Military

5 VA Funding Tips

Understanding VA Funding: An Overview

VA funding is a type of mortgage loan that is guaranteed by the United States Department of Veterans Affairs (VA). These loans are designed to help eligible veterans, active-duty personnel, and surviving spouses purchase, build, or improve a home. One of the most significant benefits of VA loans is that they often require no down payment and offer more lenient credit score requirements compared to conventional loans. However, navigating the process of obtaining a VA loan can be complex, and it’s essential to understand the key aspects and tips to make the most out of this benefit.

Eligibility and Benefits

To be eligible for a VA loan, individuals must meet specific service requirements, which typically include serving in the military, being an active-duty service member, or being the surviving spouse of a veteran. The benefits of VA loans are numerous, including no down payment requirement, lower interest rates, no private mortgage insurance (PMI) premiums, and more lenient credit score requirements. Understanding these benefits is crucial for making an informed decision about whether a VA loan is the right choice for your home financing needs.

5 Key VA Funding Tips

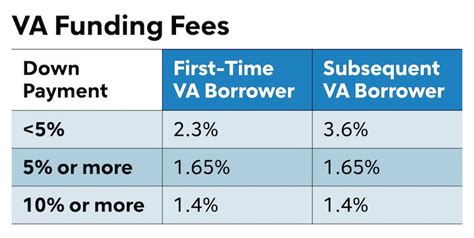

Here are five essential tips to consider when exploring VA funding for your home purchase: - Tip 1: Check Your Eligibility: Before starting the application process, ensure you meet the VA’s eligibility requirements. This involves obtaining a Certificate of Eligibility (COE), which can be done through the VA’s eBenefits portal, by mail, or through a lender. - Tip 2: Understand the Funding Fee: While VA loans offer many benefits, they come with a funding fee, which is a percentage of the loan amount that helps offset the cost of the VA loan program. This fee can be financed into the loan or paid upfront. First-time users of the VA loan benefit may face a higher funding fee compared to subsequent users. - Tip 3: Choose the Right Lender: Not all lenders offer VA loans, and among those that do, the terms and efficiency of the loan process can vary significantly. It’s crucial to shop around and find a lender that is experienced in handling VA loans and can guide you through the process smoothly. - Tip 4: Consider Working with a VA-Specialized Real Estate Agent: A real estate agent who is familiar with VA loans can be incredibly valuable. They can help you find homes that meet VA requirements and navigate any issues that arise during the inspection and appraisal process. - Tip 5: Be Prepared for the Appraisal Process: The VA has specific requirements for the property’s condition, including minimum property requirements (MPRs) that ensure the home is safe, sound, and secure. Being aware of these requirements and preparing accordingly can help avoid delays or even a failed appraisal.

Additional Considerations

Beyond these tips, it’s also important to consider the long-term implications of a VA loan. This includes understanding how the funding fee works, knowing that you can reuse your VA loan benefit, and being aware of the potential for a higher funding fee if you’re a first-time user or if you’re putting less than 5% down. Furthermore, staying informed about any changes to VA loan policies and benefits can help you make the most of your home buying experience.

Navigating the Application Process

The application process for a VA loan involves several steps, including pre-approval, pre-qualification, and the formal application. It’s beneficial to have all necessary documents ready, including your COE, proof of income, and bank statements. The lender will also order a VA appraisal of the property to ensure it meets the VA’s MPRs. Being organized and prepared can significantly streamline this process.

📝 Note: Keeping detailed records and maintaining open communication with your lender and real estate agent can help prevent misunderstandings and ensure a smoother transaction.

Conclusion and Final Thoughts

In summary, VA funding offers a unique set of benefits for eligible veterans and service members looking to purchase a home. By understanding the eligibility requirements, benefits, and the process involved, individuals can make informed decisions about their home financing options. Whether you’re a first-time homebuyer or looking to reuse your VA loan benefit, being prepared and knowledgeable about the process can lead to a successful and satisfying home buying experience.

What are the eligibility requirements for a VA loan?

+

To be eligible for a VA loan, you must meet specific service requirements, which typically include serving in the military, being an active-duty service member, or being the surviving spouse of a veteran. You will need to obtain a Certificate of Eligibility (COE) to confirm your eligibility.

Do VA loans require a down payment?

+

No, one of the significant benefits of VA loans is that they often require no down payment, making them more accessible to eligible veterans and service members.

Can I reuse my VA loan benefit?

+