5 USAF Divestment Tips

Introduction to USAF Divestment

The United States Air Force (USAF) is one of the most technologically advanced and well-equipped air forces in the world. However, with the ever-evolving nature of modern warfare and the need to adapt to new challenges, the USAF must constantly review and refine its inventory of aircraft, equipment, and strategies. This process of refinement often involves divestment, which is the act of disposing of or retiring certain assets that are no longer necessary, efficient, or cost-effective. In this context, understanding the principles and strategies behind USAF divestment is crucial for maintaining a lean, effective, and forward-looking air force.

Understanding the Need for Divestment

The need for divestment in the USAF arises from several factors, including technological advancements, changing operational requirements, and budget constraints. As technology advances, older systems may become obsolete or less capable compared to newer models. Similarly, shifts in global conflicts and strategic priorities can render certain assets less relevant. Budget constraints also play a significant role, as maintaining a large and diverse fleet of aircraft and equipment can be extremely costly. By divesting assets that no longer align with current needs or capabilities, the USAF can redirect resources towards more critical and modern assets.

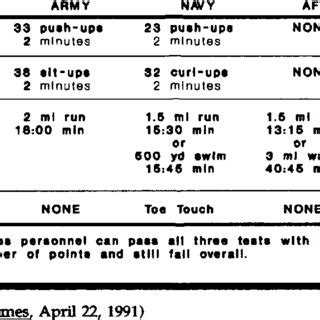

Strategic Considerations for Divestment

When considering divestment, the USAF must weigh several strategic factors, including: - Operational Impact: How will the removal of certain assets affect current and future operational capabilities? - Cost Savings: What financial benefits can be realized through divestment, and how can these savings be applied to other areas? - Technological Advancement: Are there newer, more advanced systems that can replace or enhance the capabilities of the assets being considered for divestment? - International Partnerships and Sales: Can the assets being divested be sold or transferred to allied nations, potentially strengthening partnerships and generating revenue? These considerations require a deep understanding of both the current state of the USAF’s capabilities and the future strategic environment in which it will operate.

5 Key Tips for Effective Divestment

Effective divestment in the USAF involves a thoughtful and multi-faceted approach. The following tips highlight key considerations and strategies: 1. Conduct Thorough Asset Evaluations: Before deciding on divestment, conduct comprehensive evaluations of the assets in question. This includes assessing their current condition, operational effectiveness, maintenance costs, and potential for upgrade or modernization. 2. Align Divestment with Strategic Objectives: Ensure that divestment decisions are aligned with the USAF’s overall strategic objectives and budget priorities. This involves considering how the divestment of certain assets will impact the ability to achieve key missions and objectives. 3. Explore Alternative Uses or Sales: Before disposing of assets, explore alternative uses or the potential for sale to other military branches or foreign governments. This can help maximize the value realized from divestment. 4. Consider the Impact on Personnel and Training: Divestment can have significant implications for personnel, particularly in terms of training and expertise. Consider how the removal of certain assets will affect training programs and the skill sets of USAF personnel. 5. Develop a Phased Divestment Plan: Implementing divestment as part of a phased plan can help mitigate operational impacts and ensure a smooth transition. This involves carefully sequencing the removal of assets, training personnel on new systems, and ensuring that operational capabilities are maintained throughout the process.

Implementing Divestment Strategies

Implementing a divestment strategy requires careful planning, coordination, and execution. This involves: - Establishing Clear Goals and Objectives: Define what the USAF aims to achieve through divestment, whether it be cost savings, operational efficiency, or the acquisition of newer technologies. - Engaging Stakeholders: Consult with various stakeholders, including operational commanders, logistics personnel, and industry partners, to ensure that all perspectives are considered. - Monitoring Progress and Adjusting Plans: Continuously monitor the progress of divestment efforts and be prepared to adjust plans as necessary in response to changing circumstances or unforeseen challenges.

💡 Note: Effective communication and transparency are key throughout the divestment process, both within the USAF and with external stakeholders, to ensure that all parties understand the rationale and benefits of divestment decisions.

Conclusion and Future Directions

In conclusion, divestment is a critical component of the USAF’s ongoing effort to modernize and optimize its capabilities. By adopting a strategic and thoughtful approach to divestment, the USAF can ensure it remains at the forefront of military aviation, capable of addressing the complex and evolving challenges of the 21st century. The process of divestment, while complex and multifaceted, offers significant opportunities for the USAF to refine its assets, enhance its operational effectiveness, and secure its position as a leading air force globally.

What is the primary goal of USAF divestment?

+

The primary goal of USAF divestment is to refine and optimize the air force’s inventory of aircraft and equipment, ensuring it remains aligned with current operational needs and strategic priorities.

How does the USAF decide which assets to divest?

+

The decision to divest assets is based on thorough evaluations considering factors such as operational effectiveness, maintenance costs, technological advancements, and alignment with strategic objectives.

What are the potential benefits of divestment for the USAF?

+

The potential benefits include cost savings, enhanced operational efficiency, the ability to invest in newer, more advanced technologies, and improved alignment with current and future strategic priorities.