5 TSP Contribution Limits

Understanding the 5 TSP Contribution Limits

The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees and members of the uniformed services. It offers a range of investment options and a convenient way to save for retirement. One of the key aspects of the TSP is the contribution limits, which dictate how much an individual can contribute to their account each year. In this article, we will explore the 5 TSP contribution limits and what they mean for your retirement savings.

What are the 5 TSP Contribution Limits?

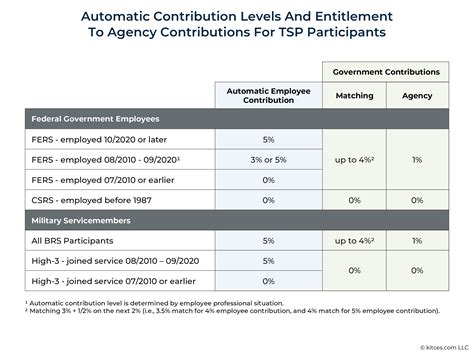

The 5 TSP contribution limits refer to the maximum amount of money that can be contributed to a TSP account each year. These limits are set by the Internal Revenue Service (IRS) and are subject to change annually. The 5 limits are: * Limit 1: Annual Addition Limit: This is the maximum amount of money that can be contributed to a TSP account in a calendar year. For 2022, this limit is 20,500. * Limit 2: Catch-up Contribution Limit: This limit applies to individuals who are 50 years or older and allows them to contribute an additional 6,500 to their TSP account in 2022. * Limit 3: Annual Limit for Highly Compensated Employees: This limit applies to highly compensated employees, who are defined as those earning more than 130,000 in 2022. The annual limit for these employees is 20,500. * Limit 4: Limit on Total Contributions: This limit applies to the total amount of money that can be contributed to a TSP account, including contributions from all sources, such as employee contributions, agency contributions, and catch-up contributions. For 2022, this limit is 61,000. * Limit 5: Limit on Agency Contributions: This limit applies to the amount of money that can be contributed to a TSP account by an individual's agency, such as the federal government. For 2022, this limit is 20,500.

Why are the 5 TSP Contribution Limits Important?

The 5 TSP contribution limits are important because they help individuals plan their retirement savings strategy. By understanding the limits, individuals can make informed decisions about how much to contribute to their TSP account each year. Additionally, the limits help prevent individuals from over-contributing to their TSP account, which can result in penalties and taxes.

How to Make the Most of the 5 TSP Contribution Limits

To make the most of the 5 TSP contribution limits, individuals should consider the following strategies: * Contribute as much as possible: Individuals should aim to contribute as much as possible to their TSP account each year, up to the annual addition limit. * Take advantage of catch-up contributions: Individuals who are 50 years or older should consider making catch-up contributions to their TSP account. * Consider agency contributions: Individuals should consider contributing to their TSP account through their agency, such as the federal government. * Monitor and adjust contributions: Individuals should regularly monitor their TSP contributions and adjust them as needed to ensure they are maximizing their retirement savings.

📝 Note: It's essential to review and understand the 5 TSP contribution limits and how they apply to your individual situation to make the most of your retirement savings.

Example of the 5 TSP Contribution Limits in Action

Let’s consider an example of how the 5 TSP contribution limits might work in practice:

| Contribution Type | Limit |

|---|---|

| Annual Addition Limit | $20,500 |

| Catch-up Contribution Limit | $6,500 |

| Annual Limit for Highly Compensated Employees | $20,500 |

| Limit on Total Contributions | $61,000 |

| Limit on Agency Contributions | $20,500 |

In this example, an individual who is 50 years or older and earns more than 130,000 per year can contribute up to 20,500 to their TSP account, plus an additional 6,500 in catch-up contributions. The individual's agency can also contribute up to 20,500 to their TSP account.

Conclusion and Final Thoughts

In conclusion, understanding the 5 TSP contribution limits is crucial for making the most of your retirement savings. By knowing the limits and how they apply to your individual situation, you can create a retirement savings strategy that works best for you. Remember to contribute as much as possible, take advantage of catch-up contributions, consider agency contributions, and monitor and adjust your contributions regularly.

What is the annual addition limit for TSP contributions in 2022?

+

The annual addition limit for TSP contributions in 2022 is 20,500.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Can I contribute more than the annual addition limit to my TSP account?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>No, you cannot contribute more than the annual addition limit to your TSP account. However, you may be eligible to make catch-up contributions if you are 50 years or older.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How do I make catch-up contributions to my TSP account?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>To make catch-up contributions to your TSP account, you must be 50 years or older and have already contributed the maximum annual addition limit to your account. You can then contribute an additional 6,500 to your account in 2022.