5 Tips from UOregon Financial Management Group

Effective Financial Management: 5 Essential Tips from the University of Oregon Financial Management Group

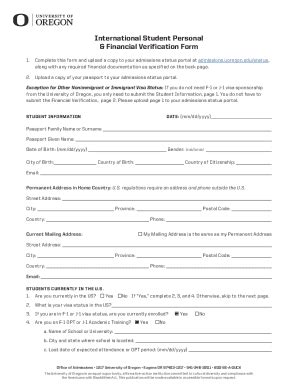

As we navigate the complexities of personal and professional financial landscapes, it’s essential to have a solid foundation in financial management. The University of Oregon Financial Management Group, a renowned authority in the field, offers valuable insights and practical advice to help individuals and organizations achieve financial stability and success. Here are five essential tips to improve your financial management skills.

Tip 1: Set Clear Financial Goals

Establishing clear financial goals is the first step towards achieving financial stability. Define your objectives, whether it’s saving for retirement, paying off debt, or building an emergency fund. Make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART). This will help you create a roadmap for your financial journey and stay focused on what’s truly important.

Tip 2: Create a Comprehensive Budget

A well-crafted budget is the cornerstone of effective financial management. Track your income and expenses to understand where your money is going. Categorize your expenses into needs (housing, food, utilities) and wants (entertainment, hobbies). Allocate 50-30-20: 50% for needs, 30% for discretionary spending, and 20% for saving and debt repayment. Regularly review and adjust your budget to ensure you’re on track to meet your financial goals.

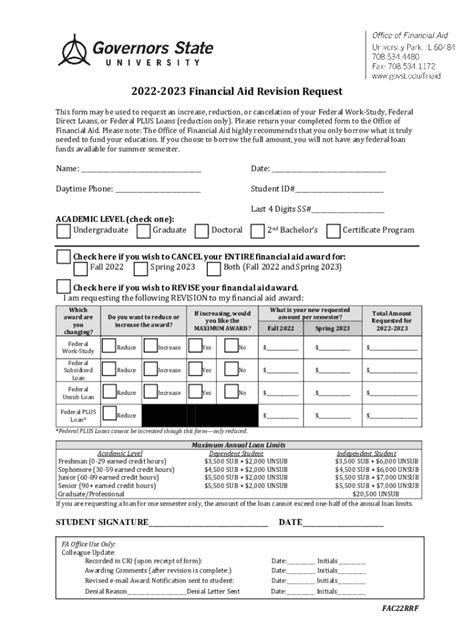

Tip 3: Manage Debt Effectively

Debt can be a significant obstacle to achieving financial stability. Prioritize your debts, focusing on high-interest loans and credit cards first. Consider consolidating debt into a lower-interest loan or balance transfer credit card. Pay more than the minimum payment each month to reduce principal balances and interest charges. Remember, debt repayment is a long-term process; stay committed and patient.

Tip 4: Build an Emergency Fund

Unexpected expenses and financial setbacks can arise at any moment. Aim to save 3-6 months’ worth of living expenses in an easily accessible savings account. This fund will provide a cushion against financial shocks, allowing you to avoid going into debt or depleting your retirement savings. Review and adjust your emergency fund regularly to ensure it remains aligned with your changing financial needs.

Tip 5: Invest for the Future

Investing is a critical component of long-term financial success. Take advantage of tax-advantaged accounts such as 401(k), IRA, or Roth IRA for retirement savings. Diversify your investments across asset classes, such as stocks, bonds, and real estate, to minimize risk and maximize returns. Start early, as compound interest can significantly impact your investment growth over time.

📝 Note: It's essential to consult with a financial advisor or conduct your own research before making investment decisions.

By implementing these five tips from the University of Oregon Financial Management Group, you’ll be well on your way to achieving financial stability and success. Remember to stay informed, adapt to changing circumstances, and continually reassess your financial goals and strategies.

In conclusion, effective financial management requires discipline, patience, and a well-planned approach. By setting clear financial goals, creating a comprehensive budget, managing debt effectively, building an emergency fund, and investing for the future, you’ll be better equipped to navigate life’s financial challenges and achieve long-term financial success.

What is the 50-30-20 rule in budgeting?

+

The 50-30-20 rule is a budgeting guideline that allocates 50% of your income towards necessary expenses (housing, food, utilities), 30% towards discretionary spending (entertainment, hobbies), and 20% towards saving and debt repayment.

How do I prioritize my debts for repayment?

+

Prioritize your debts by focusing on high-interest loans and credit cards first, followed by lower-interest debts. Consider consolidating debt into a lower-interest loan or balance transfer credit card to simplify repayment.

What is the importance of building an emergency fund?

+

An emergency fund provides a cushion against unexpected expenses and financial setbacks, allowing you to avoid going into debt or depleting your retirement savings. Aim to save 3-6 months’ worth of living expenses in an easily accessible savings account.

Related Terms:

- UO Business clubs

- University of Oregon finance club

- University of Oregon investment group