5 Tips TSP L2055 Allocation

Introduction to TSP L2055 Allocation

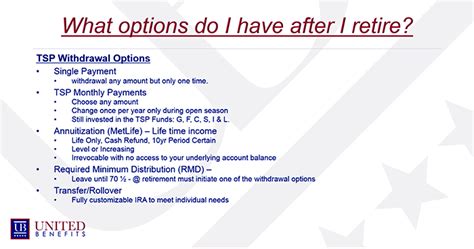

The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees and members of the military. It offers a range of investment options, including the L2055 fund, which is a lifecycle fund designed for participants who plan to retire between 2050 and 2054. In this article, we will discuss the importance of allocating your TSP contributions to the L2055 fund and provide five tips to help you make the most of this investment option.

Understanding the L2055 Fund

The L2055 fund is a target date fund, which means it automatically adjusts its asset allocation over time to become more conservative as the target date approaches. This fund is designed to provide a balanced portfolio with a mix of stocks, bonds, and other investments. The L2055 fund is a good option for TSP participants who want a hands-off approach to investing and are looking for a diversified portfolio that will automatically adjust over time.

Tips for Allocating to the L2055 Fund

Here are five tips to consider when allocating your TSP contributions to the L2055 fund: * Start early: The sooner you start contributing to the L2055 fund, the more time your money has to grow. Even small, consistent contributions can add up over time. * Contribute regularly: Make regular contributions to your TSP account, and consider setting up automatic payroll deductions to make saving easier and less prone to being neglected. * Take advantage of matching contributions: If you are a federal employee, you may be eligible for matching contributions from your agency. Make sure to contribute enough to maximize these matching contributions. * Monitor and adjust your allocation: While the L2055 fund is designed to automatically adjust its asset allocation over time, it’s still important to monitor your account and make adjustments as needed. You may need to adjust your allocation if your financial situation or investment goals change. * Consider your overall financial situation: Before allocating your TSP contributions to the L2055 fund, consider your overall financial situation and investment goals. You may want to consult with a financial advisor to determine the best investment strategy for your individual circumstances.

Benefits of the L2055 Fund

The L2055 fund offers several benefits, including: * Diversification: The L2055 fund provides a diversified portfolio with a mix of stocks, bonds, and other investments, which can help reduce risk and increase potential returns. * Professional management: The L2055 fund is managed by professional investment managers who have expertise in investing and asset allocation. * Low costs: The L2055 fund has low costs compared to other investment options, which can help you keep more of your money. * Automatic rebalancing: The L2055 fund automatically rebalances its asset allocation over time, which can help you stay on track with your investment goals.

Table of L2055 Fund Allocation

The following table shows the asset allocation of the L2055 fund:

| Investment Category | Allocation |

|---|---|

| Stocks | 55% |

| Bonds | 35% |

| Other Investments | 10% |

💡 Note: The asset allocation of the L2055 fund may change over time, so it's essential to monitor your account and make adjustments as needed.

In summary, the L2055 fund is a good option for TSP participants who want a hands-off approach to investing and are looking for a diversified portfolio that will automatically adjust over time. By following the five tips outlined in this article and considering your overall financial situation and investment goals, you can make the most of this investment option and achieve your retirement savings goals.

What is the L2055 fund?

+

The L2055 fund is a lifecycle fund designed for TSP participants who plan to retire between 2050 and 2054. It provides a diversified portfolio with a mix of stocks, bonds, and other investments.

How do I allocate my TSP contributions to the L2055 fund?

+

To allocate your TSP contributions to the L2055 fund, log in to your TSP account and follow the instructions for changing your investment elections. You can also contact the TSP customer service for assistance.

Can I change my allocation to the L2055 fund at any time?

+

Yes, you can change your allocation to the L2055 fund at any time. However, it’s essential to monitor your account and make adjustments as needed to ensure that your investment strategy aligns with your financial situation and investment goals.