5 Texas Paycheck Tax Tips

Understanding Texas Paycheck Tax

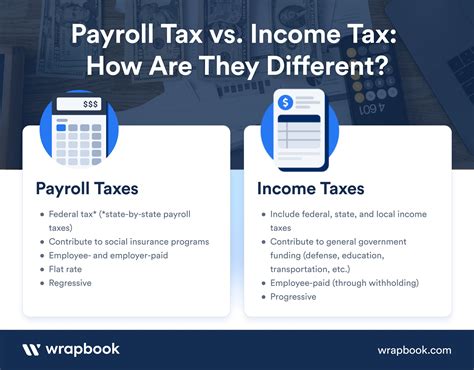

Texas is one of the few states in the United States with no state income tax. However, Texans still have to deal with federal income taxes and other types of taxes. When it comes to paycheck taxes, there are several things to consider to ensure you’re not overpaying or underpaying your taxes. In this article, we’ll provide you with five Texas paycheck tax tips to help you navigate the complex world of taxation.

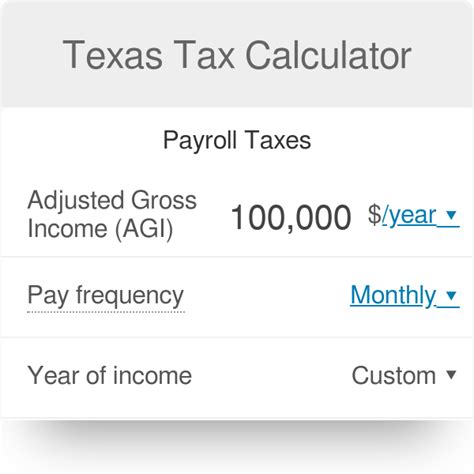

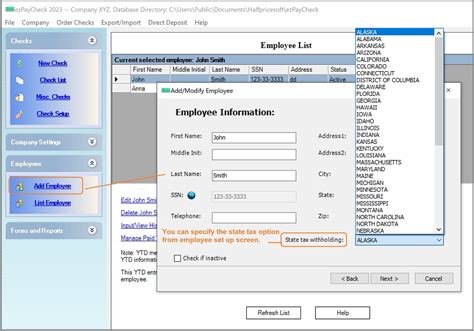

Tip 1: Know Your Tax Withholding

The first step to managing your paycheck taxes is to understand how tax withholding works. When you start a new job, you’ll typically fill out a Form W-4, which determines how much federal income tax is withheld from your paycheck. It’s essential to review and update your W-4 form regularly to ensure you’re not having too much or too little tax withheld. You can use the Tax Withholding Estimator tool provided by the IRS to help you determine the correct amount of tax to withhold.

Tip 2: Take Advantage of Tax Credits

Tax credits can significantly reduce the amount of taxes you owe. In Texas, you may be eligible for various tax credits, such as the Child Tax Credit or the Earned Income Tax Credit (EITC). These credits can help reduce your tax liability, and in some cases, you may even be eligible for a refund. It’s crucial to review the eligibility requirements for each credit and claim them on your tax return if you qualify.

Tip 3: Consider Itemizing Deductions

While Texas has no state income tax, you may still be able to itemize deductions on your federal tax return. Itemizing deductions allows you to claim specific expenses, such as mortgage interest, charitable donations, and medical expenses, which can help reduce your taxable income. However, you’ll need to determine whether itemizing deductions is beneficial for your situation, as the standard deduction may be more advantageous.

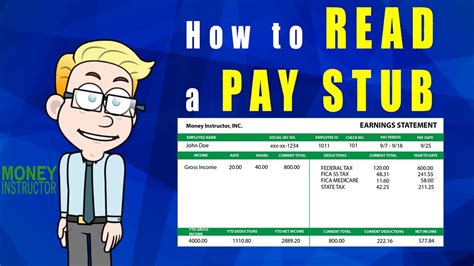

Tip 4: Review Your Pay Stub

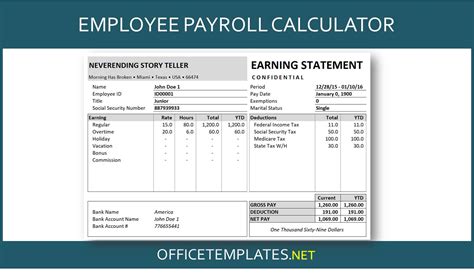

Your pay stub contains essential information about your taxes, including the amount of taxes withheld and any deductions or contributions made. It’s vital to review your pay stub regularly to ensure that everything is accurate and up-to-date. Check for any errors or discrepancies, and contact your employer or payroll department if you notice any issues.

Tip 5: Consult a Tax Professional

Tax laws and regulations can be complex, and it’s easy to make mistakes or overlook important details. Consider consulting a tax professional who can provide personalized guidance and help you navigate the tax system. A tax professional can help you optimize your tax strategy, ensure compliance with tax laws, and even represent you in case of an audit.

📝 Note: It's essential to keep accurate records of your taxes, including pay stubs, W-2 forms, and tax returns, in case of an audit or if you need to reference them in the future.

To further illustrate the importance of managing your paycheck taxes, consider the following table:

| Tax Withholding Status | Impact on Take-Home Pay |

|---|---|

| Underwithholding | May result in a tax bill or penalty at tax time |

| Overwithholding | May result in a larger refund, but reduces take-home pay throughout the year |

| Optimal Withholding | Minimizes tax liability and maximizes take-home pay |

In summary, managing your paycheck taxes requires attention to detail, understanding of tax laws, and strategic planning. By following these five Texas paycheck tax tips, you can ensure you’re not overpaying or underpaying your taxes and make the most of your hard-earned money. Remember to stay informed, review your pay stub regularly, and consider consulting a tax professional to optimize your tax strategy.

What is the difference between tax credits and tax deductions?

+

Tax credits directly reduce the amount of taxes you owe, while tax deductions reduce your taxable income, which in turn reduces your tax liability.

How often should I review my W-4 form?

+

You should review and update your W-4 form whenever your income or family situation changes, such as when you get married, have a child, or change jobs.

What is the purpose of the Tax Withholding Estimator tool?

+

The Tax Withholding Estimator tool helps you determine the correct amount of federal income tax to withhold from your paycheck, ensuring you’re not overpaying or underpaying your taxes.