5 Key Answers for Market Economy Worksheet

In the vast world of economics, understanding a market economy is fundamental for grasping how supply and demand interact to allocate resources. A market economy, also known as a capitalist or free market economy, operates on the principles of market freedom, private property, and the absence of coercive state control over production. Below are five key answers to common questions you might encounter on a market economy worksheet:

1. What are the Characteristics of a Market Economy?

A market economy thrives on:

- Private Property Rights: Individuals and businesses have the freedom to own, trade, and use resources as they see fit.

- Voluntary Exchange: Transactions occur based on mutual agreement between buyers and sellers.

- Competition: Multiple producers offer similar goods or services, leading to innovation and better quality.

- Profit Motive: Businesses aim to maximize profits, driving efficiency and production.

- Limited Government Intervention: The government’s role is minimal, mainly acting to regulate and correct market failures.

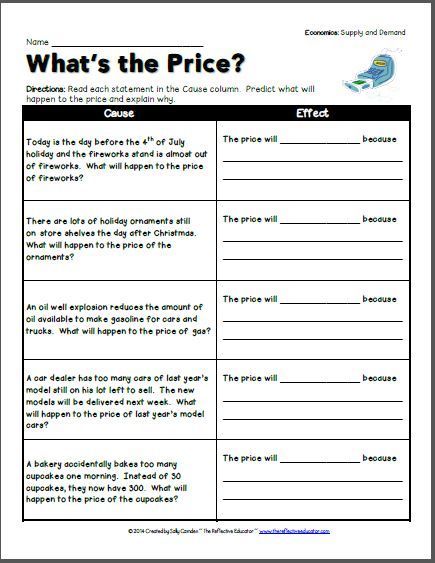

2. How is Price Determined in a Market Economy?

Price determination in a market economy is governed by:

- Supply and Demand: The basic economic model where the price equilibrates where the quantity of goods supplied equals the quantity demanded.

- Market Forces: Prices adjust to changes in consumer preferences, production costs, technology, and competition.

📌 Note: In a market economy, prices act as signals for resource allocation.

3. What Role does the Government Play in a Market Economy?

Though the government’s role in a market economy is minimal, it includes:

- Regulating Markets: Preventing monopolies, ensuring fair competition, and protecting consumers.

- Providing Public Goods: Items like national defense or public infrastructure that markets might under-produce.

- Social Welfare: Implementing policies like social security to address inequality.

- Externalities: Correcting market failures where social costs or benefits are not reflected in market prices.

4. What are the Advantages and Disadvantages of a Market Economy?

| Advantages | Disadvantages |

|---|---|

|

|

5. What is Market Failure and How Can it be Addressed?

Market failure occurs when the market does not allocate resources efficiently. Here’s how it can be addressed:

- Externalities: By taxing or subsidizing activities with external costs or benefits.

- Public Goods: Government provision to ensure non-excludable, non-rivalrous goods are accessible.

- Monopolies: Through anti-trust laws and regulation.

- Information Asymmetry: By enforcing regulations like mandatory disclosure.

Key points summarized:

Understanding the characteristics, price mechanisms, government roles, advantages, disadvantages, and ways to mitigate market failures provide a comprehensive grasp of how a market economy functions. From private property rights to market forces setting prices, from limited government intervention to addressing market failures, this economic system drives innovation, efficiency, and growth while also presenting challenges like inequality and externalities. By recognizing these aspects, one can better understand how market economies strive to balance the interests of producers, consumers, and the broader society.

What are the primary drivers of a market economy?

+

The primary drivers of a market economy are private property rights, profit motive, competition, and the forces of supply and demand. These elements work together to allocate resources efficiently and stimulate economic activity.

How do prices signal information in a market economy?

+

Prices act as signals by indicating where resources are needed most; high prices signal high demand or low supply, prompting producers to increase supply or innovate, while low prices might indicate an overabundance or low demand, suggesting a need for adjustments in production or pricing.

What happens if the market fails to correct itself?

+

If the market fails to self-correct, governments can intervene by implementing policies like regulations, taxes, subsidies, or direct provision of public goods. Such actions aim to realign the market’s behavior with broader societal benefits.