5 Essential Tips for Texas Divorce Property Division Worksheet

Understanding the Texas Divorce Property Division

In Texas, navigating the division of property during a divorce can be a daunting task. The state follows community property laws, which dictate that any property acquired during the marriage is considered communal and must be divided in a just and right manner. Here, we will explore the 5 Essential Tips for Texas Divorce Property Division Worksheet to help you ensure a fair distribution of assets.

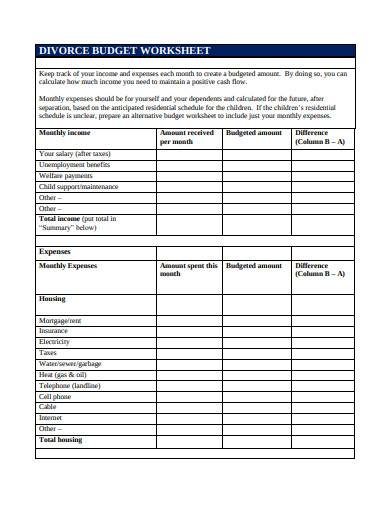

1. Gather Comprehensive Documentation

Before you even begin the division process, you’ll need to:

- Compile financial statements, bank records, tax returns, and investment accounts.

- List all real estate, personal property, and business interests.

- Document debts and liabilities, including mortgages, loans, and credit card debts.

This step ensures you have a complete picture of your marital estate, preventing oversight during division.

📝 Note: Ensure all documents are up-to-date and accessible for both parties to review.

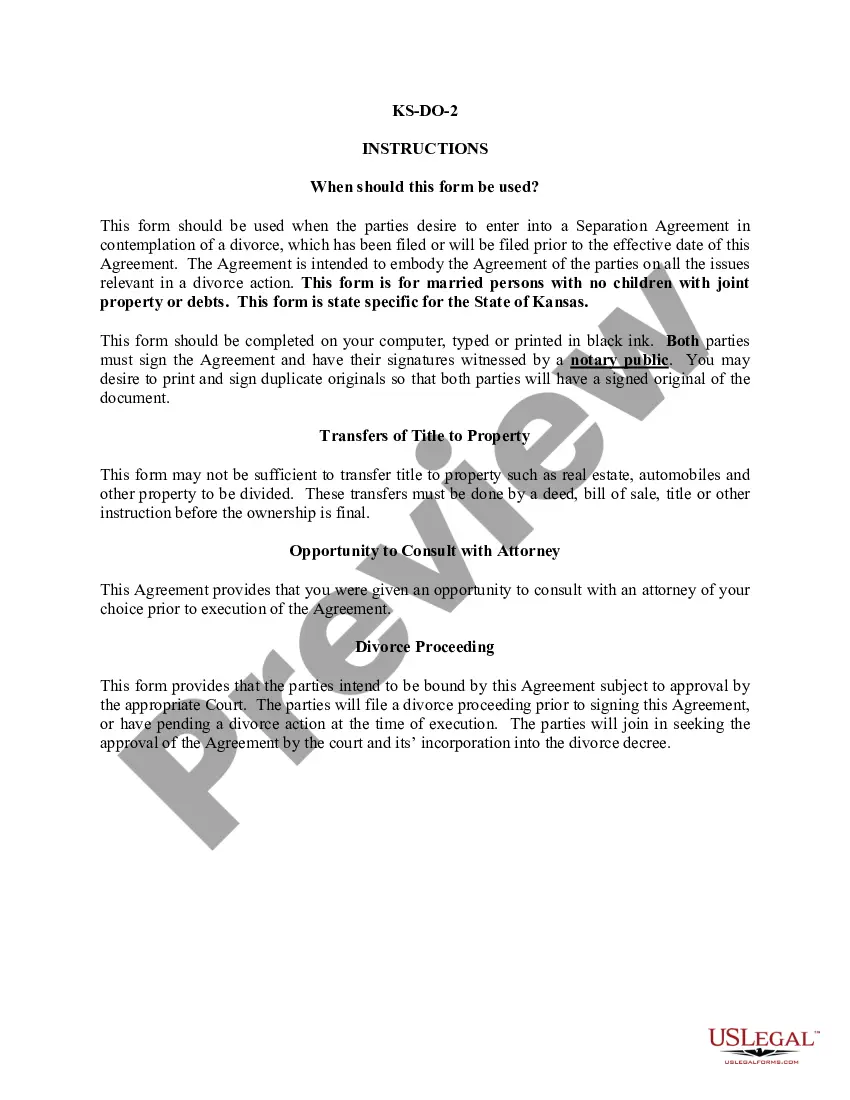

2. Identify Community vs. Separate Property

Understanding what constitutes community property and what remains separate is crucial:

- Community Property: Includes earnings during marriage, property bought with those earnings, and any debt incurred together.

- Separate Property: Property owned before marriage, gifts, or inheritance received during marriage, and personal injury awards unless linked to loss of income.

A well-prepared property division worksheet can help delineate these categories, reducing disputes.

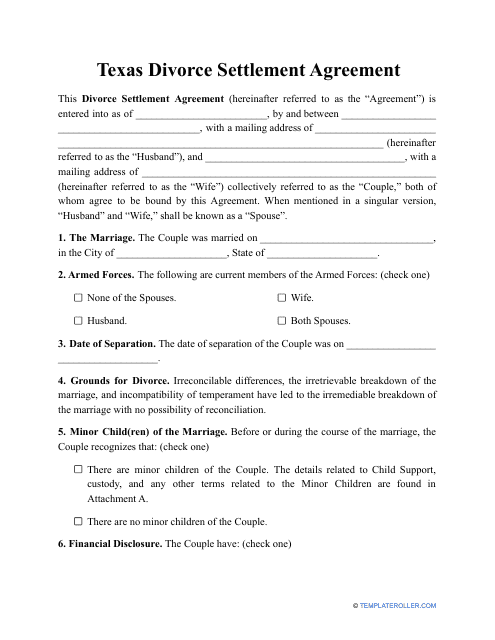

3. Equitable Distribution

The court aims for an equitable distribution, which does not necessarily mean a 50⁄50 split. Factors considered include:

- Duration of the marriage.

- Each spouse’s contribution to the estate.

- The economic circumstances of each party after division.

- Fault in the breakup of marriage.

Your worksheet should reflect these considerations to propose a fair settlement.

| Asset Type | Community Property | Separate Property |

|---|---|---|

| Real Estate | House bought during marriage | Property owned before marriage |

| Investments | Stocks purchased with earnings during marriage | Inherited stocks |

| Retirement Accounts | Contributions made during marriage | Account established pre-marriage |

4. Make Logical Apportionments

Some items or businesses might not lend themselves to physical division. You’ll need to:

- Identify assets that can be sold, and divide the proceeds.

- Consider offsetting with other assets if one spouse retains the asset.

- Negotiate the value of items that are emotionally or financially significant.

Your worksheet should provide an overview of these logical apportionments to simplify negotiations.

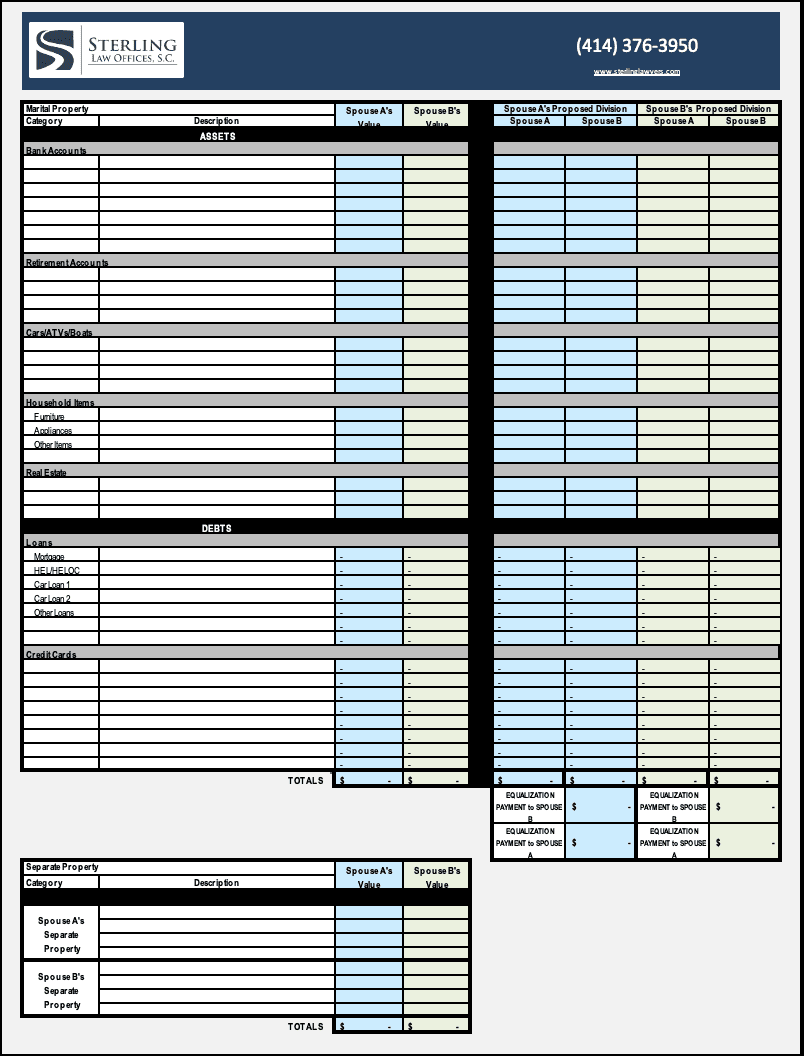

5. Use a Worksheet to Organize and Clarify

A well-structured divorce property division worksheet:

- Ensures all assets are accounted for and distributed properly.

- Helps in identifying discrepancies or undervalued items.

- Provides a clear basis for negotiations, discussions, and mediations.

The use of such a worksheet is a proactive step towards an amicable resolution. Here’s a basic outline for your worksheet:

| Item Description | Value | Ownership Before Marriage (Y/N) | Proposed Allocation | Community/Separate Property |

|---|---|---|---|---|

| House on Main Street | $350,000 | No | Spouse A | Community |

| Stocks | $50,000 | Yes | Spouse B | Separate |

| Car | $15,000 | No | Spouse A | Community |

By meticulously preparing this worksheet, you're not only ensuring that you understand your financial situation but also setting the stage for a smoother negotiation process.

In closing, navigating the intricate terrain of Texas divorce property division requires careful preparation, a clear understanding of the law, and thoughtful negotiation. With these 5 essential tips, you can approach your property division with confidence, knowing you’ve done your due diligence to ensure an equitable outcome. Whether you choose to settle outside the courtroom or let a judge decide, a well-organized property division worksheet will serve as your roadmap to a financially just conclusion.

What qualifies as community property in Texas?

+

Community property includes all property acquired by either spouse during the marriage, excluding gifts and inheritance which are considered separate.

Can a spouse keep separate property after divorce?

+

Yes, a spouse usually retains their separate property, which includes assets owned before marriage or received through gift or inheritance during the marriage.

How is debt handled in Texas divorce?

+

Like assets, debt acquired during the marriage is usually considered community debt and should be equitably distributed.