5 Utah Savings Plan Tips

Introduction to Utah Savings Plans

When it comes to planning for the future, saving money is one of the most important things you can do. Whether you’re trying to build up your emergency fund, save for a big purchase, or plan for retirement, having a solid savings plan in place can help you achieve your goals. In Utah, there are several options available for those looking to save, from traditional savings accounts to more specialized plans like 529 plans for education expenses. In this article, we’ll explore five tips for making the most of your Utah savings plan.

Understanding Your Savings Options

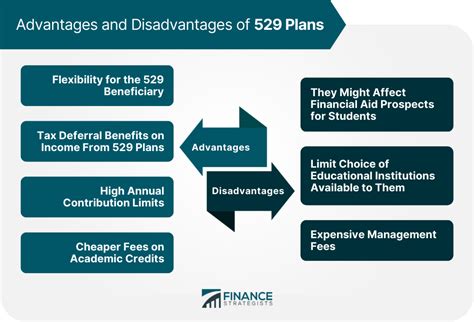

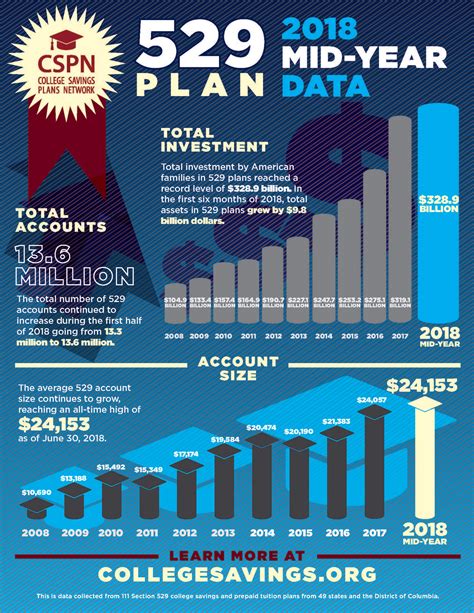

Before you start saving, it’s essential to understand the different types of savings options available in Utah. Some popular options include: * Traditional savings accounts: These accounts offer easy access to your money and typically come with low fees. * High-yield savings accounts: These accounts offer higher interest rates than traditional savings accounts, helping your savings grow faster over time. * 529 plans: These plans are designed to help families save for education expenses, offering tax benefits and other incentives. * Retirement accounts: Options like 401(k) and IRA accounts can help you save for retirement, often with tax benefits and employer matching contributions.

Tip 1: Set Clear Savings Goals

The first step in making the most of your Utah savings plan is to set clear savings goals. What are you trying to save for? Do you want to build up your emergency fund, save for a down payment on a house, or plan for retirement? Having a specific goal in mind will help you stay focused and motivated to save. Consider writing down your goals and tracking your progress to help you stay on track.

Tip 2: Create a Budget and Track Your Expenses

Creating a budget and tracking your expenses is essential for making the most of your Utah savings plan. By understanding where your money is going, you can identify areas where you can cut back and allocate more funds to savings. Consider using the 50/30/20 rule as a guideline: 50% of your income should go towards necessary expenses like rent and utilities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

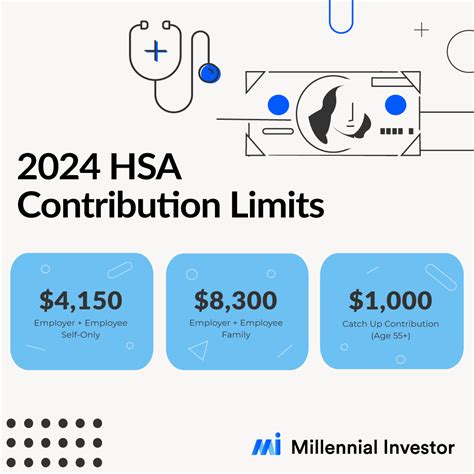

Tip 3: Take Advantage of Tax Benefits

Many Utah savings plans offer tax benefits that can help your savings grow faster. For example, contributions to a 529 plan are tax-deductible, and earnings on the account are tax-free if used for qualified education expenses. Similarly, contributions to a retirement account like a 401(k) or IRA may be tax-deductible, and earnings on the account are tax-deferred until withdrawal. Be sure to explore the tax benefits available for your Utah savings plan and take advantage of them to maximize your savings.

Tip 4: Automate Your Savings

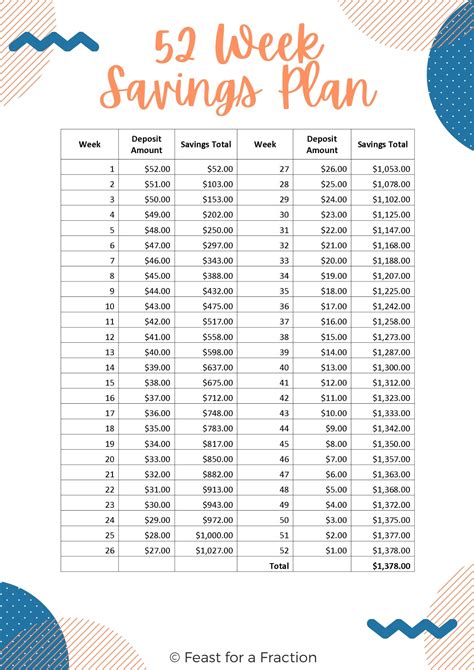

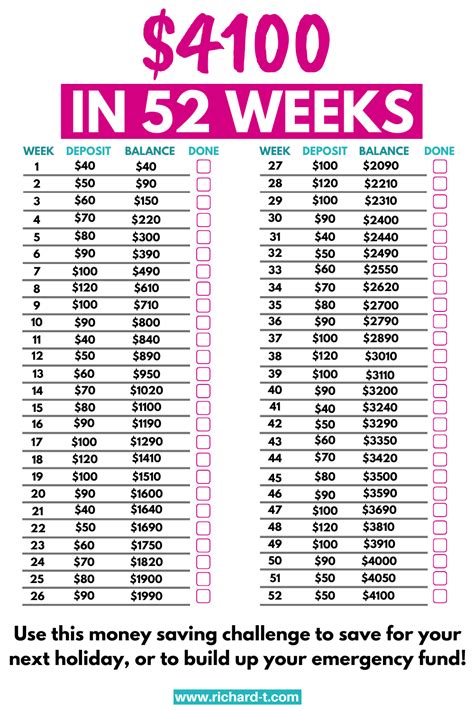

One of the easiest ways to make saving easier is to automate it. Set up automatic transfers from your checking account to your savings or investment accounts, and consider setting up a separate account specifically for savings. This will help you ensure that you save a fixed amount regularly, without having to think about it. You can also consider setting up automatic increases to your savings transfers over time, to help your savings grow faster.

Tip 5: Monitor and Adjust Your Plan

Finally, it’s essential to monitor and adjust your Utah savings plan regularly. As your financial situation changes, your savings goals and strategy may need to change too. Consider reviewing your budget and savings progress regularly, and making adjustments as needed. You may also want to consider consulting with a financial advisor or planner to get personalized advice and guidance on your savings plan.

💡 Note: Be sure to review and understand the fees and terms associated with your Utah savings plan, to ensure you're getting the best possible deal.

To help illustrate the benefits of different Utah savings plans, consider the following table:

| Plan Type | Interest Rate | Fees | Tax Benefits |

|---|---|---|---|

| Traditional Savings Account | 0.1%-1.0% | Low | None |

| High-Yield Savings Account | 1.5%-2.5% | Low | None |

| 529 Plan | Varies | Low | Tax-deductible contributions, tax-free earnings |

| Retirement Account | Varies | Low | Tax-deductible contributions, tax-deferred earnings |

In the end, making the most of your Utah savings plan requires a combination of setting clear goals, creating a budget, taking advantage of tax benefits, automating your savings, and monitoring and adjusting your plan regularly. By following these tips and exploring the different savings options available in Utah, you can achieve your financial goals and secure a brighter future.

What is the best type of savings account for me?

+

The best type of savings account for you will depend on your individual financial goals and needs. Consider factors like interest rate, fees, and tax benefits when choosing a savings account.

How much should I save each month?

+

The amount you should save each month will depend on your income, expenses, and financial goals. Consider using the 50/30/20 rule as a guideline, and adjust as needed to achieve your savings goals.

What are the tax benefits of a 529 plan?

+

Contributions to a 529 plan are tax-deductible, and earnings on the account are tax-free if used for qualified education expenses. This can help your savings grow faster and reduce your tax liability.