Tennessee Paycheck Calculator Tool

Introduction to Paycheck Calculators

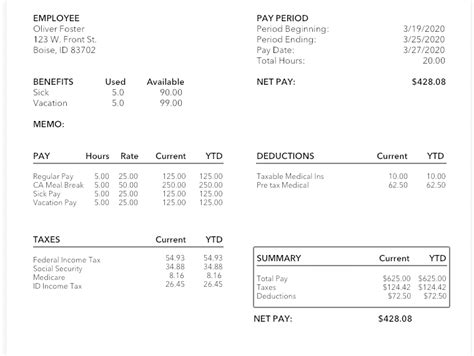

When it comes to managing finances, understanding how much you take home from your salary is crucial. This is where paycheck calculators come into play, providing a valuable tool for individuals to estimate their net pay based on their gross income and other factors such as deductions and taxes. For residents of Tennessee, utilizing a Tennessee paycheck calculator can help in planning financials more effectively.

How Paycheck Calculators Work

Paycheck calculators are designed to simplify the process of calculating take-home pay. These tools consider various factors, including: - Gross Income: The total amount of money you earn before any deductions. - Tax Rates: Federal, state, and local tax rates that apply to your income. - Deductions: Contributions to health insurance, 401(k), and other benefits that are deducted from your paycheck. - Exemptions and Allowances: Factors that reduce your taxable income.

By inputting your details into a paycheck calculator, you can get an accurate estimate of your net pay, helping you manage your finances more efficiently.

Tennessee Specifics

Tennessee has a unique set of rules and rates that affect income tax and payroll calculations. Notably, Tennessee does not have a state income tax on wages, which can significantly impact the calculation of take-home pay for residents. However, there is a tax on certain types of income, such as dividends and interest income. A Tennessee paycheck calculator will take these specifics into account, providing a more accurate calculation of your net pay.

Using a Tennessee Paycheck Calculator

To use a Tennessee paycheck calculator effectively, follow these steps: - Determine Your Gross Income: Calculate your total salary before any deductions. - Identify Deductions: List all deductions from your paycheck, including health insurance, retirement contributions, and any other pre-tax deductions. - Consider Tax Exemptions: Factor in any tax exemptions or allowances you are eligible for. - Input Data into the Calculator: Use the calculator to input your gross income, deductions, and exemptions. - Review Your Results: Understand your estimated net pay and plan your finances accordingly.

Benefits of Paycheck Calculators

The benefits of using a paycheck calculator, especially one tailored to Tennessee’s tax environment, are numerous: - Financial Planning: Helps in planning your budget and financial goals. - Tax Planning: Assists in understanding and potentially minimizing your tax liability. - Investment Decisions: Can inform decisions about retirement contributions and other investment strategies.

📝 Note: Always consult with a financial advisor for personalized advice on managing your finances and taxes.

Common Mistakes to Avoid

When using a paycheck calculator, it’s essential to avoid common mistakes: - Inaccurate Input: Ensure all inputted data is accurate and up-to-date. - Overlooking Deductions: Don’t forget to include all eligible deductions. - Not Accounting for Changes: Regularly update your calculations to reflect changes in income, deductions, or tax rates.

Conclusion and Future Planning

In summary, a Tennessee paycheck calculator is a vital tool for anyone looking to manage their finances effectively. By understanding how these calculators work and using them correctly, individuals can make more informed decisions about their financial futures. Whether you’re planning for retirement, saving for a big purchase, or simply wanting to understand where your money is going, a paycheck calculator can provide valuable insights.

What is the main advantage of using a Tennessee paycheck calculator?

+

The main advantage is that it helps you accurately estimate your take-home pay, considering Tennessee’s specific tax rules and your individual deductions and exemptions.

Does Tennessee have a state income tax on wages?

+

No, Tennessee does not have a state income tax on wages. However, it does tax certain types of income, such as dividends and interest income.

How often should I update my paycheck calculations?

+

You should update your calculations whenever there is a change in your income, deductions, exemptions, or tax rates to ensure your financial planning remains accurate and effective.