Military

Travis Credit Union Loans

Introduction to Travis Credit Union Loans

Travis Credit Union is a not-for-profit financial cooperative that offers a wide range of loan products to its members. With a strong commitment to providing excellent service and competitive rates, Travis Credit Union has become a trusted choice for individuals and families seeking financial assistance. In this article, we will delve into the world of Travis Credit Union loans, exploring the various types of loans available, their features, and the benefits of choosing Travis Credit Union as your lending partner.

Types of Loans Offered by Travis Credit Union

Travis Credit Union offers a diverse portfolio of loans to cater to the unique needs of its members. Some of the most popular loan products include: * Auto Loans: Competitive rates and flexible terms for new and used vehicle purchases * Personal Loans: Unsecured loans for various purposes, such as debt consolidation, weddings, or unexpected expenses * Home Loans: Affordable mortgage options for purchasing or refinancing a primary residence * Home Equity Loans: Loans that utilize the equity in your home to fund home improvements, pay off debt, or cover other expenses * Student Loans: Financial assistance for higher education expenses, with flexible repayment terms and competitive interest rates * Business Loans: Loans and lines of credit designed to support small businesses and entrepreneurs

Features and Benefits of Travis Credit Union Loans

Travis Credit Union loans come with a range of features and benefits that set them apart from other lenders. Some of the key advantages include: * Competitive Rates: Travis Credit Union offers some of the most competitive interest rates in the market, helping you save money on your loan *

Eligibility and Application Process

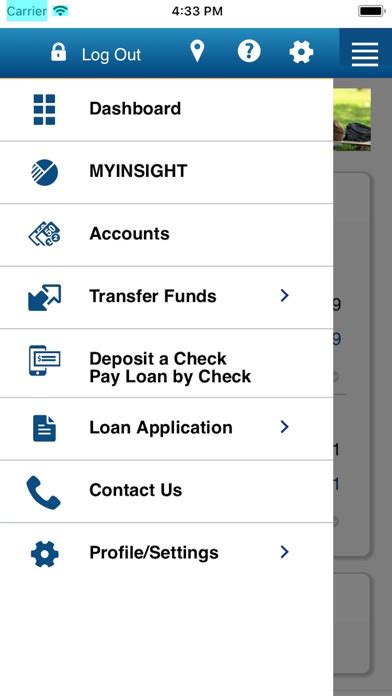

To be eligible for a Travis Credit Union loan, you must be a member of the credit union. Membership is open to individuals who live, work, or worship in specific counties in California. The application process is straightforward and can be completed online, by phone, or in person at a branch location. You will need to provide some basic information, such as: * Identification and proof of address * Income verification * Credit report and score * Loan amount and purpose

📝 Note: Travis Credit Union uses a secure online application system to protect your personal and financial information.

Repayment Options and Terms

Travis Credit Union offers flexible repayment options to help you manage your loan. You can choose from a variety of terms, including: * Monthly payments * Bi-weekly payments * Automatic payments * Online payments The repayment term will vary depending on the type of loan and your individual circumstances. For example:

| Loan Type | Repayment Term |

|---|---|

| Auto Loan | Up to 84 months |

| Personal Loan | Up to 60 months |

| Home Loan | Up to 30 years |

Conclusion

In summary, Travis Credit Union loans offer a range of benefits, including competitive rates, flexible terms, and personalized service. With a variety of loan products to choose from, you’re sure to find one that meets your unique needs and financial goals. By becoming a member of Travis Credit Union, you can take advantage of these benefits and experience the difference of working with a member-owned financial cooperative.

What is the minimum credit score required for a Travis Credit Union loan?

+

The minimum credit score required for a Travis Credit Union loan varies depending on the type of loan and individual circumstances. However, a credit score of 620 or higher is generally recommended.

Can I apply for a Travis Credit Union loan online?

+

Yes, you can apply for a Travis Credit Union loan online, 24⁄7, using our secure online application system.

Do I need to be a member of Travis Credit Union to apply for a loan?

+

Yes, you must be a member of Travis Credit Union to apply for a loan. Membership is open to individuals who live, work, or worship in specific counties in California.