Tricare for Life Medicare Benefits

Introduction to Tricare for Life Medicare Benefits

Tricare for Life is a supplemental insurance program designed for military retirees and their families who are eligible for Medicare. It provides comprehensive coverage for medical expenses, filling the gaps in Medicare’s coverage. Understanding the benefits and how Tricare for Life works in conjunction with Medicare is essential for those who are nearing retirement or are already retired from the military.

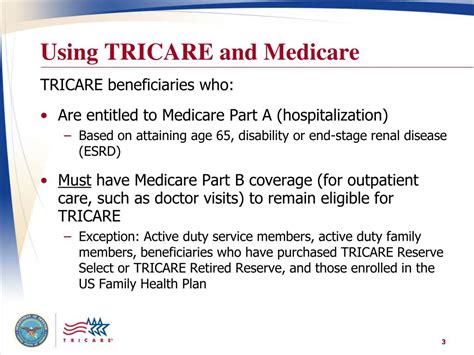

Eligibility for Tricare for Life

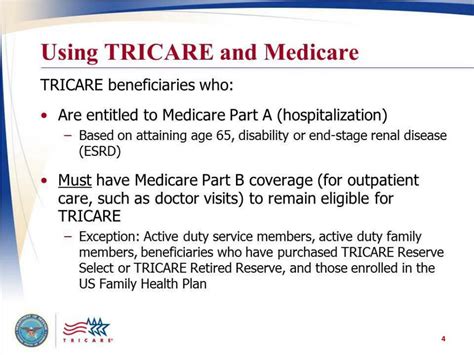

To be eligible for Tricare for Life, an individual must meet specific criteria. These include being a military retiree or a family member of a military retiree, being entitled to Medicare Part A, and being enrolled in Medicare Part B. Medicare Part A typically covers hospital stays, while Medicare Part B covers doctor visits and other medical services. Tricare for Life is particularly beneficial for those who have Medicare but want additional coverage for out-of-pocket expenses that Medicare does not cover.

How Tricare for Life Works with Medicare

Tricare for Life works as a supplement to Medicare, meaning that Medicare is the primary payer for medical expenses, and Tricare for Life covers the remaining costs after Medicare has paid its share. This can significantly reduce out-of-pocket expenses for beneficiaries. When a Tricare for Life beneficiary receives medical care, the provider bills Medicare first. Medicare then pays its portion of the bill, and the remaining balance is covered by Tricare for Life, usually leaving the beneficiary with little to no out-of-pocket expenses.

Benefits of Tricare for Life

The benefits of Tricare for Life are numerous, including: - Lower Out-of-Pocket Costs: By covering expenses that Medicare does not, Tricare for Life can significantly reduce the financial burden of healthcare on beneficiaries. - Comprehensive Coverage: It provides worldwide coverage, allowing beneficiaries to receive care from any Medicare-authorized provider without needing a referral. - Pharmacy Coverage: Tricare for Life also covers prescription drugs, which can be filled at any pharmacy that participates in the Tricare network. - Dental and Vision Coverage: While Tricare for Life itself does not cover dental and vision care, beneficiaries can purchase separate plans through the Federal Employees Dental and Vision Insurance Program (FEDVIP).

Enrollment in Tricare for Life

Enrollment in Tricare for Life is automatic for those who are eligible and have Medicare Part B. Beneficiaries do not need to take any action to enroll, as the program is designed to work seamlessly with Medicare. However, it’s essential for potential beneficiaries to ensure they have Medicare Part B, as this is a requirement for Tricare for Life coverage.

Costs Associated with Tricare for Life

One of the significant advantages of Tricare for Life is that there are no premiums for the coverage itself. However, beneficiaries must pay for Medicare Part B premiums, which can vary based on income level and other factors. Additionally, while Tricare for Life covers many expenses, beneficiaries may still incur some costs for services not covered by Medicare or Tricare, such as certain dental and vision services.

| Service | Medicare Coverage | Tricare for Life Coverage |

|---|---|---|

| Hospital Stays | Covered under Part A | Covers remaining balance after Medicare payment |

| Doctor Visits | Covered under Part B | Covers remaining balance after Medicare payment |

| Prescription Drugs | Covered under Part D | Covers prescription drugs with no deductible or copay |

💡 Note: Understanding the specifics of what Medicare and Tricare for Life cover can help beneficiaries navigate their healthcare options more effectively.

Tricare for Life and Travel

One of the benefits of Tricare for Life is that it provides coverage worldwide. This means that beneficiaries can travel without worrying about the availability of healthcare. Whether traveling within the U.S. or abroad, Tricare for Life beneficiaries can receive necessary medical care, knowing that their expenses will be covered.

Maintenance of Tricare for Life Benefits

To maintain Tricare for Life benefits, beneficiaries must ensure they continue to pay their Medicare Part B premiums. Failure to pay these premiums can result in the loss of both Medicare and Tricare for Life coverage. It’s also crucial to keep the Defense Enrollment Eligibility Reporting System (DEERS) up to date with current address and other personal information to ensure continuous coverage.

In summary, Tricare for Life offers comprehensive and supplemental healthcare coverage to military retirees and their families, working in conjunction with Medicare to minimize out-of-pocket expenses. By understanding the eligibility requirements, benefits, and how Tricare for Life works with Medicare, beneficiaries can make informed decisions about their healthcare and ensure they receive the care they need without incurring significant financial burdens.

What is Tricare for Life, and how does it work with Medicare?

+

Tricare for Life is a supplemental insurance program that works in conjunction with Medicare. It covers the remaining balance of medical expenses after Medicare has paid its share, significantly reducing out-of-pocket costs for beneficiaries.

Who is eligible for Tricare for Life?

+

Eligibility for Tricare for Life includes being a military retiree or a family member of a military retiree, being entitled to Medicare Part A, and being enrolled in Medicare Part B.

Do beneficiaries have to pay premiums for Tricare for Life?

+

There are no premiums for Tricare for Life itself. However, beneficiaries must pay for Medicare Part B premiums to maintain coverage.