Michigan Tax Calculator

Introduction to Michigan Tax Calculator

The Michigan tax calculator is a tool designed to help individuals and businesses calculate their tax liability in the state of Michigan. Michigan has a progressive income tax system, with rates ranging from 4.25% to 4.25%. The tax calculator takes into account various factors, including income, deductions, and credits, to provide an accurate estimate of tax liability. In this article, we will explore the features and benefits of the Michigan tax calculator and provide a step-by-step guide on how to use it.

How to Use the Michigan Tax Calculator

Using the Michigan tax calculator is a straightforward process that requires some basic information about your income and tax situation. Here are the steps to follow: * Gather necessary information: Start by gathering all the necessary information about your income, including your gross income, deductions, and credits. * Choose the correct filing status: Select the correct filing status, such as single, married, or head of household. * Enter income and deductions: Enter your income and deductions, including any 401(k) or IRA contributions. * Claim credits: Claim any eligible credits, such as the earned income tax credit (EITC) or child tax credit. * Calculate tax liability: The calculator will then calculate your tax liability based on the information provided.

Features of the Michigan Tax Calculator

The Michigan tax calculator has several features that make it a useful tool for individuals and businesses. Some of the key features include: * Accurate calculations: The calculator provides accurate calculations based on the latest tax laws and regulations. * Easy to use: The calculator is easy to use, with a simple and intuitive interface. * Customizable: The calculator allows users to customize their calculations based on their specific tax situation. * Free to use: The calculator is free to use, with no fees or charges.

Benefits of Using the Michigan Tax Calculator

Using the Michigan tax calculator can provide several benefits, including: * Saves time: The calculator saves time and effort, as users do not have to manually calculate their tax liability. * Reduces errors: The calculator reduces errors, as it automatically calculates tax liability based on the information provided. * Provides accurate estimates: The calculator provides accurate estimates of tax liability, helping users plan their finances. * Helps with tax planning: The calculator helps users with tax planning, as it allows them to explore different scenarios and see how they impact their tax liability.

Michigan Tax Rates

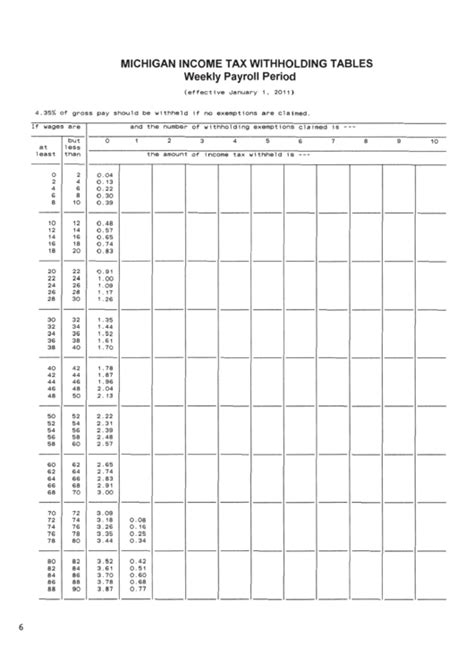

Michigan has a progressive income tax system, with rates ranging from 4.25% to 4.25%. The tax rates are as follows:

| Income Range | Tax Rate |

|---|---|

| 0 - 20,000 | 4.25% |

| 20,001 - 40,000 | 4.25% |

| 40,001 - 60,000 | 4.25% |

| $60,001 and above | 4.25% |

It’s worth noting that these rates are subject to change, and users should check the official Michigan government website for the latest information.

💡 Note: The Michigan tax calculator is a tool designed to provide an estimate of tax liability, and users should consult a tax professional for accurate and personalized advice.

In terms of tax deductions and credits, Michigan offers several options, including: * Standard deduction: The standard deduction is 4,750 for single filers and 9,500 for joint filers. * Itemized deductions: Itemized deductions include mortgage interest, property taxes, and charitable donations. * Earned income tax credit (EITC): The EITC is a refundable credit for low-income working individuals and families. * Child tax credit: The child tax credit is a non-refundable credit for families with qualifying children.

Conclusion and Final Thoughts

In conclusion, the Michigan tax calculator is a useful tool for individuals and businesses looking to estimate their tax liability in the state of Michigan. With its accurate calculations, easy-to-use interface, and customizable features, the calculator provides a valuable resource for tax planning and preparation. By understanding how to use the calculator and taking advantage of available tax deductions and credits, users can minimize their tax liability and maximize their refund.

What is the Michigan tax rate?

+

The Michigan tax rate is 4.25% for all income ranges.

How do I use the Michigan tax calculator?

+

To use the Michigan tax calculator, simply gather your income and deduction information, choose your filing status, and enter the information into the calculator.

What are some common tax deductions and credits in Michigan?

+

Some common tax deductions and credits in Michigan include the standard deduction, itemized deductions, earned income tax credit (EITC), and child tax credit.