Master Your Money: USMC Financial Worksheet Guide

Financial planning is a critical aspect of personal management, especially for individuals in the military, where the financial landscape can be quite different. The USMC Financial Worksheet is an invaluable tool designed to help Marines and their families manage their finances effectively. This guide will walk you through how to use this worksheet, offering practical steps and insights to master your money, thereby ensuring your financial stability and peace of mind.

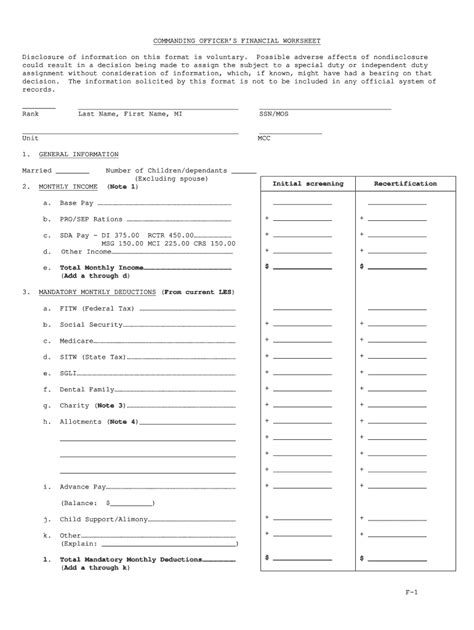

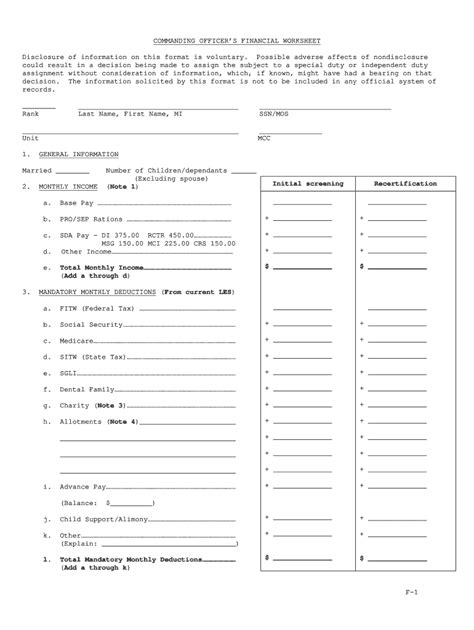

Understanding the USMC Financial Worksheet

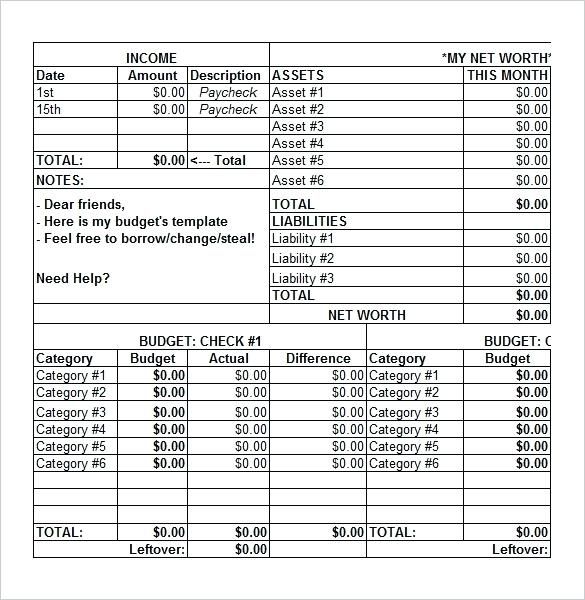

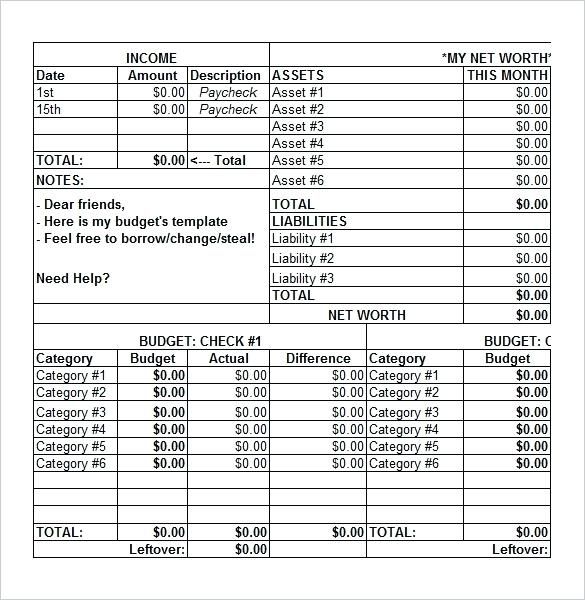

The USMC Financial Worksheet is not just a form; it's a pathway to financial stability. It includes sections for:

- Income: Tracking your sources of income from active duty pay to allowances.

- Expenses: Detailed categories to record your monthly spending habits.

- Debt: Areas to note all liabilities, interest rates, and payments.

- Assets: Cataloging your savings, investments, and property.

Each section helps in crafting a comprehensive view of your financial health, making it easier to identify areas for improvement.

Filling Out the Worksheet

Income

Begin by listing all your income:

- Basic Pay

- Housing Allowance (BAH)

- Clothing Allowance

- Other allowances like hazardous duty or combat pay

Record each income type, ensuring you're not missing any sources like interest or dividends from investments.

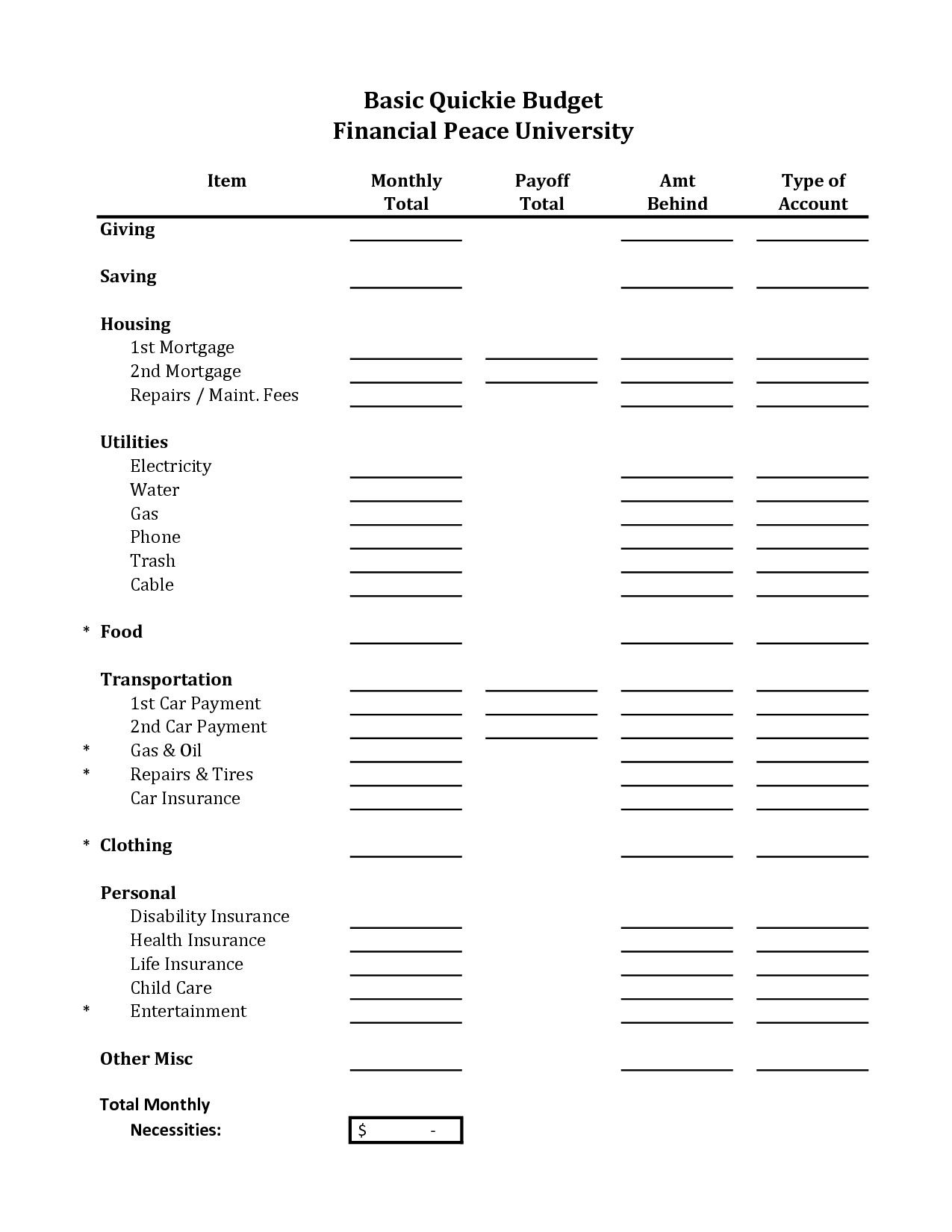

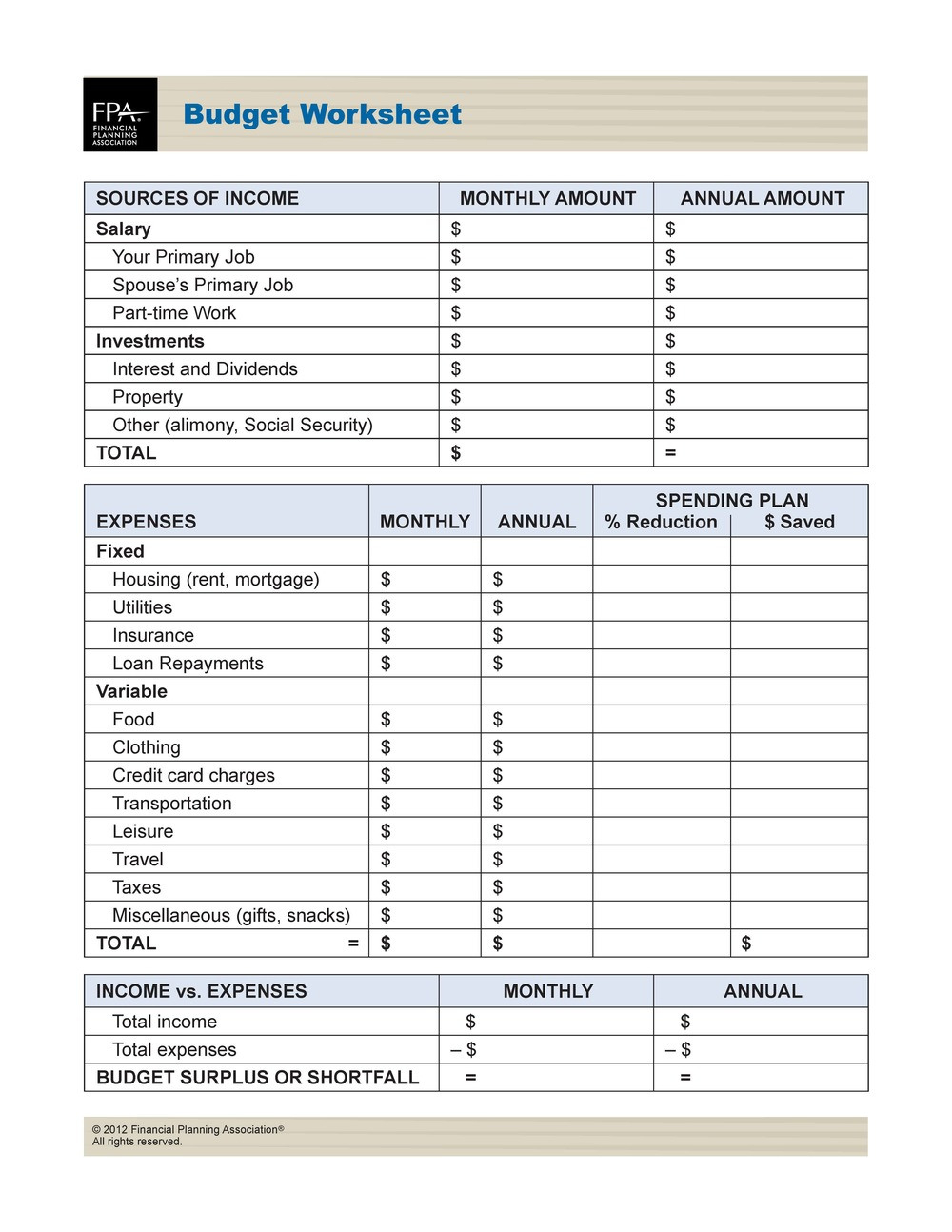

Expenses

Expenses can be broken down into:

- Fixed Expenses: Housing, car payments, utilities

- Variable Expenses: Groceries, entertainment, dining out

- Irregular Expenses: Car maintenance, insurance premiums

Use the worksheet to track these for a few months to get an accurate average of your spending.

Debt

List all debts including:

- Credit Card Debt

- Personal Loans

- Student Loans

- Mortgages

Pay close attention to interest rates and minimum payments to strategize debt payoff.

Assets

Finally, your assets section should include:

- Cash and Savings Accounts

- Retirement Accounts (TSP, etc.)

- Investments

- Real Property and Vehicles

This gives you a snapshot of what you own and your net worth.

Strategic Financial Planning

With the USMC Financial Worksheet completed, you can now:

- Assess: Evaluate your financial position by calculating your net worth, which is assets minus liabilities.

- Budget: Use the expense tracking to set up a realistic budget that aligns with your income and spending habits.

- Save: Identify areas where you can cut costs to increase savings or invest in your future.

- Plan: Develop short-term and long-term financial goals like retirement, buying a home, or funding education.

- Adjust: Regularly review and adjust your financial plan as your income or expenses change.

💡 Note: Your financial worksheet is dynamic; update it monthly for the best results.

Maximizing Your Benefits

The USMC provides numerous financial benefits:

- Basic Allowance for Housing (BAH)

- Combat Zone Tax Exclusion

- GI Bill for education benefits

- Special Pay for hazardous duties

Ensure these are accurately reflected in your worksheet to take full advantage of the financial perks you're entitled to.

Managing Debt and Building Credit

Utilize your worksheet to:

- Track debt payments and reduce high-interest debts first.

- Maintain a good credit score by ensuring timely payments and low credit utilization.

- Consider consolidating debts or using 0% interest credit card transfers for large debts.

Saving and Investing

With your expenses under control, focus on:

- Emergency Fund: Aim for 3-6 months of living expenses.

- Retirement Savings: Maximize contributions to your TSP or other retirement plans.

- Investments: Explore low-cost index funds or ETFs for long-term growth.

Protecting Your Assets

Insurance and estate planning are vital:

- Ensure adequate life, health, and property insurance.

- Consider creating a will and a power of attorney for financial decisions.

Final Thoughts

Mastering your money through the USMC Financial Worksheet is an ongoing process. By using this tool, you gain control over your financial life, which can lead to greater peace of mind, security, and the ability to meet your financial goals. Regular review and adjustment are key to staying on track.

Embrace this journey with the mindset of continuous improvement. By doing so, you not only secure your financial future but also model financial responsibility for your family and fellow Marines.

What is the USMC Financial Worksheet used for?

+

The USMC Financial Worksheet helps Marines and their families track their income, expenses, debts, and assets to manage their finances effectively.

How often should I update my financial worksheet?

+

It’s recommended to review and update your financial worksheet monthly or whenever there are significant changes in your financial situation.

Can I use the USMC Financial Worksheet for long-term planning?

+

Absolutely, the worksheet provides a foundation for setting both short-term and long-term financial goals, like retirement or education funding.