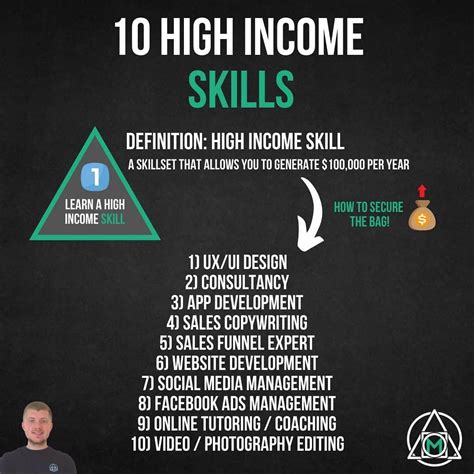

5 UIC Earnings Tips

Introduction to UIC Earnings

Unemployment Insurance Claims (UIC) earnings can be a vital source of financial support for individuals who have lost their jobs or are experiencing a reduction in work hours. However, navigating the UIC earnings process can be complex and overwhelming, especially for those who are new to the system. In this article, we will provide 5 UIC earnings tips to help individuals maximize their benefits and ensure a smooth claims process.

Understanding UIC Earnings Basics

Before we dive into the tips, it’s essential to understand the basics of UIC earnings. Unemployment Insurance is a state-federal program that provides financial assistance to eligible individuals who are unemployed or underemployed. The UIC earnings process involves filing a claim, providing required documentation, and meeting specific eligibility criteria. To be eligible for UIC earnings, individuals must have worked for a certain period, earned a minimum amount of wages, and be actively seeking new employment.

Tip 1: File Your Claim Promptly

The first tip is to file your UIC claim promptly. It’s crucial to submit your application as soon as possible after becoming unemployed or experiencing a reduction in work hours. This will help ensure that you receive your benefits in a timely manner. When filing your claim, make sure to provide all required documentation, including your Social Security number, driver’s license, and proof of employment.

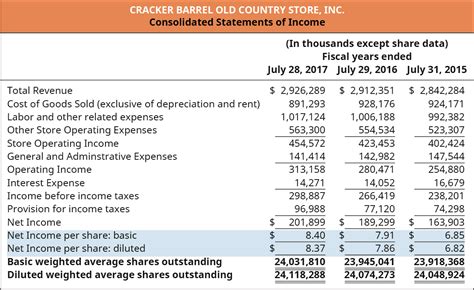

Tip 2: Understand Your Eligibility Criteria

The second tip is to understand your eligibility criteria. Each state has its own set of rules and regulations regarding UIC earnings. It’s essential to familiarize yourself with the specific requirements in your state, including the minimum wage requirement and work history. You can visit your state’s unemployment website or contact their customer service department to get more information on the eligibility criteria.

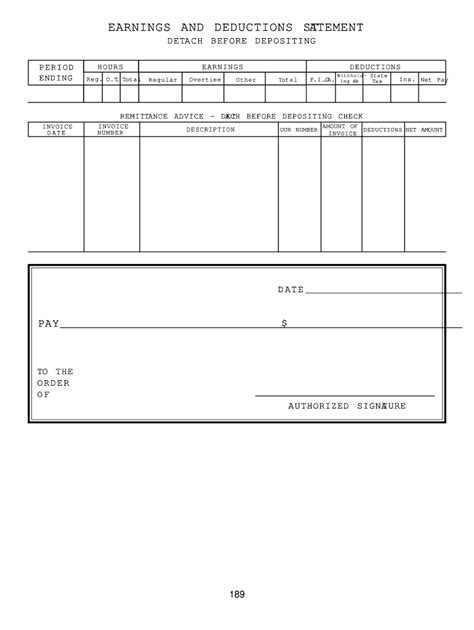

Tip 3: Keep Accurate Records

The third tip is to keep accurate records. When filing your UIC claim, you’ll need to provide detailed information about your employment history, including your job title, dates of employment, and wages earned. It’s essential to keep accurate records of this information, as it will help ensure that your claim is processed correctly. You can use a spreadsheet or notebook to keep track of your employment history and wages earned.

Tip 4: Be Prepared for the Interview

The fourth tip is to be prepared for the interview. As part of the UIC claims process, you may be required to participate in an interview with a claims examiner. This interview will help determine your eligibility for benefits and answer any questions you may have about the process. To prepare for the interview, make sure to:

- Gather all required documentation, including your identification and proof of employment

- Review your employment history and wages earned

- Prepare to discuss your job search efforts and availability for work

Tip 5: Stay Organized and Follow Up

The fifth tip is to stay organized and follow up. After filing your UIC claim, it’s essential to stay organized and follow up with the claims examiner to ensure that your application is being processed correctly. You can:

- Check your email and mail regularly for updates on your claim

- Contact the claims examiner if you have any questions or concerns

- Keep a record of your correspondence with the claims examiner, including dates and times of conversations

| Tip | Description |

|---|---|

| File Your Claim Promptly | Submit your application as soon as possible after becoming unemployed or experiencing a reduction in work hours |

| Understand Your Eligibility Criteria | Familiarize yourself with the specific requirements in your state, including the minimum wage requirement and work history |

| Keep Accurate Records | Keep detailed information about your employment history, including your job title, dates of employment, and wages earned |

| Be Prepared for the Interview | Gather all required documentation, review your employment history, and prepare to discuss your job search efforts and availability for work |

| Stay Organized and Follow Up | Stay organized, follow up with the claims examiner, and keep a record of your correspondence |

💡 Note: Make sure to follow the specific guidelines and requirements in your state, as the UIC earnings process may vary.

In summary, maximizing your UIC earnings requires a thorough understanding of the claims process, eligibility criteria, and required documentation. By following these 5 UIC earnings tips, you can ensure a smooth and successful claims process and receive the financial support you need during a difficult time. Remember to stay organized, follow up with the claims examiner, and keep accurate records to ensure that your application is being processed correctly.

What is the minimum wage requirement for UIC earnings?

+

The minimum wage requirement for UIC earnings varies by state. You can visit your state’s unemployment website or contact their customer service department to get more information on the eligibility criteria.

How long does it take to process a UIC claim?

+

The processing time for a UIC claim can vary depending on the state and the complexity of the application. On average, it can take several weeks to several months to process a claim.

Can I appeal a denied UIC claim?

+