5 VA Loan Lenders

Introduction to VA Loan Lenders

VA loans are a type of mortgage loan guaranteed by the United States Department of Veterans Affairs (VA). These loans offer favorable terms to eligible veterans, active-duty personnel, and surviving spouses. The VA does not lend money; instead, it guarantees a portion of the loan, allowing private lenders to offer more favorable terms. In this article, we will explore five prominent VA loan lenders, their benefits, and what to consider when choosing a lender.

Benefits of VA Loans

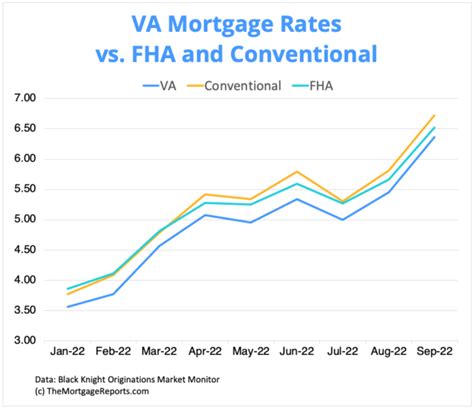

Before diving into the lenders, it’s essential to understand the benefits of VA loans. These benefits include: * No down payment requirement: VA loans do not require a down payment, making them an attractive option for those who may not have the funds for a traditional mortgage. * Lower interest rates: VA loans often have lower interest rates compared to conventional loans. * No mortgage insurance premiums: VA loans do not require mortgage insurance premiums, which can save borrowers hundreds or even thousands of dollars per year. * Lenient credit score requirements: VA loans have more lenient credit score requirements, making it easier for borrowers with less-than-perfect credit to qualify.

5 Prominent VA Loan Lenders

Here are five prominent VA loan lenders: * Veterans United Home Loans: Veterans United is one of the largest VA loan lenders in the country. They offer a range of loan options, including purchase loans, refinance loans, and cash-out refinance loans. * USAA: USAA is a well-known financial services company that offers a range of VA loan options. They are known for their excellent customer service and competitive rates. * NAVY Federal Credit Union: NAVY Federal is a credit union that offers VA loans to its members. They offer competitive rates and a range of loan options, including purchase loans and refinance loans. * Bank of America: Bank of America is a large bank that offers VA loans to eligible borrowers. They offer a range of loan options, including purchase loans and refinance loans, and have a dedicated team of VA loan specialists. * Wells Fargo: Wells Fargo is another large bank that offers VA loans. They offer a range of loan options, including purchase loans and refinance loans, and have a dedicated team of VA loan specialists.

What to Consider When Choosing a VA Loan Lender

When choosing a VA loan lender, there are several factors to consider: * Interest rates: Compare interest rates among lenders to ensure you’re getting the best deal. * Fees: Look for lenders with low or no fees, as these can add up quickly. * Customer service: Consider lenders with excellent customer service, as this can make the loan process much smoother. * Loan options: Consider lenders that offer a range of loan options, including purchase loans, refinance loans, and cash-out refinance loans. * Reputation: Research the lender’s reputation and read reviews from other borrowers to ensure you’re working with a reputable lender.

Comparison of VA Loan Lenders

The following table compares the five VA loan lenders mentioned above:

| Lender | Interest Rates | Fees | Customer Service | Loan Options |

|---|---|---|---|---|

| Veterans United | Competitive | Low | Excellent | Purchase, Refinance, Cash-out Refinance |

| USAA | Competitive | Low | Excellent | Purchase, Refinance |

| NAVY Federal | Competitive | Low | Excellent | Purchase, Refinance |

| Bank of America | Competitive | Varies | Good | Purchase, Refinance |

| Wells Fargo | Competitive | Varies | Good | Purchase, Refinance |

📝 Note: The information in this table is subject to change and may not be up-to-date. It's essential to research and compares lenders before making a decision.

In summary, choosing the right VA loan lender is crucial to ensuring a smooth and successful loan process. By considering factors such as interest rates, fees, customer service, loan options, and reputation, you can find the best lender for your needs. Remember to research and compare lenders before making a decision, and don’t hesitate to reach out to a lender’s customer service team if you have any questions or concerns.

What is the minimum credit score required for a VA loan?

+

The minimum credit score required for a VA loan is 620, but some lenders may have more lenient requirements.

Can I use a VA loan to purchase a second home?

+

No, VA loans can only be used to purchase a primary residence.

How long does the VA loan process typically take?

+

The VA loan process typically takes 30-60 days, but can vary depending on the lender and the borrower’s situation.