge * Not being eligible for retirement pay * Not having received a dishonorable discharge It’s essential to note that eligibility requirements may vary depending on the specific circumstances of the separation.

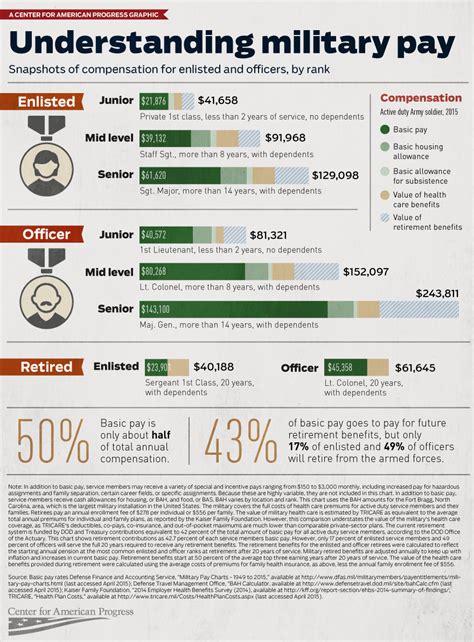

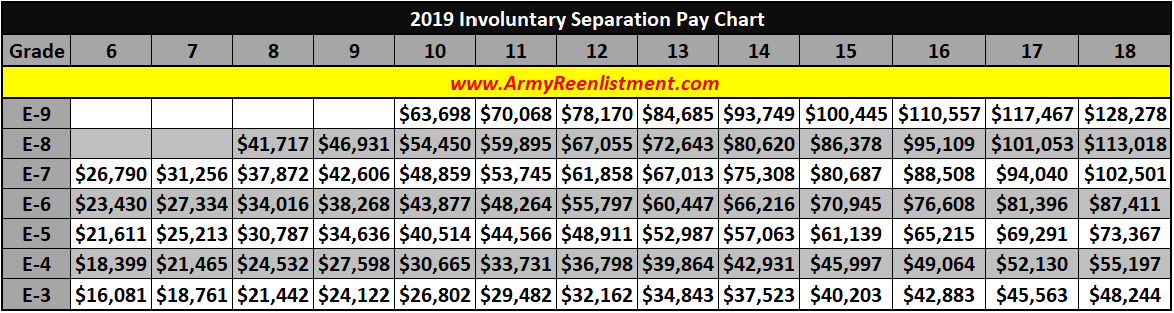

Calculation of Veterans Separation Pay

The amount of Veterans Separation Pay is calculated based on the individual’s years of service and basic pay. The calculation is as follows: * For members with 6-12 years of service, the payment is 10% of 12 months of basic pay * For members with 13-18 years of service, the payment is 12.5% of 12 months of basic pay * For members with 19-22 years of service, the payment is 15% of 12 months of basic pay * For members with 23 or more years of service, the payment is 17.5% of 12 months of basic pay The payment is typically made in a lump sum, and the amount is taxable.

Taxation of Veterans Separation Pay

Veterans Separation Pay is considered taxable income by the Internal Revenue Service (IRS). The payment is reported on the individual’s tax return, and taxes are withheld accordingly. However, some states may exempt Veterans Separation Pay from state income tax. It’s crucial to consult with a tax professional to understand the specific tax implications of receiving Veterans Separation Pay.

Impact of Veterans Separation Pay on Benefits

Receiving Veterans Separation Pay may impact an individual’s eligibility for other veterans’ benefits. For example: * Unemployment benefits: Receiving Veterans Separation Pay may affect an individual’s eligibility for unemployment benefits * Disability benefits: Receiving Veterans Separation Pay may impact an individual’s eligibility for disability benefits * Education benefits: Receiving Veterans Separation Pay may affect an individual’s eligibility for education benefits It’s essential to understand how Veterans Separation Pay may impact other benefits and to consult with a veterans’ benefits counselor if necessary.

Notes on Veterans Separation Pay

📝 Note: Veterans Separation Pay is not the same as readjustment pay, which is a type of pay provided to veterans who are separating from the military and need assistance readjusting to civilian life.

📝 Note: The eligibility criteria and calculation of Veterans Separation Pay may vary depending on the specific circumstances of the separation and the individual’s branch of service.

Conclusion and Final Thoughts

In conclusion, Veterans Separation Pay is a type of pay provided to military personnel who are separating from the military. The pay is intended to help veterans transition to civilian life and is calculated based on years of service and basic pay. Understanding the eligibility criteria, calculation, and taxation of Veterans Separation Pay is essential for individuals who are separating from the military. Additionally, it’s crucial to consider how receiving Veterans Separation Pay may impact other benefits and to consult with a veterans’ benefits counselor if necessary.

What is the purpose of Veterans Separation Pay?

+

Veterans Separation Pay is intended to help veterans transition to civilian life by providing a lump sum payment.

How is Veterans Separation Pay calculated?

+

Veterans Separation Pay is calculated based on years of service and basic pay, with the payment amount varying depending on the individual’s years of service.

Is Veterans Separation Pay taxable?

+

Yes, Veterans Separation Pay is considered taxable income by the Internal Revenue Service (IRS).