Military

Texas Paycheck Tax Calculator

Introduction to Texas Paycheck Tax Calculator

Texas, known for its vast landscapes, diverse culture, and thriving economy, attracts individuals and businesses alike. When it comes to managing finances, understanding the tax implications is crucial. The Texas Paycheck Tax Calculator is a valuable tool designed to help individuals and employers navigate the complexities of payroll taxes. This calculator takes into account various factors, including income, deductions, and exemptions, to provide an accurate estimate of the taxes withheld from a paycheck.

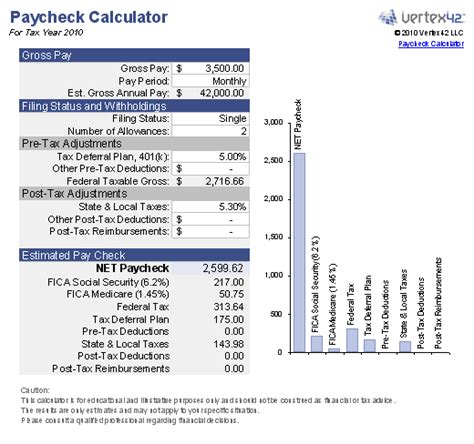

How the Texas Paycheck Tax Calculator Works

The calculator operates on a straightforward principle: it considers the gross income, the frequency of pay (e.g., weekly, biweekly, monthly), and other relevant details such as marital status, number of dependents, and any additional income or deductions. Here are the key steps to use the Texas Paycheck Tax Calculator: - Gross Income: Enter the total income before any deductions. - Pay Frequency: Select how often the individual is paid (e.g., weekly, biweekly). - Marital Status and Dependents: Choose the appropriate marital status and number of dependents. - Additional Income/Deductions: Input any other income sources or deductions that might affect the taxable income.

Understanding Texas State Income Tax

One of the unique aspects of Texas is its approach to state income tax. Unlike many other states, Texas does not have a state income tax. This means that residents of Texas do not have to pay state taxes on their income, which can significantly impact the amount of money taken home from a paycheck. However, it’s essential to note that while there’s no state income tax, other taxes such as sales tax and property tax still apply.

Federal Income Tax

While Texas does not impose a state income tax, federal income taxes still apply. The federal government taxes income based on a progressive tax system, with tax rates ranging from 10% to 37%. The tax brackets and rates are adjusted annually for inflation, and the tax owed is calculated based on the taxpayer’s filing status and taxable income.

Other Taxes and Deductions

In addition to federal income taxes, other deductions and taxes may be withheld from a paycheck, including: - Social Security Tax: A 6.2% tax withheld from the employee’s paycheck, with the employer matching this amount. - Medicare Tax: A 1.45% tax for Medicare, also matched by the employer. - Health Insurance Premiums: Deductions for health insurance premiums. - 401(k) or Retirement Plan Contributions: Pre-tax contributions to retirement accounts. - Other Benefits and Deductions: Life insurance, disability insurance, and other pre-tax benefits.

Benefits of Using a Texas Paycheck Tax Calculator

Utilizing a Texas Paycheck Tax Calculator offers several benefits: - Accuracy: Provides a precise estimate of taxes withheld, helping in financial planning. - Time-Saving: Simplifies the process of calculating taxes, reducing the time spent on financial calculations. - Informed Decision Making: Allows individuals to understand the impact of changes in income, deductions, or exemptions on their take-home pay.

📝 Note: Always consult with a financial advisor or tax professional for personalized advice, as individual circumstances can significantly affect tax obligations and benefits.

Conclusion and Final Thoughts

In summary, the Texas Paycheck Tax Calculator is an indispensable tool for anyone looking to understand their paycheck better, whether they are employees or employers. By considering the nuances of federal income tax, the absence of state income tax in Texas, and other deductions, individuals can gain a clearer picture of their financial situation. This understanding is crucial for planning, saving, and making informed decisions about benefits and investments. With the calculator’s assistance, navigating the complex world of payroll taxes becomes more manageable, allowing Texans to focus on their financial goals with confidence.

Does Texas have a state income tax?

+

No, Texas does not have a state income tax, making it one of the states with no income tax.

How do I calculate my federal income tax?

+

You can calculate your federal income tax by using tax tables or a tax calculator, considering your filing status, taxable income, and the current tax brackets and rates.

What is the purpose of a Texas Paycheck Tax Calculator?

+

The purpose of a Texas Paycheck Tax Calculator is to provide an accurate estimate of the taxes withheld from a paycheck, considering income, deductions, and exemptions, to help in financial planning and decision-making.