VA Take Home Pay Calculator

Introduction to VA Take Home Pay Calculator

The VA take home pay calculator is a valuable tool designed to help veterans and their families estimate the amount of money they will take home after deductions, based on their Veterans Administration (VA) benefits and other income sources. Understanding how much take-home pay one can expect is crucial for budgeting, financial planning, and making informed decisions about one’s lifestyle and future.

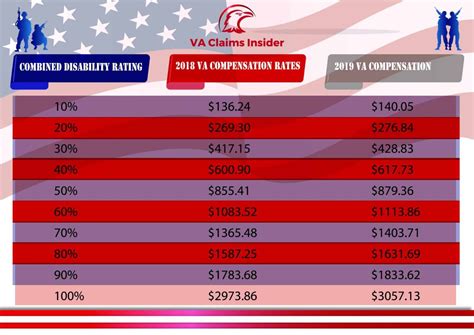

Understanding VA Benefits

Before diving into the specifics of the calculator, it’s essential to understand the types of VA benefits that can affect take-home pay. These benefits include, but are not limited to: - Disability Compensation: Tax-free benefits paid to veterans who are disabled as a result of their military service. - Pension: A tax-free benefit paid to eligible wartime veterans with limited income. - Education and Training: Benefits that help veterans cover the cost of education and training. - Health Care: Comprehensive health care benefits, which may have associated costs or premiums.

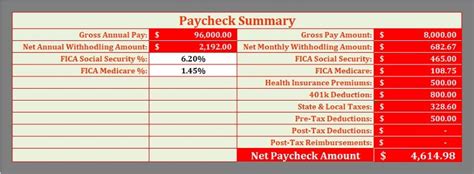

Components of the VA Take Home Pay Calculator

A typical VA take home pay calculator will require several pieces of information to provide an accurate estimate of take-home pay. These components may include: - Gross Income: The total amount of money earned before any deductions. - VA Benefits: The type and amount of VA benefits received. - Federal Income Taxes: The amount withheld for federal income taxes, which can be affected by the type of VA benefits. - State Income Taxes: Taxes withheld by the state, if applicable. - Other Deductions: Health insurance premiums, retirement contributions, and other deductions that reduce take-home pay.

How to Use the VA Take Home Pay Calculator

Using a VA take home pay calculator is straightforward. Here are the general steps: - Step 1: Input your gross income from all sources. - Step 2: Select the type and amount of VA benefits you receive. - Step 3: Enter the number of dependents you claim. - Step 4: Choose your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)). - Step 5: Enter any other income or deductions that may affect your take-home pay. - Step 6: Calculate your estimated take-home pay.

Example Calculation

Let’s consider an example to illustrate how the calculator works. Suppose John, a veteran, has a gross income of 60,000 and receives 10,000 in disability compensation. He is married, files jointly, and has two dependents. After inputting this information into the calculator, it estimates his take-home pay, considering federal and state income taxes, and other deductions.

Importance of Accurate Estimation

Accurately estimating take-home pay is crucial for financial planning. It helps veterans and their families: - Budget effectively: By knowing exactly how much disposable income they have. - Make informed decisions: About investments, large purchases, and retirement planning. - Adjust to lifestyle changes: Such as moving to a different state with varying tax laws or starting a family.

Additional Considerations

When using a VA take home pay calculator, it’s also important to consider other factors that can impact financial stability, such as: - Cost of Living: Variations in cost of living between different locations can significantly impact the value of take-home pay. - Debt Management: High levels of debt can reduce the effectiveness of take-home pay, as a larger portion may go towards debt repayment. - Savings and Emergency Funds: Building savings and emergency funds can provide a cushion against unexpected expenses and financial downturns.

💡 Note: The calculation of take-home pay can be complex and is subject to change based on tax laws and personal circumstances. It's always a good idea to consult with a financial advisor for personalized advice.

Conclusion and Final Thoughts

In conclusion, the VA take home pay calculator is a powerful tool that can help veterans and their families navigate the complexities of financial planning. By understanding the components of the calculator and how to use it effectively, individuals can make more informed decisions about their financial futures. Remember, financial stability is key to enjoying the benefits and freedom that come with service to one’s country.

What is the purpose of a VA take home pay calculator?

+

The purpose of a VA take home pay calculator is to help veterans estimate their take-home pay after considering their VA benefits and other income sources, allowing for more accurate financial planning.

What types of VA benefits are considered in the calculator?

+

The calculator considers various types of VA benefits, including disability compensation, pension, education and training benefits, and health care benefits, among others.

How often should I use the VA take home pay calculator?

+

You should use the VA take home pay calculator whenever your financial situation changes, such as when you receive a pay raise, have a change in family status, or experience a change in VA benefits, to ensure you have the most accurate estimation of your take-home pay.