5 Veterans Copay Tips

Introduction to Veterans Copay

As a veteran, navigating the complexities of healthcare and understanding the costs associated with medical services can be overwhelming. The Department of Veterans Affairs (VA) offers comprehensive healthcare benefits to eligible veterans, which include access to medical services, prescriptions, and other health-related needs. However, some veterans may be required to pay a copayment for certain services, which can vary based on their priority group, the type of service received, and other factors. In this article, we will delve into the world of veterans’ copays, exploring what they are, how they work, and most importantly, providing 5 veterans copay tips to help veterans manage and potentially reduce their out-of-pocket expenses.

Understanding Veterans Copay

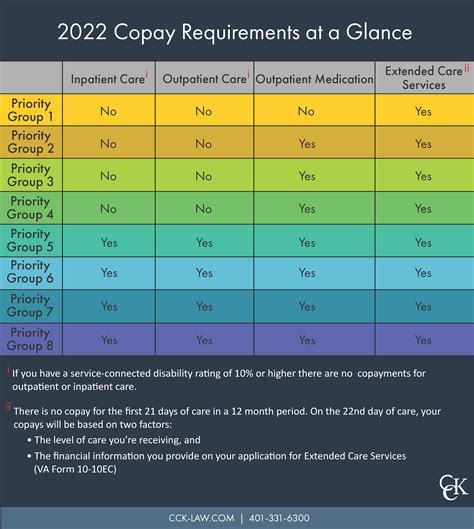

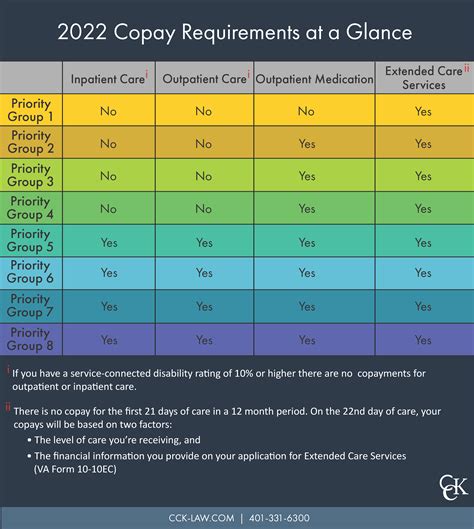

Before we dive into the tips, it’s essential to understand what veterans copay is and how it applies to VA healthcare services. The VA uses a priority group system to determine eligibility for benefits and the copayment amount for services. There are eight priority groups, with Group 1 being the highest priority and Group 8 being the lowest. Veterans in higher priority groups may not have to pay copays for certain services, while those in lower groups might have to pay more. Copays can apply to various services, including outpatient visits, inpatient stays, prescriptions, and more.

5 Veterans Copay Tips

Managing copays effectively can make a significant difference in a veteran’s healthcare budget. Here are five valuable tips to consider:

- Tip 1: Understand Your Priority Group - Knowing your priority group is crucial because it determines your copayment rates. If you’re unsure about your priority group, you can check your eligibility letter or contact the VA directly. Some services, like preventive care, might not require a copay, regardless of your group.

- Tip 2: Keep Track of Your Expenses - Keeping a record of your medical expenses, including copays, can help you stay on top of your finances. It’s also beneficial for tax purposes, as some medical expenses might be deductible.

- Tip 3: Explore Copay Exemptions - Certain veterans may be exempt from copays due to their disability status, income level, or other factors. For example, veterans with a service-connected disability rated 50% or higher might not have to pay copays for VA services. Reviewing the VA’s exemption criteria could help you save money.

- Tip 4: Consider Generic Prescriptions - When it comes to prescriptions, choosing generic drugs over brand-name drugs can significantly reduce your copay. Generic drugs are just as effective and safe as brand-name drugs but are often cheaper. The VA encourages the use of generic prescriptions whenever possible.

- Tip 5: Review and Appeal Your Copay Determination - If you believe your copay determination is incorrect or if your financial situation has changed, you can review and potentially appeal your copay status. The VA has a process for appealing copay decisions, and doing so might result in lower copays.

Additional Considerations

Besides these tips, there are other factors to consider when managing veterans copays:

- Income Verification - The VA may request income verification to determine your copay status. Ensure you respond promptly to these requests to avoid delays in your care.

- Travel Reimbursement - For veterans who have to travel for VA care, there might be reimbursement options available for mileage and other travel expenses. Checking with the VA about travel reimbursement policies can help offset some costs.

📝 Note: Veterans should regularly check the VA's official website or contact their local VA office for the most current information on copays and eligibility, as policies can change.

In essence, understanding and managing veterans copays requires a combination of knowledge about the VA’s healthcare system, awareness of personal eligibility and benefits, and proactive steps to minimize out-of-pocket expenses. By following these tips and staying informed, veterans can better navigate the healthcare system and ensure they receive the care they need without undue financial burden.

What determines my copay amount for VA services?

+

Your copay amount is determined by your priority group, the type of service you receive, and other factors such as your income level and disability status.

Can I appeal my copay determination if I believe it’s incorrect?

+

Yes, the VA has a process for appealing copay decisions. If you believe your copay status is incorrect or if your financial situation has changed, you can review and appeal your copay status.

Are there any services for which I will not have to pay a copay?

+

Yes, certain services such as preventive care might not require a copay, regardless of your priority group. Additionally, veterans with a service-connected disability rated 50% or higher might be exempt from copays for VA services.